The Weather Has No Memory

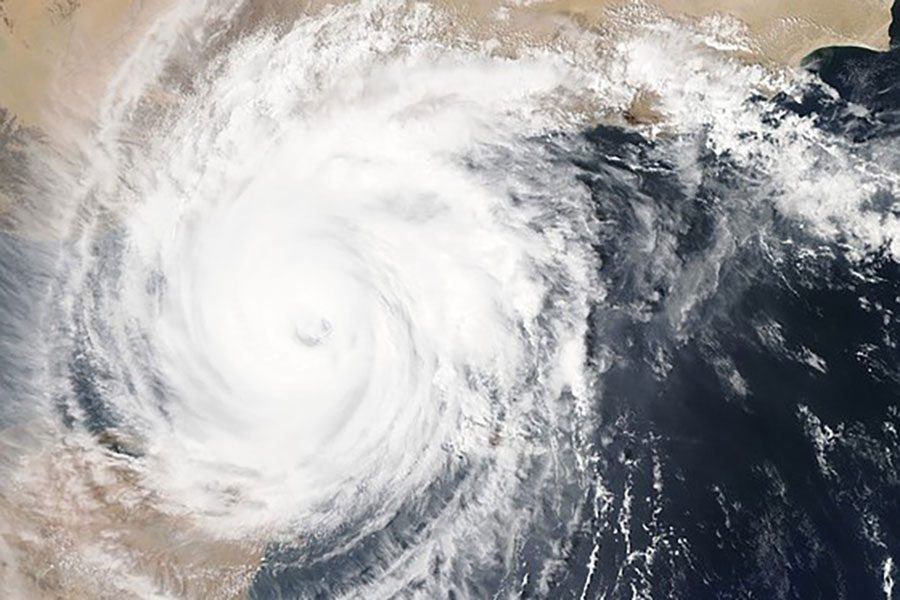

The recent threat of Hurricanes Lane (Hawaiian islands) and Florence (East Coast) brings to mind the devastating hurricane season of 2017. It also brings up questions such as, “Does last year’s active hurricane season demonstrate an increasing trend of landfalling hurricanes? Does it make it more likely this year will be an active season?” Historical weather data illustrates the answer to both is “no.”

First, hurricane data going back to 1851 for those that made landfall shows the long-term average is 1.8 per year. Furthermore, the long-term average of more powerful Category 3+ hurricanes making landfall each year is 0.6. While some may claim that climate change has created more consistent, stronger storms, the 10-year moving average of the data for both series has no discernable trend, as it has bounced around just above and below the long-term averages (source: Stone Ridge Asset Management, National Oceanic and Atmospheric Administration).

Second, hurricane data for the past 167 years shows there have been 75 major hurricane years (at least one Category 3+ hurricane). Only 34 times did a major hurricane year follow a major hurricane year. In other words, there is a 45% probability of at least one major hurricane in any year (75/167) and a 45% probability of a major hurricane year following a major hurricane year (34/75).

What does this have to do with investing? Investors with holdings in the reinsurance asset class have exposure to natural catastrophe risk. For example, loss claims following hurricane damage can result in the reduction of the return premium that a reinsurance investor receives as part of an insurance-linked security because it has to pay out on losses based on the underlying contract terms. With the recent headlines and peak hurricane season upon us (August-November), these questions are relevant for such investors, but the normal variability in weather means each year begins with a clean slate!

In the context of a portfolio, the reinsurance asset class has no correlation with any of the traditional asset classes such as stocks and bonds and is independent of financial market activity. Therefore, we believe the asset class can be a good piece of the puzzle when building a globally diversified portfolio. The combination of various risk premiums can reduce the overall level of volatility and help improve expected returns of a portfolio over the long run. Read our complete August 2018 Economic & Market Commentary for Market Returns Year-To-Date, Market Returns Longer Term Annualized, Economic Indicators, and an Appendix.

This is intended for informational purposes only and should not be construed as legal, investment or financial advice. Please consult your legal, investment and financial professionals regarding your specific circumstances.