Our Old Friend Volatility is Back

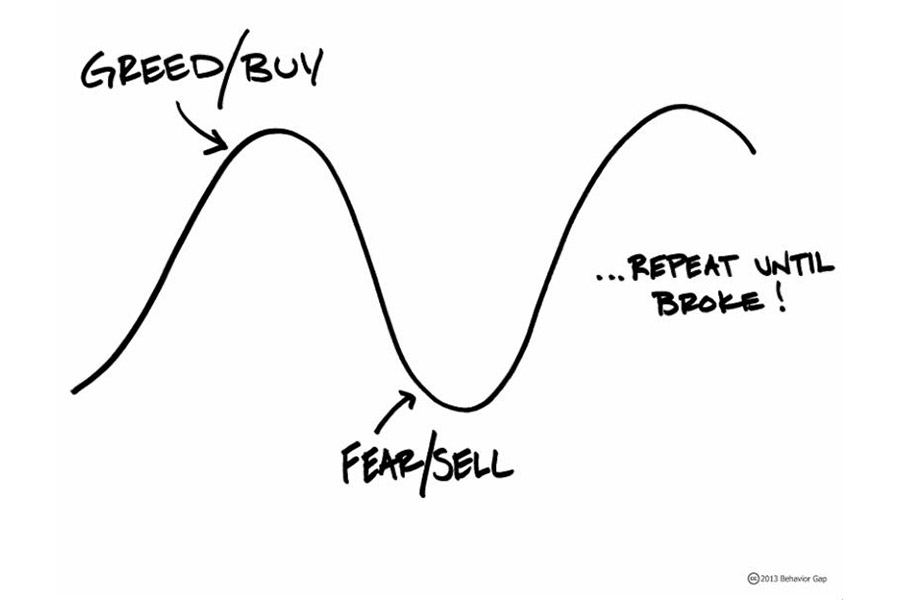

Anxiety is a completely natural response to these events. Acting on those emotions, though, can end up causing more harm than good.

2019 proved to be a terrific year for equity investors around the world, and many were lulled into a sense of complacency during a year which had very little volatility at all. No one could have predicted the cause of the market pullback in the first quarter of 2020, but that is the nature of crises.

News, by definition, is unknowable. As information and data about the virus came to light, the markets immediately priced in future economic slowdown, and it did so in about 30 days. This drawdown speed was unprecedented, but since late March, markets have rebounded, rewarding investors who remained in their seats, rebalanced with discipline and stayed the course.

Volatility is normal in markets. Without taking on risk, long term return on your capital would likely be minimal. The average intra-year drawdowns of the S&P 500 is about -14%. As to what happens next, no one knows for sure. That is the nature of risk.

In the meantime, investors can help manage their risk by diversifying broadly across and within asset classes.

For those who still feel anxious, here are seven simple truths to help you live with volatility.

#1. Don’t make presumptions.

Remember that markets are unpredictable and do not always react the way the experts predict they will. When central banks relaxed monetary policy during the crisis of 2008-09, many analysts warned of an inflation breakout. If anything, the opposite has happened as central banks fret about the effects of deflation.

#2. Someone is buying.

We think that quitting the equity market when prices are falling is like running away from a sale. While prices have been discounted to reflect higher risk, that’s another way of saying expected returns are higher. And while the media headlines proclaim that “investors are dumping stocks,” remember someone is buying them. Those buyers are often long-term investors.

#3. Market timing is hard.

Recoveries can come just as quickly and violently as the prior correction. For instance, in March 2009—when market sentiment was at its worst—the Standard & Poor’s Index 500 rebounded, producing seven consecutive months of gains totaling almost 80 percent. We’re not trying to predict that a similar recovery is in the cards, but we believe the story serves as a reminder that long-term investors can inadvertently turn paper losses into real ones by paying for the risk without waiting around for the recovery.

#4. Never forget the power of diversification.

While equity markets have turned rocky, highly rated government bonds have flourished. This helps limit the damage to balanced fund investors. This example illustrates how diversification spreads risk and can potentially lessen the bumps in the road.

#5. Markets and economies are different things.

The world economy is forever changing, and new forces are replacing old ones. This applies both between and within economies. For instance, falling oil prices can be bad for the energy sector but good for consumers. New economic forces are emerging as global measures of poverty education and health improve.

#6. Nothing lasts forever.

Just as smart investors temper their enthusiasm during market booms, they keep a reserve of optimism during market busts. And just as loading up on risk when prices are high can leave you exposed to a correction, dumping risk altogether when prices are low means you can miss the turn when it comes. As always in life, moderation is a good policy.

#7. Discipline is rewarded.

The market volatility is worrisome, no doubt. These feelings are completely understandable and familiar to those who have known volatility in the past. But through discipline, diversification and by understanding how markets work, the ride can become bearable. At some point, value re-emerges, risk appetites reawaken, and for those who acknowledged their emotions without acting on them, relief replaces anxiety.