What is Evidence-Based Investing (EBI)?

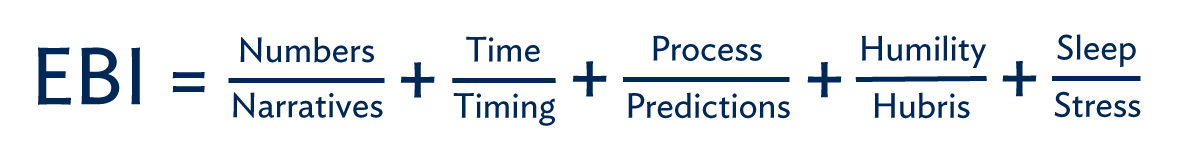

EBI is a decision-making framework that makes it possible to evaluate the related topics confronting today’s investor and challenge the wisdom of conventional investment advice. EBI offers a way to navigate the investment landscape in a systematic, analytical, and scientific manner, all with the goal of maximizing risk-adjusted after-tax returns for investors. EBI guides investors to make decisions based on data, academic research, and defined processes, rather than speculation, greed, and fear. The following formula expresses EBI:

In each of the above ratios, your numerator should be higher than your denominator. Because we obviously can’t precisely quantify these metrics, think of it as more of a personal scorecard. If you assess yourself honestly and come up with an overall “EBI Score” of greater than five, you are well on your way to being a bona fide practitioner of Evidence-Based Investing.