A Look Back at the Market’s 2017 Run

A Smooth Ride to the Top

- Stock market volatility has been historically low: standard deviation of S&P 500 Index daily returns was 0.42% in 2017, the lowest since 1965

- 2017 was the only year that the MSCI All Country World Stock Index (IMI) posted a gain in every month

- Over a year since the S&P 500 Index had a pullback of 5%

2017 Presented Many Obstacles to Slalom Around and Moguls to Overcome

- 1/20/17: Trump inauguration

- 1/25/17: Dow crosses 20,000 for the first time

- 2/8/17: Brexit bill passes U.K. House of Commons

- 2/11/17: North Korea test fires ballistic missile across the Sea of Japan

- 3/30/17: Flynn agrees to testify on Russia

- 4/10/17: Neil Gorsuch sworn in to the U.S. Supreme Court

- 4/30/17: Congress reaches bipartisan deal to avoid government shutdown

- 5/10/17: Apple becomes first company worth more than $800B

- 5/22/17: Terrorist attack at Ariana Grande concert in Manchester, U.K.

- 6/11/17: Puerto Rico holds referendum to apply for statehood

- 7/28/17: Senate fails to replace ACA

- 8/21/17: Total solar eclipse across a band of entire contiguous U.S.

- 8/25 – 8/30/17: Hurricane Harvey hits the Houston, TX area

- 9/6 – 9/10/17: Caribbean & Florida struck by Hurricane Irma

- 9/19 – 9/20/17: Hurricane Maria strikes Puerto Rico

- 10/1/17: Catalonia holds referendum on seceding from Spain

- 11/21/17: Zimbabwe’s President Mugabe forced to resign

- 12/13/17: Third U.S. interest-rate hike of 2017 to range of 1.25 – 1.50%

- 12/20/17: Tax cut & reform bill signed into legislation

Buffet’s Bet

In 2008, Warren Buffett issued a challenge to the hedge fund industry. He bet a hand-picked portfolio of hedge funds would not outperform an S&P 500 Index fund, including fees, costs, and expenses, over a 10-year period. Ted Seides of Protégé Partners took the bet.

- A Shaky Start for Buffett: 2008 was a tough year for the S&P 500 (-37%). The hedge fund index was down also, but not as much.

- Low-Cost Passive Soars Past Active: The S&P 500 Index outperformed Seides’ hedge funds every year from 2009 to 2017.

- Hedge Funds Concede: Seides conceded defeat eight months before the wager ended on 12/31/17. The proceeds of the bet will go to charity.

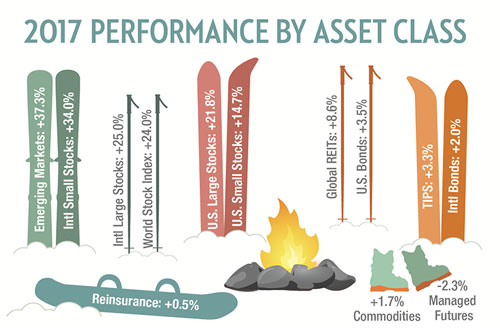

Market return data from Morningstar Direct. Indices used: World Stocks-MSCI All Country World (ACWI) IMI Index, U.S. Large Cap-CRSP U.S. Total Market TR Index, U.S. Large Value-MSCI U.S. Prime Market Value Index, U.S. Small Cap-MSCI U.S. Small Cap 1750 Index, U.S. Small Value-MSCI U.S. Small Value Index, Int’l Large-MSCI EAFE Index, Int’l Large Value-MSCI EAFE Value Index, Int’l Small-S&P EPAC Small Index, Int’l Small Value-S&P EPAC Small Value Index, Emerging Mkts-MSCI Emerging Markets Index, TIPS-BofAML U.S. Treasury Inflation-Linked Securities Index, Short Bonds-IA SBBI U.S. 1 Year Treasury Constant Maturity Index, Interm Bonds-Barclays U.S. Aggregate Bond Index, Int’l Bonds-JPM GBI Global Ex US Hdg Index, Global REITs-S&P Global REIT Index, Commodities-Bloomberg Commodity Index, Managed Futures-Credit Suisse Mgd Futures Liquid Index, Reinsurance-Swiss Re Global Cat Bond Index. Some indices have been appended prior to their inception date with similar indices in order to construct a full data set for time period.