Putting Volatility in Perspective

No one likes volatility, but it is an unavoidable part of investing in stocks. Recent trading sessions in late December 2018 and into January 2019 have brought back stock market volatility quite dramatically. 2018 was disappointing as nearly all asset classes ended in the red. Dramatic declines are unsettling regardless of the backdrop, but following a historically quiet yet resilient 2017, we understand that those feelings can be amplified. Keep in mind, that despite the -4.4% decline in the S&P 500 for 2018, the stock market had been positive for nine consecutive years. We don’t know what’s coming, but we know it has always been a good strategy in the past to hang on tight while the roller coaster goes up and down. You will only get hurt if you jump off the roller coaster.

What happened to trigger the volatility? The market appears to be driven by the negative sentiment stemming from worries over things such as the Fed raising rates too quickly or how the trade wars will play out. Long-term investors should not be concerned with this noise and maintain a focus on the fundamentals which suggest that global stocks are “on sale.” In other words, stocks are priced below their average historical valuations.

We are likely to see continued volatility in the near term, so it may be a good time to make sure you have an appropriate asset allocation given your long-term plan and risk tolerance. Your advisor has the tools and expertise to re-visit that with you if needed. We must be able to endure these market bumps in the road in order to work toward portfolio growth over the long run. We believe the best way to manage volatility is through properly diversifying and rebalancing a portfolio across various asset classes. Investors who can maintain perspective and discipline over time will likely be rewarded.

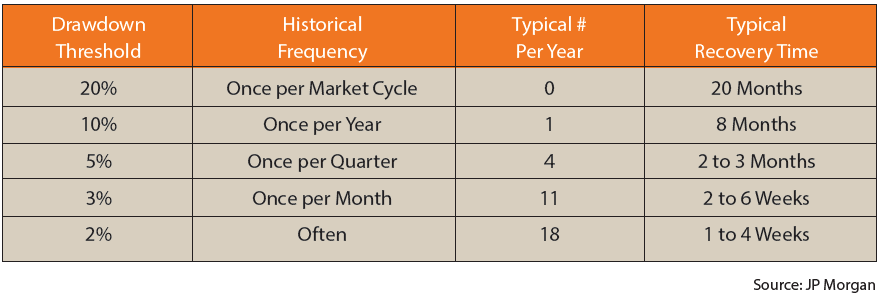

Although it is easy to forget when stocks rise, volatility is normal. Figure 1 puts that into perspective.

Figure 1: Frequency of Market Pullbacks

On average a decline of at least 10% happens once every year. Inexperienced investors may find these declines reason to panic, but the numbers show that this is typical market behavior.

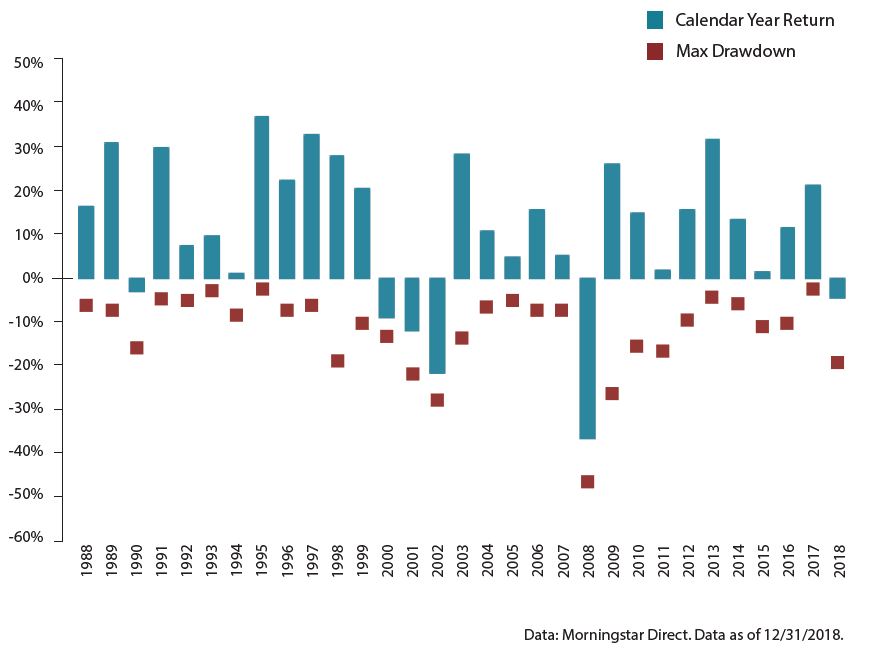

As you can see in Figure 2, despite these drawdowns, many years have shown substantial intra-year declines (red squares) and were still able to post strong returns (blue bars). The average intra-year decline since 1988 has been -11.9%.

Figure 2: S&P 500 Calendar Year Returns vs. Max Drawdowns

Don’t Try to Time The Market

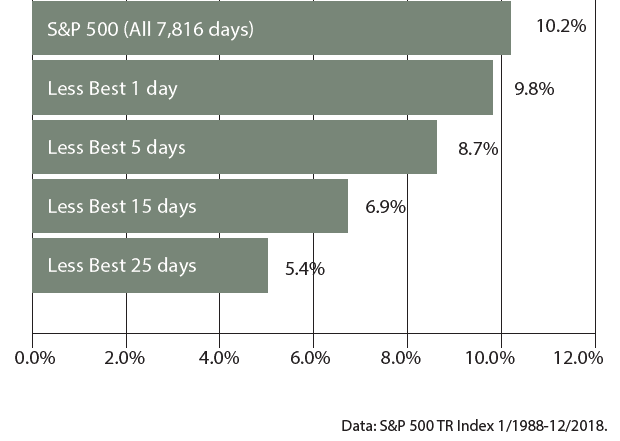

You probably heard it before – trying to time the market is a “fool’s game.” Since no one can consistently forecast when markets will fall and when they will rebound, exiting the market creates an unnecessary risk of missing out. Missing even just one of the best returning days in the market can set your portfolio back substantially (as demonstrated in Figure 3). Missing the best 25 days would have resulted in losing 4.8% on average.

Figure 3: Missing a Few Days Can Make a Big Difference

What is Most Important?

Increased market volatility can cause emotions to soar. Your advisor helps you sort through the noise and focus on what we believe is most important. Keep these key ideas in mind when markets and media are in a frenzy:

- Market volatility is normal.

- Bear markets will happen.

- Don’t try to time the market.

- Focus on the long term.

- Focus on what you can control.

Savant Capital Management is a Registered Investment Advisor. This information is not intended as personalized investment advice. The index returns herein assume reinvestment of all dividends and interest and do not reflect fees or expenses. Index portfolios reflected in this publication are not representative of any actual client returns. Savant’s marketing material should not be construed by any existing or prospective client as a guarantee that they will experience a certain level of results if they engage the advisor’s services.