Divorce Help: Financial Planning and How to Regain Your Confidence

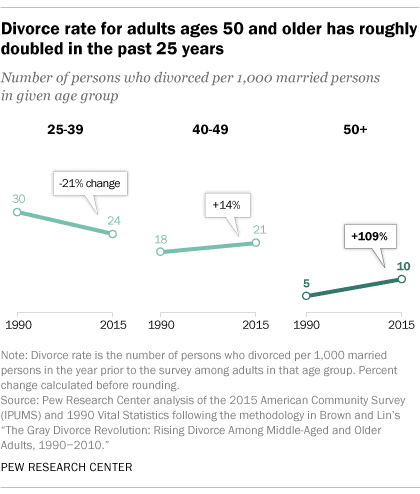

While divorce has long been associated with younger couples navigating the challenges of early marriages, a new pattern is emerging, where couples are increasingly deciding to end their unions later in life. Research shows divorces involving couples 50 and older have more than doubled since the 1990s. Looking further, the divorce rate among couples ages 65 and older has more than tripled.

The hardest group hit? Those divorcing from a second or third marriage. [i]

Gray divorce happens for many reasons, just like any divorce, but one of the primary reasons is weighing the opportunity for happiness in the future. Especially as responsibilities may be changing – children becoming more independent, parents passing on and no longer needing the intensity of managing care – this may bring more freedom and focus on what each partner wants in the coming years. The Baby Boomer generation has a longer life expectancy than the previous generation, which may make married couples think more deeply about how they want to spend those years.

Finances can also strain a marriage, especially if one spouse favors saving while the other spends more. It may seem easier to remove the financial strain and live how it works best for the individual.

If you find yourself going through or recovering from a gray divorce, what financial planning steps should you take to help regain your confidence?

Post-Divorce Checklist

Divorced at last? After you finalize your divorce, there is still much to do. Savant’s Post-Divorce Checklist outlines the financial and legal steps to consider after your divorce is final.

Rethink Your Financial Priorities

Your first step for divorce help should be to reflect on your financial priorities for the future.

As a couple, you likely had goals and objectives you created together. However, divorce is a significant life transition. While you lose that particular relationship, you regain the freedom to recreate your life on your terms.

Take the time to think through what is important to you going forward, which might be different than what you valued in the past. You may be able to pursue new and different goals or better align your former goals with your future priorities. This clarity will help you decide how and why to alter your spending and financial priorities.

Revisit Recurring and Regular Expenses

When you’re single again, it can be a shock to shoulder all monthly expenses alone. It can be done; it just requires attention to your spending as you work through your changing situation. As you transition from possibly two incomes, during pre-retirement, or multiple streams of income following retirement, to one income or fewer streams of retirement, you will likely have to prioritize your expenditures.

Think about what you can continue to prioritize with your finances and what may have to change. Are you keeping the house? Does it still have a mortgage? You’ll need to include the mortgage payment in your budget. Besides the mortgage, there are property taxes, insurance, and home maintenance to cover as well.

Next, you may need to think about alimony when seeking divorce help. Most long-term marriages end up with lengthy or even lifetime alimony expenses. Shorter marriages might involve shorter-term payments.[ii] Alimony payments may be good news if you’re the receiver or bad news if you’ll be paying since this no longer constitutes taxable income or a deduction.

If you will likely be responsible for paying alimony, it’s time to think about how that will impact your budget.

What other regular expenses will you incur? Consider the cost of your daily living expenses and any outstanding debts or obligations you have, including:

- Healthcare expenses, both insurance costs and ongoing cost of care for medical needs. You may not yet be old enough for Medicare and if you are, it will be important to determine if the coverage is adequate or you may need to purchase a supplemental policy to assist.

- Financial support you’ve provided or promised to children or grandchildren.

- Ongoing payments for Country Club or HOA membership dues.

- Yard and lawn care, housekeeping, utilities, cable, or other needs.

- Regular insurance payments, such as life, auto, or long-term care.

- Subscription costs, whether to periodicals, regular deliveries, streaming services, audio or book databases, etc.

- Travel commitments, vacation homes or leisure items, or timeshares.

As you look at expenses, this is where it pays to think things through.

There may be ways to drastically reduce ongoing expenses. You could consider downsizing your current home if the expenses for upkeep are too significant. If you own a second home, it may make sense to examine keeping only one residence. If your vehicle is a luxury brand, it could also be more manageable to drive a vehicle with lower purchase and maintenance costs. These changes may add liquidity to your personal finances, which can help assist with ongoing living expenses.

Considering the costs of “extra” commitments such as a private dining club membership, the country club access, or even something as minor as a subscription service you don’t use.

Another important understanding for income and expense purposes in divorce help is making sense of your income tax liabilities, which may look very different as a single taxpayer than it does filing taxes jointly. If you are working, it may mean withholdings need to be adjusted on a paycheck-to-paycheck basis. If you are retired, then this change may affect what you will need to estimate for quarterly tax payments.

Also, if you’re offering support to loved ones like adult children or grandchildren, that may need to be revisited as well. Remember, students can access loans for college, but there’s no financing available for retirement savings. So be conservative with what you can and can’t offer your family until your finances have been settled.

Splitting Assets in the Divorce

As part of a divorce settlement, there will be a documented agreement with each asset identified and clearly divided.

While this process seems relatively straightforward, it’s an area where making smart financial choices can have a major impact based on those asset divisions. As you are negotiating the property settlement with your former spouse, it is imperative that you consult with a professional who can assist you in the tax ramifications of accepting certain assets as part of this property divide.

For example, a divorce settlement agreement can result in one spouse being awarded the entire retirement account and IRA, while the other spouse receives the personal investment accounts with equal dollar amounts. Even though the total dollar amount is the same, the effects of the division may not create parity. Retirement accounts are generally taxed as ordinary income for every dollar withdrawn, while personal investment accounts are generally only taxed on capital gains from growth and the dividend and income earned going forward. This type of account is far less taxing compared to accepting an IRA or retirement account.

Advice from a qualified financial planner can be crucial in this level of divorce help – someone who understands tax laws, to evaluate the property and assets settlement not just based on total dollars, but single-taxpayer status and income. The planner can partner with you to assess which assets are most prudent for you when the divorce is final.

Before the final court decision, it’s wise to look ahead and make some estimates. Compare your likely split of the assets to your liabilities and see where it leaves you. Will you need to supplement with part-time income or withdraw more money from your retirement accounts to get by?

As those assets are divided, it’s essential to remember to update the beneficiary for each asset that requires a beneficiary designation. For each account, noting the beneficiary with whom you’d like to receive the funds will keep your legacy protected and avoid it accidentally going to a former spouse.

Review Possible Adjustments to Your Investments

Now that you’re single, you may have different investment priorities and risk tolerance, which will likely affect your portfolio makeup.

You may have to change your overall asset allocation. For example, if you’ve lost part of your retirement account balance or income stream as a result of the divorce, you’ll need to determine how to proceed. You could take higher risks to attempt to increase your growth, but along with that comes an increased risk of losses.

Instead, you can consider engaging the divorce help of a financial planner who also provides tax-focused planning to look for ways to maximize your tax efficiency. Their goal is to help you improve your after-tax returns without taking on more risk. It can also be relevant to other areas of your finances, balancing account types and withdrawals well within current tax law.

Update Your Insurance Policies

You’ll probably need to adjust your insurance policies. Start by updating your beneficiaries and removing your former spouse.

It’s also an excellent time to evaluate if you can or should reduce or increase coverage. Home, auto, and personal property insurance should be evaluated to make sure they properly reflect your current situation, are solely in your name, and any additional needs you have are protected. You may not need some insurance policies you had before as you transition to single status.

Legal Documentation

Along with beneficiaries of insurance policies, it’s important to update several legacy documents:

- Last Will and Testament

- Financial Power of Attorney

- Medical Power of Attorney

Often, the spouse is named as the executor and heir to your estate. For medical decisions or through an accident, your former spouse may still be documented to handle financial and healthcare decisions. Updating these documents to include individuals who are more appropriate is key. Please note that these documents can be updated before the divorce is final and, in many cases, an individual may want to make some of these changes after the date of separation.

Healthcare

If you are covered by Medicare, be aware that your premium amount can change based on life circumstances.

After the divorce is final, you should re-evaluate your Medicare premiums. A Medicare premium is based on the income reported on your tax return from two years ago, and the higher the income, the higher the premium. You were likely paying a Medicare premium rate based on your married status and income level before your divorce. Processing a ‘change in life event’ with the Social Security Administration may allow you to lower that monthly premium to better match your current income, rather than income while married from two years prior. Note: This change is not automatic; a financial planner can provide divorce help to guide you to discover if you qualify for a reduced premium and help you access it.

If you are still covered by your spouse’s employer-sponsored health insurance policy, you will need to find a new plan. If you’re employed, your best bet is often to enroll in your employer’s health plan. If that’s not an option, you can extend your coverage through COBRA while you look for other plans or apply through the affordable care marketplace.[iii] COBRA currently allows an individual who is losing employer coverage due to divorce to keep the coverage for 36 months as compared to the normal 18-month timeline. This means you may have some time to evaluate the options and compare the costs of COBRA to an individual healthcare policy.

Social Security

Divorce can impact your Social Security as well. Were you married for over ten years? If so, you may be entitled to receive Social Security benefits on your ex-spouse’s record, which may mean a higher benefit if he/she earned more, provided:

- You’re unmarried, and

- You are 62 or older, and

- Your ex-spouse, remarried or not, is entitled to Social Security retirement or disability benefits, and

- The benefit you’re entitled to get based on your work record is less than what you would get based on your ex-spouse’s work record.

Bottom Line

If you’re going through a divorce, take time to take care of your health and emotional well-being. Divorce can be a draining process, but millions of people have emerged to live happier and more fulfilled lives.

Sources:

[i] Led by Baby Boomers, divorce rates climb for America’s 50+ population

[ii] Alimony: Definition, Types, and Tax Rules

[iii] All About COBRA Health Insurance

This is intended for informational purposes only. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant. Please consult your investment professional regarding your unique situation.