The Lights are Still on in the Bond Market

Mark Twain once said, “the reports of my death have been greatly exaggerated” in response to many who presumed him dead, when in fact he was living abroad.

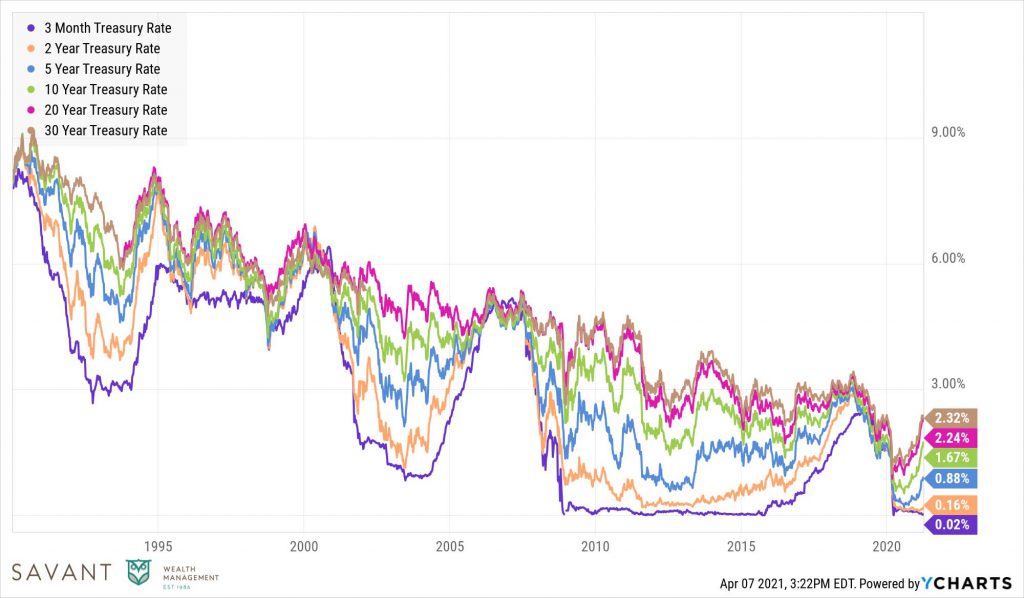

The same can be said for the bond market today. There are no easy answers in the world of fixed income. Even with the recent uptick in interest rates, bond yields across the maturity spectrum remain depressed.

Source: YCharts. Time period reflects 1/1/1990 to 4/1/2021.

There are no trick plays for bond investors; the playbook consists of either earning less income to better protect your money or earn more income while accepting more risk.

Through March 22, 2020, the Barclays Aggregate Bond Index, the bond market equivalent of the S&P 500, is down 3.46% for the year. If the year ended today, it would be the worst year for bonds since 1977.

The main culprit appears to be COVID-19 related government stimulus sparking fears that inflation is coming. For bondholders, inflation serves as a tapeworm that eats investment dollars right off our plates.

Famous bond investor Howard Marks recently addressed this possibility of inflation brought on by government stimulus:

“On TV on February 7, Treasury Secretary Janet Yellen responded to a question about inflation risk posed by the proposed Covid-19 relief package with a long discourse on the importance of delivering relief to Americans who are suffering. Few would argue with that premise. She also made clear that she believes it’s better to provide too much relief than too little. True as well. But that doesn’t mean (a) the more relief the better or (b) there aren’t risks attached.”

It seems obvious the “risks attached” comes from interest rates rising from all-time lows with little cushion from coupon payments to lessen the blow.

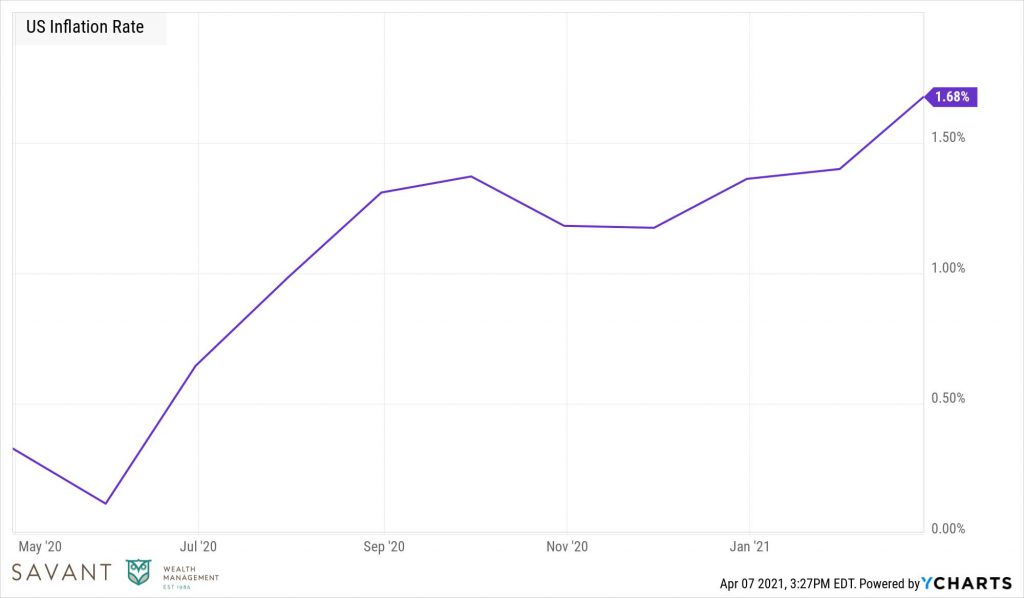

For perspective, inflation is still quite low by historical standards, only up 1.7% versus last year.

Source: YCharts. Time period reflects 3/1/2020 through 2/28/2021.

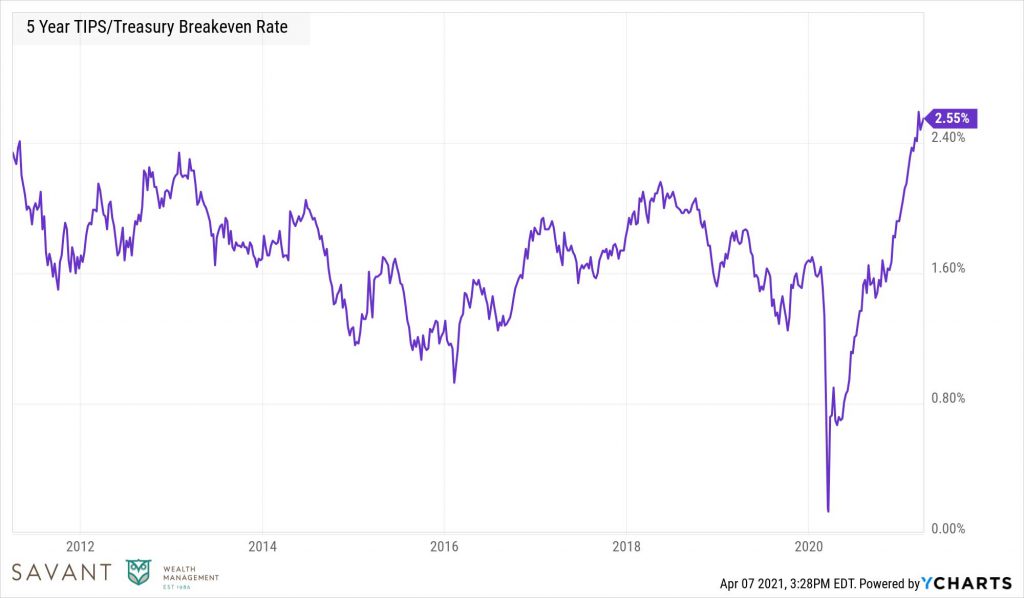

But inflation expectations, measured by the five-year break-even inflation rate, currently sit at their highest level in nearly 10 years at 2.5%.

Source: YCharts. Time period reflects 4/1/2011 to 4/1/2021.

Because the primary risk for bond investors resides with the possibility of higher inflation and the subsequent higher interest rates that would likely follow, we believe investors should consider making allowances for this in portfolios.

In fixed income, certain assets are more impacted than others by inflation. This includes limiting exposure to long-term bonds that suffer more when interest rates rise and holding assets like Treasury Inflation Protected Securities (TIPS) and floating rate instruments that may serve as more effective hedges.

And while inflation is a negative for bond holders, some areas of the market benefit from higher inflation. Certain equities, such as real estate that owns hotels, rental properties and warehouses can increase rents in response to market conditions and stand to be more valuable. In addition, value stocks, such as banks and energy stocks, could benefit as well. Energy and utility stocks benefit from higher commodity prices and financial stocks benefit from higher interest rates, both of which are products of higher inflation.

While it’s easy to claim bonds serve no purpose today given persistently low yields, we think they still serve as a key tenant in a portfolio. While not all encompassing, their value lies in the following:

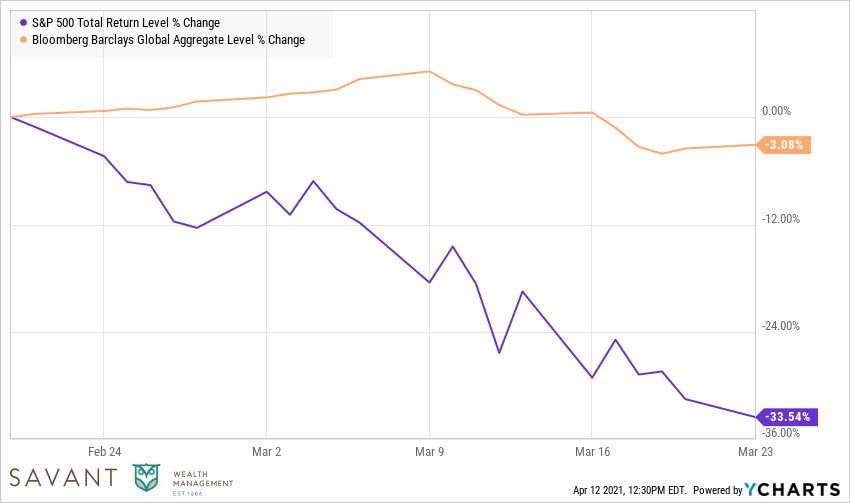

Bonds provide a hedge to stock market volatility. Look at the period from market peak in February 2020 through market bottom in March 2020.

Source: YCharts. Time period reflects 2/20/2020 to 3/23/2020.

Though bonds were still down during that time, they held up much better than stocks and provided an anchor in the portfolio. At the very least, bonds provide an emotional hedge to declines in the stock market. While you give up higher expected returns in the long-term you may receive significantly less risk in the short-term.

Investors can also use bonds to rebalance into stocks during market declines. After the market bottomed in late March 2020, the market rallied back to all-time highs by the middle of June 2020. Not all market recoveries will happen that fast, but every market dip has been followed by a new market high for the past hundred plus years. A very simple way to “buy the dip” is to sell bonds and buy stocks.

Lastly, sitting in cash comes at a cost. While bond yields are extremely low, yields on cash are even lower. Interest payments, even if only slightly higher, can compound at higher rates over time in bonds.

Relative to stocks, bond investors have had smooth sailing for the past 40 years. The Barclays Aggregative Bond Index has only finished with a negative return for a full year three times since 1977. As has been said, a bad year in bonds is a bad day in stocks. Based on current interest rates, things will be more challenging going forward. But don’t expect to see bonds in the obituaries anytime soon.

This is intended for educational purposes only and should not be construed as personalized investment advice. Please contact your investment professional regarding your unique needs.