Beat the Short-Term Market Jitters

When the financial markets are in turmoil and account balances start to fall, there is a strong temptation to ask your financial advisor to “do something” to stem any perceived losses. Yet it is often the case that staying the course—or doing nothing—proves to be the better path.

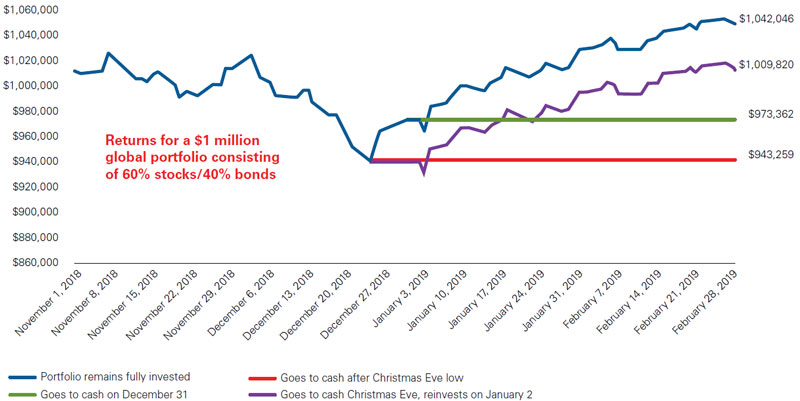

Here is one recent example: A hypothetical 60% stock/40% bond portfolio that stood at $1 million on the morning of November 1, 2018, would have lost 5.7% of its value by Christmas Eve. Yet selling the portfolio at that time and fleeing the markets, even if briefly, would have cost an investor tens of thousands of dollars in two months, versus the alternative of staying invested.

When faced with a similar situation, consider how you might feel if markets rebounded and you could have recouped all your money, and more. That’s why it’s best to stick to the long-term plan you and your advisor have built. Any changes should be made because of changes in your life, not changes in the markets. If you have questions about making portfolio moves, remember to talk to your financial advisor before acting.

Staying the course can pay off; abandoning course can be costly

The global stock market drop in late 2018 offered a lesson in investor behavior

Sources: Vanguard calculations, based on data from FactSet, as of February 28, 2019.

Notes: U.S. stocks represented by CRSP US Total Market Index. U.S. bonds represented by Bloomberg Barclays U.S. Aggregate Float Adjusted Index. Global stocks represented by FTSE Global All Cap ex US Index. Global bonds represented by Bloomberg Barclays Global Aggregate ex-USD Float Adjusted RIC Capped Index. The performance of an index is not an exact representation of any particular investment, as you cannot directly invest in an index.

Past performance is no guarantee of future results.

All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. We recommend that you consult a tax or financial advisor about your individual situation. Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot directly invest in an index.

Investments in bonds are subject to interest rate, credit, and inflation risk.

This information has been prepared by Vanguard. Savant does not guarantee its accuracy, timeliness, or completeness.