Our Approach

The Savant Wealth Team – Your Access Point to Our Collective Wisdom

Our expansive team approach allows our financial advisors the depth of resources necessary to help solve the most complicated problems. We have a deep bench of in-house estate planning, taxation, and accounting specialists to analyze your situation through the lens of their respective discipline. As your team collaborates, the valuable insights from each of the members is applied to your situation. The result is a thorough plan of action that is ready for final review and execution.

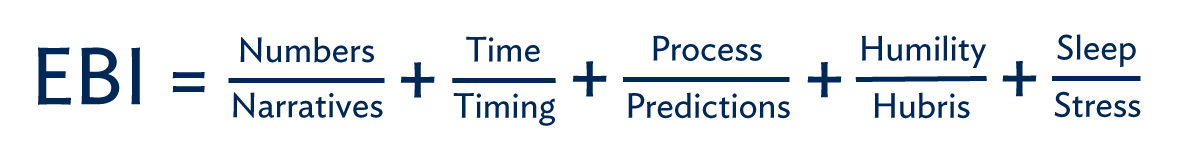

Through our collective wisdom and experience working with all types of clients, we’ve learned to stick with the fundamentals. Although concepts like investing for the long term, diversification, and staying in your seat don’t sound flashy, they are primary cornerstones of our craft. Our steady, evidenced-based approaches to investing and financial planning are structured to anticipate rocky inclines and uncertain times, not just smooth trails and sunny skies.