Fed Pauses Rate Hikes Again – What’s Happened and What’s Next?

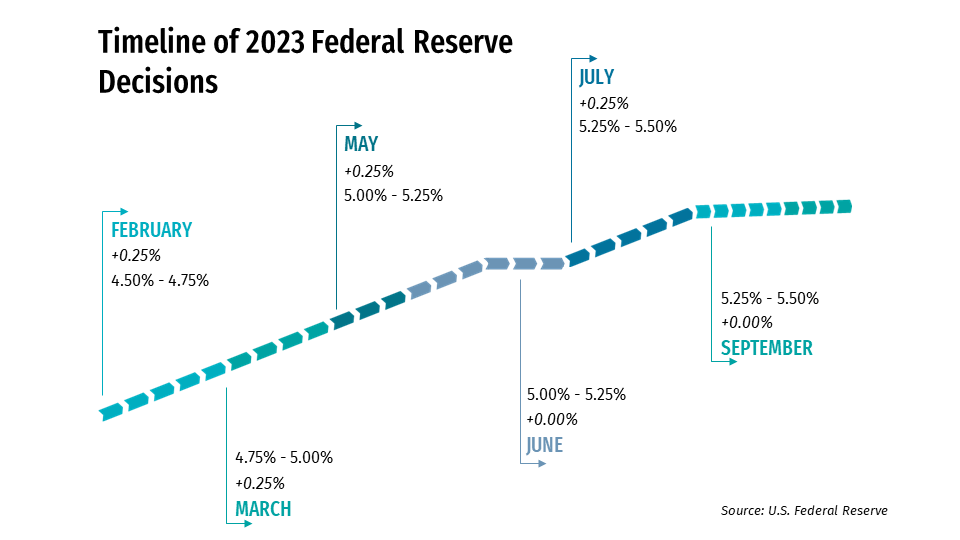

If you’ve been following along this year, you know it’s been like a rollercoaster ride. We’ve been on the chain lift nearly the whole time, watching interest rates go up four times this year alone. Now, it seems like we could be stuck on the pre-drop following two interest rate pauses. These pauses, however, are essential for assessing the monetary policy lags that affect the economy and inflation.

Figure One

So, when will we get to experience the first drop, when interest rates are cut for the first time since 2022? And when we finish our descent, will we be met with a soft landing or a hard landing?

It’s difficult for anyone to know the exact answer to these questions, but we can look at some key factors at play here.

Labor market conditions are an important indicator of the health of the U.S. economy. Although the U.S. labor market has remained resilient, slight signs of cooling are beginning to show. While payrolls rose by 187,000 in August, the unemployment rate rose to 3.8%, its highest level in 18 months.

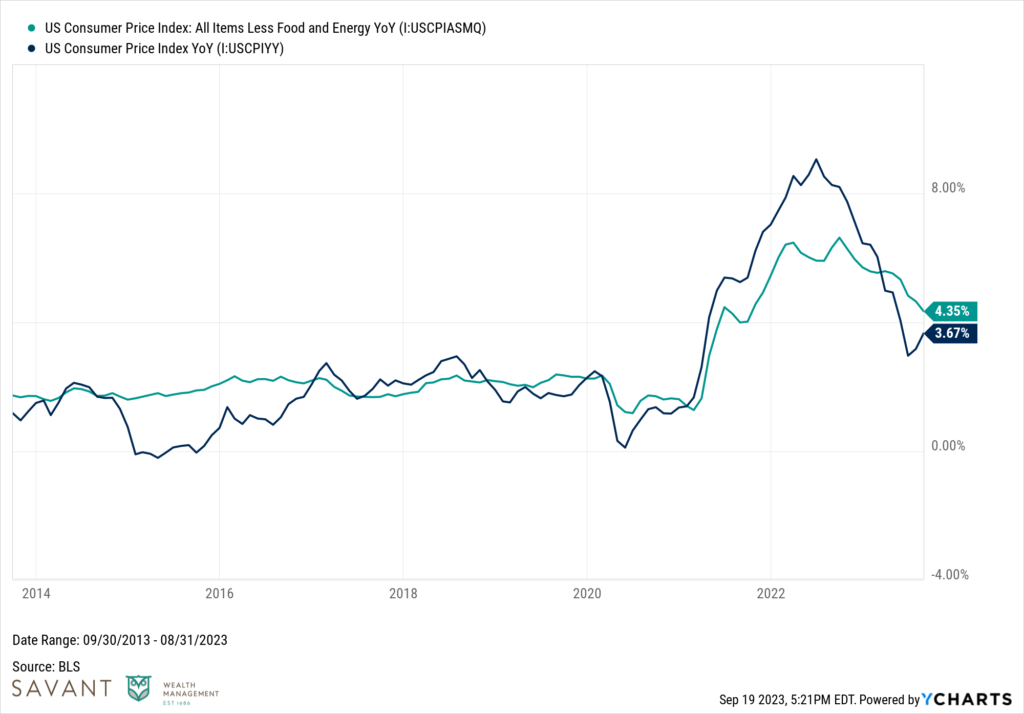

Headline inflation, on the other hand, rose 3.7% YoY in August but has still substantially declined from its peak of 8.9% in June 2022. Whether the Fed will cut interest rates in the near term depends on how inflation continues to decelerate. This deceleration, along with a resilient economy, could help pave the way toward a soft landing.

Figure Two

With minimal changes to the Fed’s post-meeting policy statement, many investors honed in on the dot plot , which represents what each U.S. central banker believes will be the appropriate midpoint of the federal funds rate at the end of each calendar year for the next three years.

The median projection this time showed officials expect to raise interest rates at least once more this year, but one former senior Fed economist, William English, believes that from a communications perspective, it’s easier for the Fed to project one more increase and then decide against it than it is to signal no more increases and hike again. Additionally, the Fed is now forecasting two rate cuts in 2024.

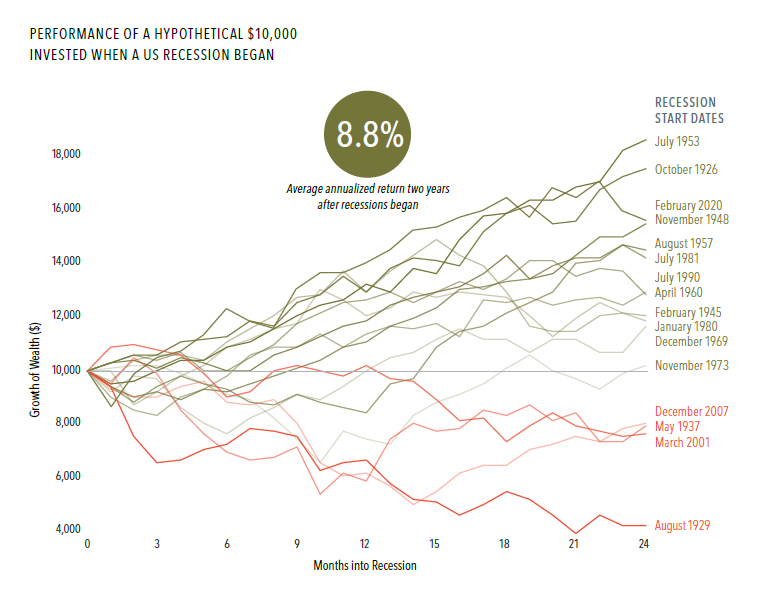

Now whether we are met with a soft landing or a hard landing, it’s crucial to maintain a long-term perspective. Portfolio diversification is key right now, as some asset classes will perform better than others under both scenarios. A recession is still a possible outcome. Research by DFA shows that in 12 of the 16 previous U.S. recessions, stock returns were positive two years after the recession began, and the average annualized return was 8.8%.

Figure Three

Source: DFA. Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. In U.S. Dollars. Performance includes reinvestment of dividends and capital gains. Growth of wealth shows the growth of a hypothetical investment of $10,000 in the securities in the Fama/French Total U.S. Market Research Index over the 24 months starting the month after the relevant recession start date. Index data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. See disclosures for additional details.

With only two Federal Open Market Committee (FOMC) meetings remaining this year, the Fed continues to face a delicate balancing act. At Savant, we understand that times like these can be very uncomfortable, but we believe they are temporary and diversification can be a powerful tool in your portfolio.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. Past performance is not indicative of future results.

Figure Three Disclosures – Continued

Sample includes 16 U.S. recessions as identified by the National Bureau of Economic Research (NBER) from October 1926 to February 2020. NBER defines recessions as starting at the peak of a business cycle. A business cycle is a description of the various stages of economic output.

Fama/French Total U.S. Market Research Index: July 1926–present: Fama/French Total U.S. Market Research Factor + One-Month U.S. Treasury Bills. Source: Ken French website.

The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

Results shown during periods prior to each index’s index inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.