What to Expect When You’re Expecting (Outperformance)

The recent stretch of underperformance for small and value stocks has been challenging. Value and size factors have been pronounced dead before, only to come back with a vengeance. Is this time different? Or what is that light at the end of the tunnel?

Everyone has a bad day at the office now and then, but a rough decade? That’s worth exploring a bit more when it comes to the struggles small and value stocks have had since 2010. By tilting towards these factors, or risk premia, returns are supposed to increase but instead, cumulatively, small stocks have underperformed large stocks by 13.2% and value stocks have underperformed growth stocks by 33.7% since January 2010 across developed countries. To make things worse, both small and value have continued to underperform the broader market as stocks fell over 20% in the first quarter.

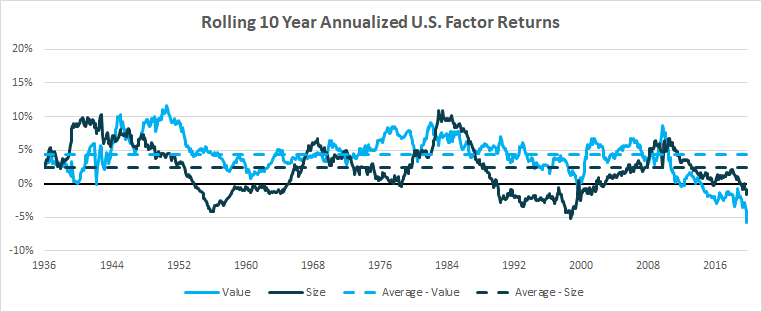

Exhibit 1

Looking at over 90 years of history in Exhibit 1, both the value and size factors have seen negative returns over 10-year stretches. Note that in Exhibits 1-3, we are looking at pure factor returns. This means the value factor portrays the return of value stocks minus the return of growth stocks, the size factor depicts the return of small stocks minus the return of large stocks, and so on. In fact, this is not even the first time we have seen both factors post negative 10-year returns at the same time. Despite a few prolonged periods of negative returns for these factors, we see that, on average, the value factor has contributed a 4.3% 10-year annualized return and the size factor has added 2.3%.

While the long-term averages are savory, it is crucial for investors to remember the alias for these factors – risk premia. Investing in these factors only pays off over the long run because risk is involved. The risk is that the factors can, and will, suffer periods of underperformance. It will not always be easy, but historically investors who remain invested in these factors have been rewarded. Did you know investing in stocks is also a form of factor investing? As investors have the choice to hold stocks or hold cash, the equity risk premium is calculated as the return of stocks minus the return of very short-term government bonds.

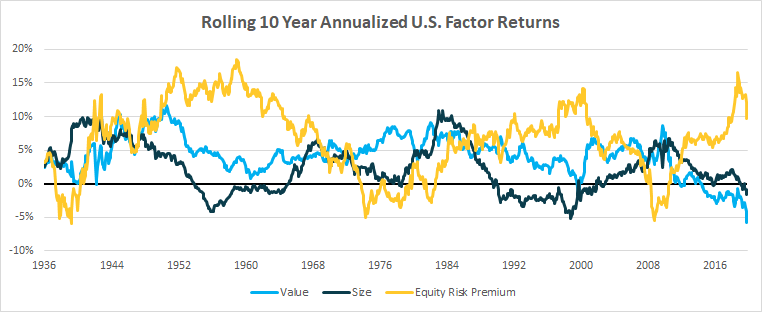

When we overlay the equity risk premium into the chart (Exhibit 2) showing the value and size factors as well, we notice that stocks have had more periods of underperformance and arguably worse underperformance than either the value or the size factor! Of course, this is not a call to eliminate stocks from your portfolio. Rather, we need to understand that successful long-term investing requires diversifying across several uncorrelated sources of return.

Exhibit 2

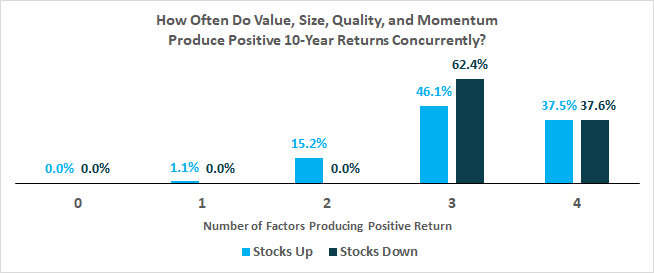

Adding two additional factors to the mix, quality and momentum, Exhibit 3 shows us that regardless of the market environment the value, size, quality, and momentum factors usually “work.” Historically, when the equity risk premium has been positive over a 10-year stretch there has been a 16.3% probability, or about a 1 in 6 chance, that only one or two factors have been generating positive returns over the same stretch. But overwhelmingly, at least three of the factors are generating positive returns whether stocks are up or down. This suggests that while diversifying across these factors may help improve long-run returns, they can also help mitigate the damage that prolonged, negative stock returns could do to your financial plan.

Exhibit 3

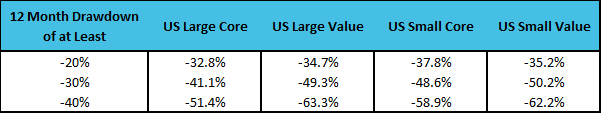

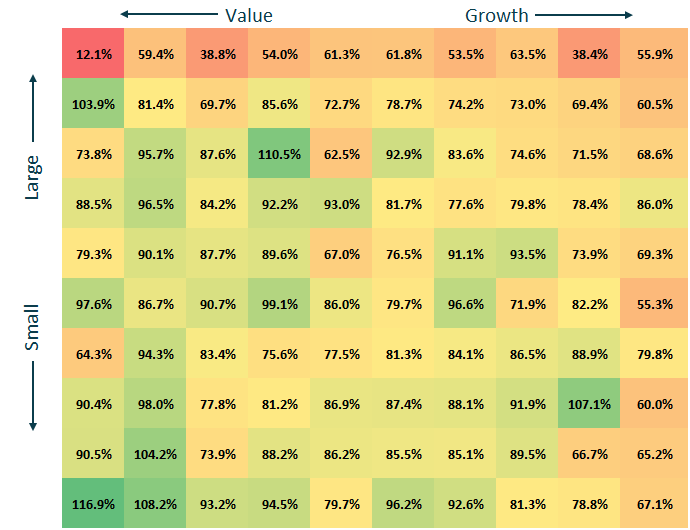

While it is rare for multiple factors to underperform at the same time, it is not unusual for the value and size factors to underperform during periods when stocks struggle. Exhibit 4 illustrates the performance of large value, small core, and small value stocks relative to large core across worsening levels of bear markets. Notably, the small and value strategies underperform regardless of the strength of the bear market. A down market is not an ideal time for underperformance, but academics would argue that this risk of underperformance during the worst of times is the basis for why investors in small and value stocks should continue to expect a return premium into the future.

Exhibit 4

Some have looked at the recent pain and uttered those four dangerous words – this time is different – while pointing to today’s gigantic, consumer-friendly tech companies as the final nail in the small value coffin! Before we get too carried away, the evidence suggests we have been here before. First, it was railroads in the 1880s, then came the assembly line and the automobile in the 1910s and 1920s. A few decades later the “Nifty Fifty” were untouchable, followed by internet stocks of the DotCom bubble. Odds are this time is not different. It is unlikely this decade’s hot stocks such as Facebook, Apple, Netflix, and Google are not the ones to finally lead U.S. stocks to the promised land of everlasting bull markets (as we learned the hard way in the first quarter of 2020) and shift the paradigm of the last 100 years.

So if the value and size factors aren’t being lowered into their graves surrounded by weeping academics, what light might there be at the end of the tunnel? For starters, two signals point to a brighter future for small and value stocks on the horizon: attractive valuations and a history of outperformance following crisis periods.

While the pain of this sudden, sharp bear market has been exacerbated by the underperformance of small and value stocks, historically, Exhibit 5 highlights that small value stocks have been among the best performers coming out of a bear market. For the three years following the 1973-1974, 1987, 2000-2002, and 2007-2009 bear markets, small value stocks outpaced large growth stocks by a wide margin, on average.

Exhibit 5: Three Year Cumulative Performance of U.S. Stocks by Size and Value Decile Following Bear Markets

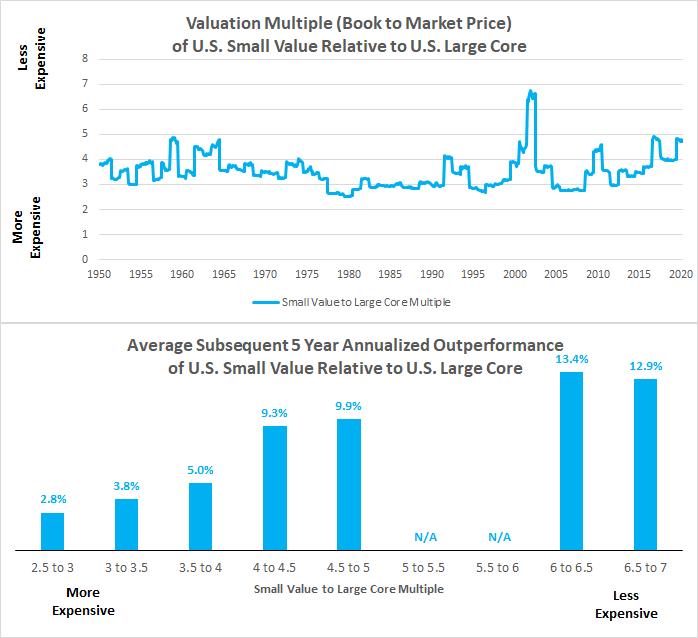

Furthermore, relative to large core stocks, the top chart in Exhibit 6 shows small value stocks are near their cheapest levels since 1950. While knick-knacks from the dollar store are often cheap because they are not worth buying, when asset classes are cheap it has some predictive power regarding improved forward-looking returns. In this case, when small value is cheap relative to large core stocks it may foretell longer-term outperformance for small value stocks.

Exhibit 6

Historically, the bottom chart in Exhibit 6 demonstrates that small value stocks have, on average, outperformed large core stocks regardless of the environment. But when small value stocks become less expensive relative to large core stocks, the longer-term outlook has brightened further. Notably, these analytics tell us nothing about next month (or next year for that matter) but demonstrate evidence of opportunity for long-term investors.

For investors believing that the small or value factors represented consistent, year-over-year outperformance, this rough stretch has likely had them scratching their heads at best. But we believe long-term investors should understand:

#1. No risk, no reward: These size and value factors are risk premia. If we expect long-term outperformance, it is in part explained by the underlying risk, which manifests itself in periods of underperformance.

#2. We have been here before: This is not the first time investors have proclaimed the death of the size or value premiums. The world has certainly changed and this crisis is much different than the last – no one is questioning that. But the truth is, it’s always different this time! It’s not about whether “this time is different,” but rather if it’s different enough to throw almost a century of data out the window.

#3. Opportunity’s knocking: No doubt, the recent stretch of underperformance for small and value stocks has been challenging. But the combination of attractive valuations and a history of outperformance coming out of bear markets may represent an ever-brightening light at the end of this tunnel of recent underperformance.