Evidence-Based Investing: Application and Monitoring

Apply the Evidence and Monitor for Effectiveness

If you are following our blog series about evidence-based investing (EBI), you have learned that EBI is the foundation of our investment philosophy and is designed to build globally diversified portfolios that aim to minimize unrewarded risks and maximize after-tax return. In this blog, we review steps three and four of the EBI process, which include implementing or applying the evidence gathered during the first two steps of the process and monitoring its effectiveness throughout the client journey.

Apply the Evidence

Once a portfolio is set, some investors simply stop there and assume the work is done. However, to implement an investment strategy that will deliver the level of risk and expected return needed for success, it is vital to monitor the portfolio over time to ensure it continues to track the allocation that has been carefully selected. The ongoing action and application of the evidence is what we call the implementation phase. The implementation phase involves three key areas: investment selection, rebalancing, and tax management. Each area plays a critical role in finalizing your plan and is discussed in more detail below.

Investment Selection

This first area of the implementation phase focuses on selecting optimal investments for each of the asset classes. The conventional approach to investing is anchored in the basic belief that active managers can effectively outperform the market. Evidence shows, however, that active management is inefficient, costly, and counterproductive. It is very difficult, if not impossible, to consistently beat the market over time. Instead, indexed and structured asset class strategies offer the ideal path to broadly diversified and tax-efficient global portfolios of stocks, bonds, and alternative investments.

Rebalancing

This is the disciplined process of trimming assets that have increased in value (i.e., sell high) and purchasing other assets that have underperformed on a relative basis (i.e., buy low). This process can offer some great benefits. When executed properly, rebalancing controls risk, increases returns, instills discipline, and simplifies life.

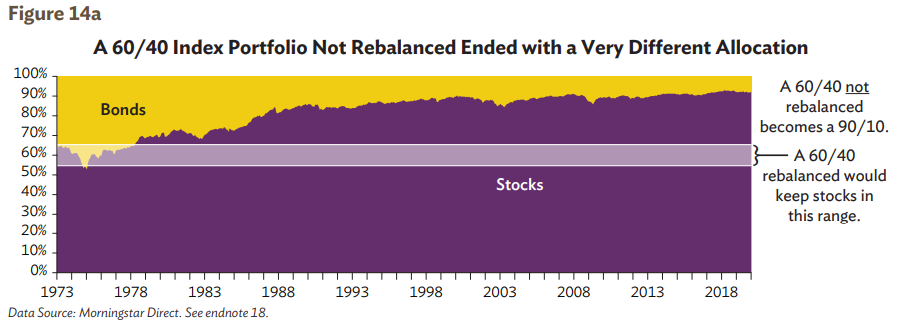

- Rebalancing ensures a commitment to long-term risk control. Risk continually changes in non-rebalanced portfolios. If the portfolio were never rebalanced, it would stray considerably from its original risk profile (see Figure 14a below).

- Research demonstrates that careful rebalancing can help enhance return. Rebalancing allows you to systematically purchase investments that have declined in price and sell investments that have increased in price.

- Rebalancing instills discipline. “Sell high” is easier said than done because most people have a hard time selling winners. This is where rebalancing helps to make more disciplined decisions. It buys temporarily out-of-favor investments – asset classes that have underperformed but offer more upside potential. Rebalancing does not rely on forecasts or predictions for excess return.

- Rebalancing simplifies life. It is critical to fully consider all tax ramifications and trading costs before rebalancing. In taxable accounts, it may make sense to do only a partial rebalance if the associated gains are too high. Determining the appropriate frequency of rebalancing is critical for success. Drift-based rebalancing, rather than calendar-based, allows for rebalancing based on market volatility, portfolio distributions, fund distributions, and client cash flows.

The illustration below results from a 60/40 index portfolio that is not rebalanced versus the same index portfolio that is rebalanced.

Managing Taxes

While return and risk are essential to your investment success, it is also critical to maximize total portfolio return after taxes. Fortunately, there are several strategies you can use to help increase your odds of success.

- Indexed/low turnover funds: Low turnover funds track an index or attempt to capture the returns of an asset class. They are naturally more tax efficient.

- Tax-managed funds: Tax-managed funds attempt to approximate a benchmark while taking advantage of several tax mitigation strategies. Instead of steadfastly tracking the index, tax-managed funds defer gains until they become long-term, which qualify for long-term tax rates instead of much higher short-term rates.

- Municipal (tax-free) bonds: Municipal bonds are issued by state and local governments, and the interest payments are exempt from federal taxation. Because there are income tax benefits, they typically offer lower interest rates than taxable bonds. This means that municipal bonds generally make sense for investors in high tax brackets.

- Tax-loss harvesting: Tax-loss harvesting works by selling a security at a loss and concurrently buying back a similar but not identical investment. To comply with “wash sale” rules, the original security can’t be repurchased within 30 days of the sale.

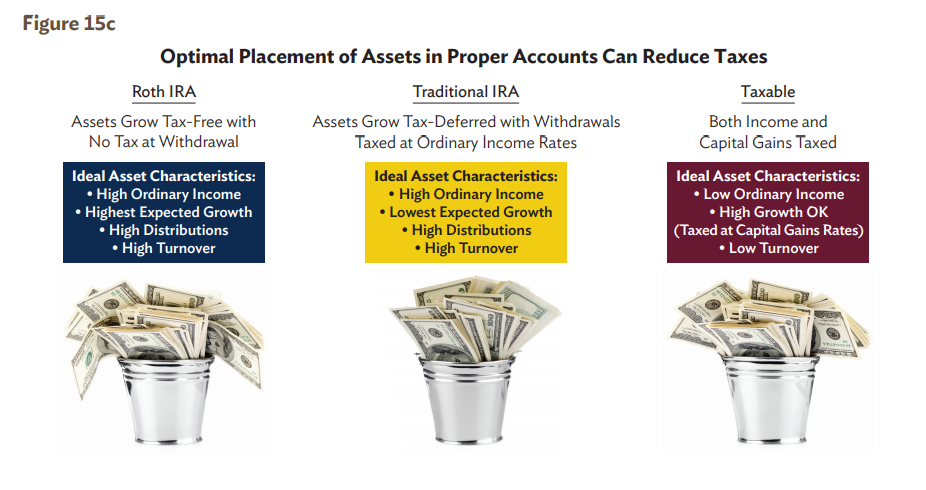

- Asset location (tax engineering): Different account types are taxed in very different manners, and the tax characteristics can be bucketed into three general types: 1) tax-deferred accounts (i.e., traditional IRAs), 2) taxable accounts, and 3) tax-free accounts (i.e., Roth IRAs).

The figure below represents how different accounts are taxed and showcases their ideal asset location characteristics.

In addition to the five strategies listed here, there are other strategies that can be utilized depending on the individual’s circumstances. Some of those strategies include Roth conversions, charitable donor advised funds, estate engineering, and distribution planning.

Monitor for Effectiveness

The fourth and final step of evidence-based investing is monitoring for effectiveness. Savant also refers to this step as “robust investment oversight” which we believe can potentially enhance investment results by eliminating needless risk. This requires the collective knowledge of an experienced investment team.

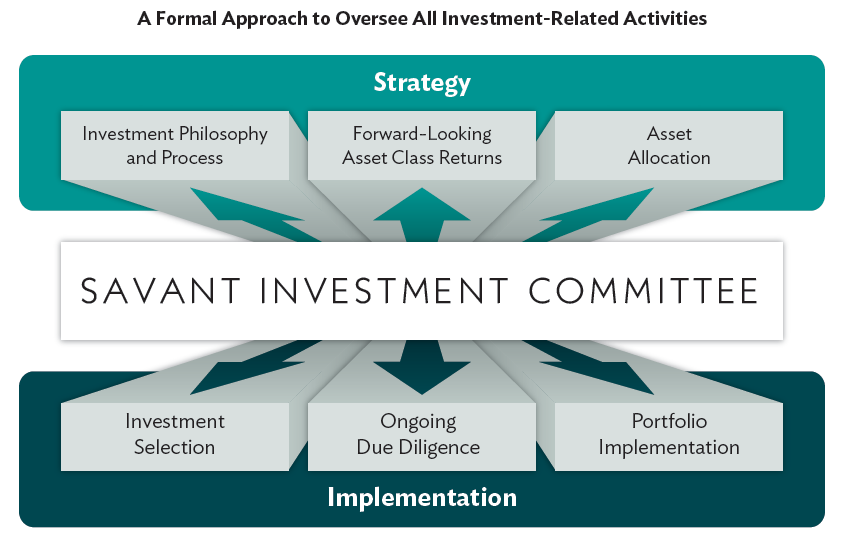

Our Investment Committee is responsible for overseeing our firm’s investment strategy and its implementation. The Committee is governed by a formal charter and bylaws and consists of executive team members, senior investment research team members, and senior advisors. This group provides the depth of experience needed to navigate the numerous facets of investment oversight. The Committee spends its time focused on the areas that we believe are essential to helping our clients meet their investment goals.

The below figure highlights our Investment Committee structure and approach to monitoring effectiveness.

- Philosophy and process: The Committee continually tests and challenges the validity of the EBI investment philosophy. While our philosophy is time-tested and does not change dramatically from year to year, we regularly refine our processes and the way we implement our strategy.

- Forward-looking asset class returns: Savant developed a robust methodology for estimating long-term, forward-looking returns. This allows us to avoid relying solely on historical returns, while also incorporating current valuations and other economic circumstances into expected returns.

- Asset allocation: We utilize our forward-looking return estimates and statistical analysis to build optimal portfolios. We estimate the expected outcome of many asset mixes under various market environments to determine the asset allocation for each portfolio.

- Investment selection and ongoing due diligence: Savant’s Investment Research Team performs an in-depth annual review to help ensure we utilize the best investment(s) for each asset class. We screen the universe of available funds which must meet criteria, including but not limited to low cost, low turnover, reasonable liquidity, transparent structure, pure representation of the asset class, reputable firm, and sufficient track record and assets under management. Funds that pass this rigorous process are eligible to be added to the portfolio. Selected funds are continuously monitored during a quarterly review process. Funds that receive enough flags are put on watch. All due diligence is brought to the Committee to discuss and determine any necessary action.

As seen throughout EBI’s four-step process, investors have access to a vast amount of available data to help maximize after-tax returns and minimize risk. The evidence-based investing approach is grounded in logic and supported by compelling data that we believe can put investors on a path towards building ideal futures.

For more information, download our EBI whitepaper or consult with your financial advisor.

Endnote 18: Liberati, A. and Vineis, P. (2004) Introduction to the Symposium: What Evidence-Based Medicine is and What it is Not. Journal of Medical Ethics.