It’s All About Time in the Market, Not Timing the Market

The difficulties of market timing have been well documented in financial literature. In addition to the challenge of deciding when to get into and out of the market, market timers must overcome the burden of higher costs due to more frequent trading as well as the tax implications of this trading. Making meaningful and correct market calls consistently enough to overcome these inherent costs is an extremely daunting challenge for investors who try to time the market. Also working against market timers is the fact that the stock market goes up more often than it goes down.

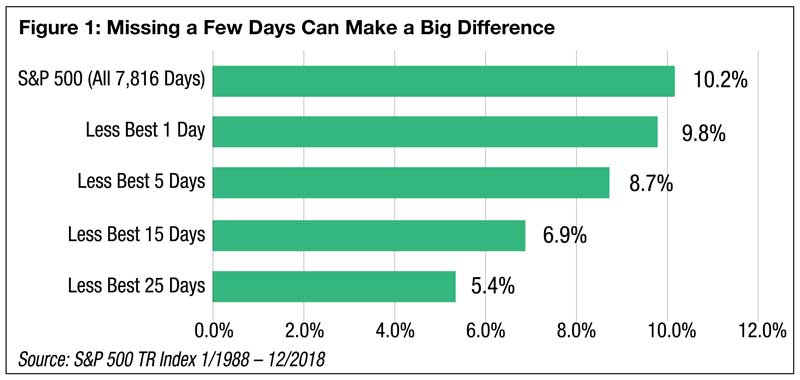

Historically, the S&P 500 has had a positive return in 76% of calendar years while the MSCI EAFE index, representing international stocks, has had a positive return in 70% of calendar years.¹ This makes staying out of the stock market an increasingly risky proposition the more time passes. On the other hand, being out of the market for short periods can be just as dangerous. Figure 1 shows how much an investor would have lost, in annualized returns, by mistiming the market and missing the best days of the S&P 500 since 1988. Although being out of the market may feel like playing it safe, the data shows that market timing is in fact a risky endeavor. However, being all in or all out is not the only form of market timing.

Some investors attempt to predict which asset classes will perform best in a specific time period and shift their allocation towards those. Although this strategy removes the risk of being completely out of the market, it produces portfolios which are not properly diversified and still faces the added costs and tax implications. Furthermore, predicting which asset classes will perform best is no easier than predicting when the market will go up or down.

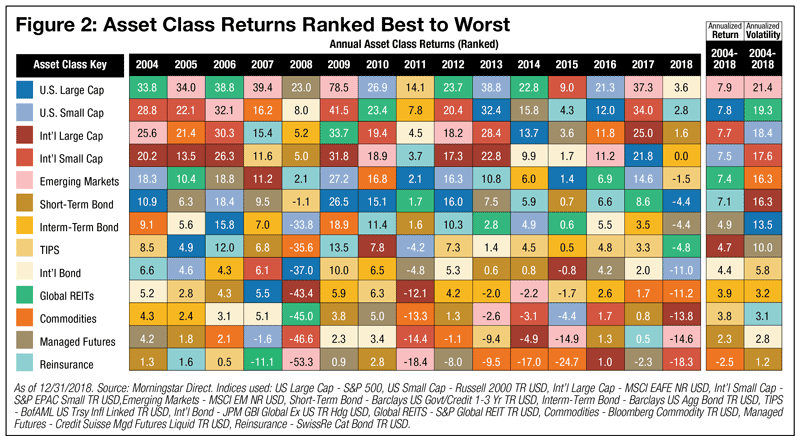

Figure 2 shows the returns of various asset classes on an annual basis from 2004 to 2018. This chart shows no discernable pattern and it is not uncommon for an individual asset class to go from being one of the best performing to one of the worst performing in subsequent years.

Over this time period, emerging markets stocks (light pink box) had the highest annualized return but there were also five calendar years where emerging markets stocks were among the three worst performing asset classes. Very few, if any, investors would have been willing to bet on emerging market stocks in 2009 after they were down 53% the year before. The wide range of returns is more evidence that building a diversified portfolio is one of two ways to reliably capture the best performing asset class year in year out. The other is staying invested through the ups and downs of the market cycle.

If the goal of market timing is to avoid losses, but market timing is extremely difficult as we’ve established, then it’s worth considering whether there is a better way to achieve this goal. For most investors, stocks are just a portion of their overall portfolio. When we combine stocks with other asset classes, such as those shown in Figure 2, to build a diversified portfolio, it is possible to shift the probability of positive returns further in your favor.

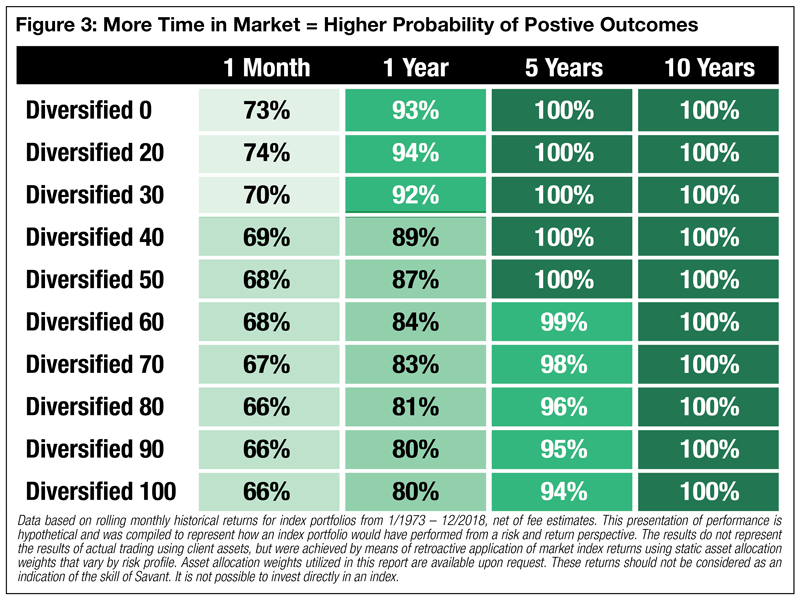

Figure 3 shows the frequency of positive returns for a range of diversified portfolios over various time periods. The diversified portfolios have all historically had a greater percentage of positive one-year returns than the individual stock indexes referenced earlier. As we extend this time horizon to five years, the percentage of periods with positive returns increases to 94% for the most stock heavy portfolio, the Diversified 100. Over ten-year periods, all of the diversified portfolios experienced positive returns for 100% of those periods. This demonstrates that successful investing is more a result of time in the market rather than timing the market.

Finally, it is important to remember that a fear of losses in the market is a normal part of investing. If you find yourself frequently worrying about your portfolio, it may be a sign that you should have a conversation with your financial advisor about whether you have the appropriate asset allocation for your risk tolerance and goals. Ensuring that your portfolio is properly allocated can help reduce your concern and can make it more likely that you will be able to remain invested for the long run which we believe is the most effective strategy.

¹ Source: Morningstar. Data for indices available for following dates: S&P 500 TR USD (1937-2018); MSCI EAFE NR USD (1986-2018).

Important Disclosures

Savant Capital Management is a Registered Investment Advisor. This information is not intended as personalized investment advice. The index returns herein assume reinvestment of all dividends and interest and do not reflect fees or expenses. Index portfolios reflected in this publication are not representative of any actual client returns. Savant’s marketing material should not be construed by any existing or prospective client as a guarantee that they will experience a certain level of results if they engage the advisor’s services.

Market return data from Morningstar Direct. Indices used (unless otherwise indicated): World Stock-MSCI ACWI IMI Index, U.S. Large Cap-S&P 500 Index, U.S. Large Value-MSCI U.S. Prime Market Value Index, U.S. Small Cap-Russell 2000 Index, U.S. Small Value-MSCI U.S. Small Value Index, Int’l Large-MSCI EAFE Index, Int’l Large Value-MSCI EAFE Value Index, Int’l Small-S&P EPAC Small Index, Int’l Small Value-S&P EPAC Small Value Index, Emerging Mkts-MSCI Emerging Markets Index, TIPS-ICE BofAML U.S. Treasury Inflation-Linked Securities Index, Short Bonds-BBgBarc U.S. Govt/Credit 1-3 Yr Index, Interm Bonds-BBgBarc U.S. Aggregate Bond Index, Int’l Bonds-JPM GBI Global Ex US Hdg Index, Global REITs-S&P Global REIT Index, Commodities-Bloomberg Commodity Index, Managed Futures-Credit Suisse Mgd Futures Liquid Index, Reinsurance-Swiss Re Global Cat Bond Index. Some indices have been appended prior to their inception date with similar indices in order to construct a full data set for time period.

Please remember that past performance is not indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Savant Capital Management), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Some of the information given in this article has been produced by unaffiliated third parties and, while it is deemed reliable, Savant does not guarantee its timeliness, sequence, accuracy, adequacy, or completeness. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Savant Capital Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, they are encouraged to consult with the professional advisor of their choosing. Please Note: “Ideal” is not intended to give assurance as to achieving successful results. Savant Capital Management is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice. If you are a Savant Capital Management client, please remember to contact Savant Capital Management, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services. A copy of Savant Capital Management’s current written disclosure statement discussing our advisory services and fees is available upon request.