Medicare Premiums: How Are They Set and What Can You Do to Adjust Them?

For those who are already retired and enrolled in Medicare or who are approaching enrollment, you should be aware of how the monthly Medicare Part B and Part D premiums are determined. If you’re already on Medicare, you are probably accustomed to paying your monthly premiums, but have you considered where these amounts came from?

How Are Your Medicare Premiums Determined?

The Social Security Administration determines your Medicare premiums for Parts B and D each year. These premiums are based on modified adjusted gross income (MAGI) from your tax return – generally from two years prior to the year in question. For example, Social Security will determine your 2024 premiums at the end of 2023. Since you will not have yet filed your 2023 tax return at that time, they will base your premiums on the income from your 2021 tax return. Your MAGI is calculated by adding back any tax-exempt interest income to your Adjusted Gross Income (AGI).

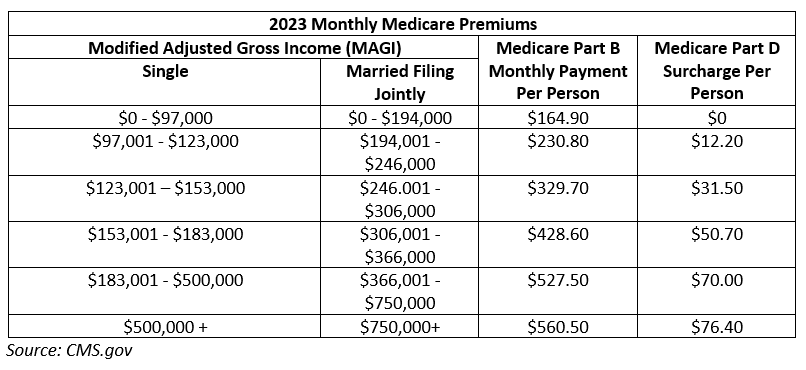

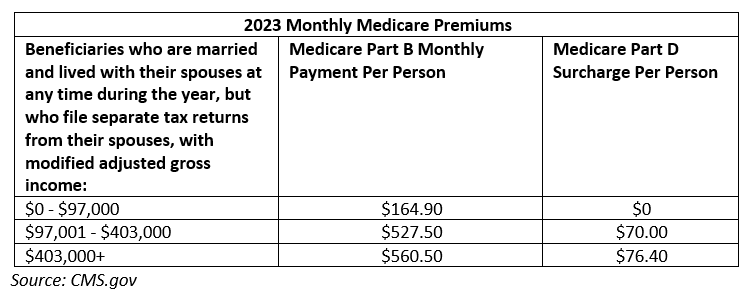

So how does Social Security know what your MAGI is to determine your Medicare premiums? Every year, the IRS sends this figure to them. Depending on your situation, you may have experienced fluctuations in Medicare pricing as a result of fluctuations in your income year-over-year. The standard premium is adjusted slightly for inflation each year, for 2023 the monthly base premium on Part B is $164.90. However, if your MAGI exceeds $97,000 (single tax return filer) / $194,000 (married filing jointly), then you will be charged an additional premium on Medicare Parts B and D. Take a look at the charts below to see where you fall:

What if your situation now looks much different than it did two years ago?

If your income has dropped significantly and you are charged higher premiums based on your income from two years ago, you may be able to file an appeal with the Social Security office to have your premiums lowered. To do this, you must first determine if you qualify for an appeal. If you experienced one of the following “Life-Changing Events” that subsequently impacted your income, you may qualify*:

- Marital Status Change – Marriage, Divorce, Death of Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property (Not at your direction)

- Includes disasters, arson, theft, eminent domain.

- Does not include sales/transfers.

- Loss of Pension Income

- Employer Settlement Payment (due to employer’s closure, bankruptcy, or reorganization)

*It is important to note that some income fluctuations do not qualify as acceptable causes for appeal in the eyes of the Social Security Administration. Large, one-time sales of property or stocks do not qualify as a loss of income-producing property because the assets were sold at your discretion. Conversions of traditional IRAs to Roth IRAs are another situation in which you may experience a temporary spike in “income” on your tax return, but likewise, these cannot be appealed. The good news is that your premiums are recalculated each year, so any impact from an unusually high-income year is only temporary.

Additionally, if your latest tax return on file with the Social Security Administration is out of date because you have either filed a more recent return or amended your originally filed return, you can request that your Medicare premiums are recalculated based on your updated tax return. You must first verify that all information is up to date with the IRS. After doing this, you can request a reconsideration of your Medicare premiums by contacting the Social Security Administration or schedule an appointment with your local Social Security office to review the changes in your income.

How to Appeal Your Premium

If you experienced one of the life-changing events, you can appeal to Social Security with Form SSA-44 – Medicare Income-Related Monthly Adjustment Amount – Life Changing Event. On this form, you will have to identify your life-changing event, estimate your income for the current year, and provide documentation to support to validate your claim. Examples include a marriage certificate, divorce decree, death certificate, letters from your employer, pay stubs, insurance company statement of loss, a letter from your pension fund administrator, a letter from your employer regarding settlement terms, etc. Once Social Security reviews your appeal, if they approve of the change, your premiums will be adjusted going forward.

Planning Tips

There are several ways to proactively plan to ensure your yearly income does not bump you into a higher bracket for Medicare premiums. Managing IRA distributions, deferring or accelerating capital gain and loss transactions, and taking advantage of certain deductions are all examples of ways to manage your income.

If you’re on Medicare, or about to apply for the first time, it’s worth doing a bit of planning to ensure that you are paying the lowest possible premium each month. If you have any questions or want to explore your options further, please do not hesitate to contact a Savant advisor.