Happy New (RMD) Year!

It isn’t often we get good news from the IRS, but if you’re one of the many older Americans who must take a required minimum distribution, or RMD, from your qualified retirement plan this year, your year just got off to a great start. That’s because new RMD tables went into effect on January 1, 2022 that will lower RMDs slightly for most ages. With smaller RMDs, you’ll also owe less in taxes. Good news, indeed!

RMDs: The Backstory

RMDs apply to people who are age 72 and above with “qualified” retirement plans, including SIMPLE, SEP, and Rollover IRAs, annuities, and most 401(k) and 403(b) plans. The IRS typically publishes tables to help you determine the RMD amount you must take each year based on your account’s balance as of Dec. 31 of the previous year.

In 2018, the president signed an executive order seeking the Treasury Department’s review of RMD rules to determine whether they needed to be updated to reflect greater longevity among Americans. The IRS ultimately created a new set of RMD tables that went into effect this year. Though we’re still waiting (as of this writing) for the IRS to update the tables on its Publication 590-B, it did submit them to the Federal Register in Nov. 2020.

How Are RMDs Calculated?

If you turned 72 last year, your first RMD will be due by April 1 of this year. Your second one will be due by Dec. 31 of this year. That’s because all RMDs must be made by Dec. 31 after the first year.

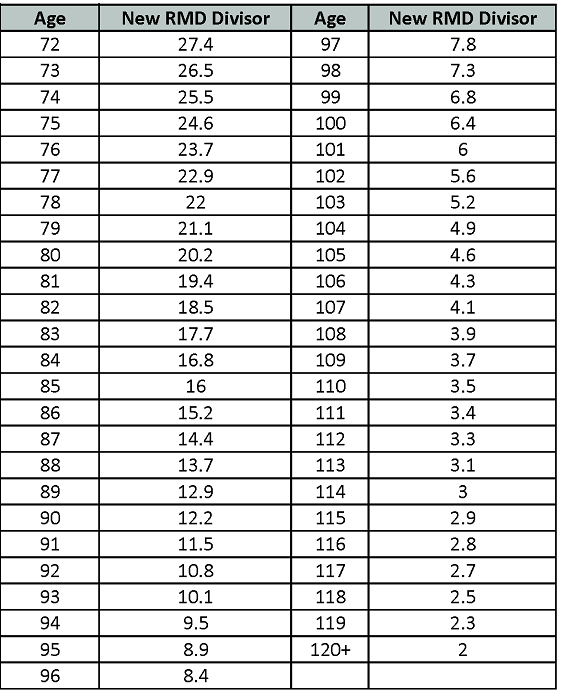

To figure out how much your RMD will be, you can use the Uniform Lifetime Table listed in the Federal Register (or Publication 590-B, when updated) to make your calculation. On the table, find your age first. Then, find the “life expectancy factor” in the column next to your age. Finally, divide the balance of your retirement account as of Dec. 31 of the previous year by your life expectancy factor.

The New Uniform Lifetime Table:

According to the Uniform Lifetime Table, if you are 72, your Life Expectancy Factor is 27.4. If the balance in your 401(k) account was $100,000 on Dec. 31, 2021, your RMD would equal $3,649.64 this year.

What If I Don’t Want to Take an RMD?

If you don’t need the money, you may be tempted not to take an RMD. But that’s where the “Required” part comes in! If you don’t take an RMD, or take less than you’re supposed to, you’ll be taxed 50% of the difference between the amount you were supposed to take and the amount you actually took (if any), so it pays to comply with the law and make an accurate calculation. There are some exceptions to the rule, and you aren’t required to take your RMD in a lump sum. You can space out the withdrawals throughout the year, as long as you withdraw the total RMD by Dec. 31.

What If I Inherited an IRA?

Inherited IRAs also have RMD rules, which differ according to your relationship with the person who left you the IRA. In more complex situations like this, it’s best to work with your financial advisor and/or tax advisor to understand the tax implications and other rules that may apply. A financial advisor can also help you create a retirement income plan that ensures you’re withdrawing from the right accounts, at the right times and in the right ways.

This is intended for educational purposes only and should not be construed as personalized investment or tax advice.

Savant Wealth Management (“Savant”) is an SEC registered investment adviser headquartered in Rockford, Illinois. Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments and/or investment strategies recommended and/or undertaken by Savant, or any non-investment related services, will be profitable, equal any historical performance levels, be suitable for your portfolio or individual situation, or prove successful.