Mutual Funds & ETFs: Which Vehicle Should You Use?

A recent surge in assets ($29B in 2000 to $3.6T in 2018)1 held in exchange-traded funds (ETFs) has sparked debate about whether mutual funds or ETFs should be used when constructing investment portfolios. Although the product decision (ETF or mutual fund) is important, research has shown that asset allocation is the main driver of portfolio performance over the long run. When constructing portfolios, investors should focus on four elements when deciding between ETFs and mutual funds: investment strategy, trading flexibility, accessibility, and costs.

Investment Strategy

There are generally two types of strategies that can be used in both ETFs and mutual funds: active management (non-index) and index-based management. Active managers take a more tactical approach to investing and attempt to beat market returns. However, research has shown that trying to actively beat the market leads to excessive costs and taxes. Index, or rules-based, investing seeks to provide exposure to a specific asset class while tracking a benchmark and mitigating excessive costs.

Trading Flexibility

Mutual funds provide the ability to transact at the daily net asset value (NAV). Investors submit an order to buy or sell a mutual fund at any point in time and the transaction is executed at the next available NAV, typically at the close of the stock or bond market that day. U.S.-listed ETF shares are more flexible in that they trade intraday on an exchange, enabling investors to execute ETF trades throughout the day. Both mutual funds and ETFs provide daily liquidity for investors.

Accessibility

When deciding between mutual funds or ETFs, investors need to determine whether they have access to a specific product. It is possible that the product might not be accessible to an investor because it fails to be included on an “approved list” by a custodian. Also, mutual funds offer multiple share classes with different minimum investments, whereas ETFs offer only one product. Advisors with significant assets under management can often access exclusive share classes with extremely low costs that may not be available in an ETF.

Furthermore, not all desired strategies are accessible via an ETF. For example, some fund managers add value by pursuing higher expected returns through factor-investing, targeting the size and value factors. They only offer this exposure through cost-effective mutual funds.

Costs: Expenses, Tax Efficiency, and Transaction Costs

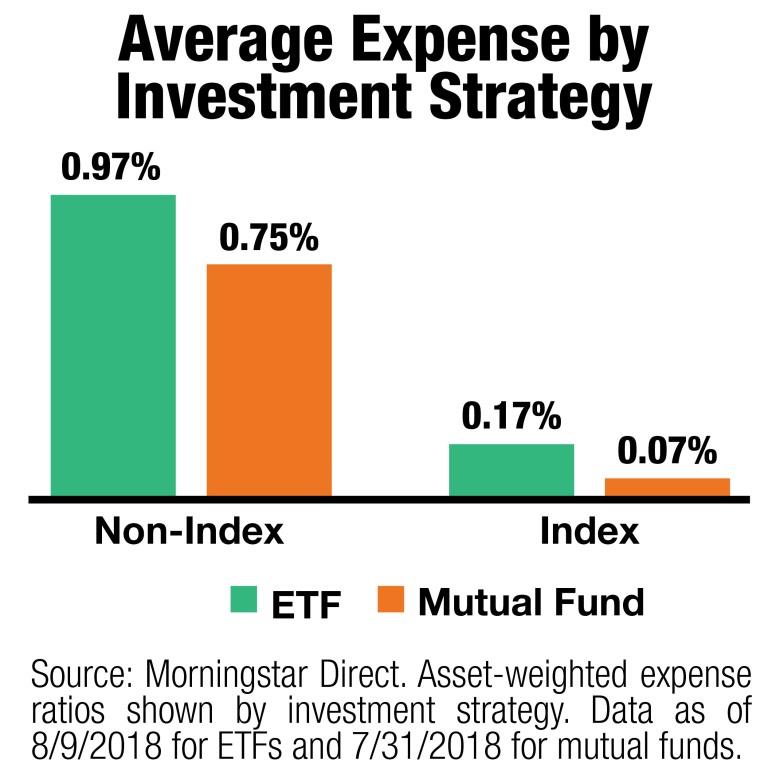

Investors should consider two types of costs when evaluating the use of mutual funds and ETFs: ongoing and transaction costs. Ongoing costs include expenses and taxes that are incurred over time. As shown in the table above, index-based strategies have much lower expense ratio costs for ETFs and mutual funds. Index strategies also generally have lower turnover than active (non-index) funds, resulting in a lower tax cost for investors. Many factors contribute to tax efficiency, but whether the fund is active or index-based is often the main driver. Transaction costs include bid-ask spreads, trading commissions, as well as premiums and discounts. They are incurred each time an investor makes a trade—thus, an increased number of transactions generally leads to increased costs.

Savant’s Approach

Savant implements an evidence-based approach, meaning many of the investments we select are index or rules-based. The goal is to provide diversification while eliminating excessive costs/taxes. Deciding to use ETFs, mutual funds, or both in a portfolio is only a part of the portfolio construction process. Savant utilizes ETFs and mutual funds that align with our investment philosophy. We use mutual funds in order to access low-cost share classes that individuals may not be able to access on their own due to higher investment minimums. While there are many moving parts to consider when choosing the investment vehicle, we believe the risk and return of a portfolio is primarily driven by the investor’s asset allocation decision.

1 Source: Morningstar Direct. Data as of 12/31/1999 and 7/31/2018.

Savant Capital Management is a Registered Investment Advisor. This information is not intended as personalized investment advice. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Savant Capital Management), or any non-investment related content, made reference to directly or indirectly in this article will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Savant Capital Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, they are encouraged to consult with the professional advisor of their choosing. Please Note: “Ideal” is not intended to give assurance as to achieving successful results. Savant Capital Management is neither a law firm nor a certified public accounting firm and no portion of the article content should be construed as legal or accounting advice.