Portfolio Spotlight – Real Assets

It is hardly a secret that inflation tends to be an enemy of stock and bondholders.

The problem for bondholders in a period of inflation is no mystery. When the value of the dollar declines, a security with income and principal payments denominated in those dollars won’t be a big winner.

While stocks have shown more resilience than bonds during periods of inflation, not all businesses can easily pass along higher input costs to their customers. If inflation rises, many businesses find they must spend much of the cash they generate only to maintain their existing volume of business. Growth becomes stunted and, in effect, businesses are running only to stand still.

Luckily, stocks and bonds are not the only game in town. Investors searching for assets with lower correlations to stocks and bonds while also providing reasonable average returns have other options. One broad group of such assets might be termed real assets – assets that are at least partially hedged against inflation, because they tend to increase in price as inflation increases.

While the marketplace has no precise definition of what constitutes a real asset, the main areas of investment include:

- Physical Real Estate: office buildings, apartment complexes, senior housing facilities, data centers, truck terminals, and logistics warehouses

- Infrastructure: energy pipelines, toll roads, cell towers, airports, seaports, gas distribution utilities, water utilities, satellites, and waste facilities

- Farmland: corn, wheat, vegetables, potatoes, almonds, walnuts, apples, and grapes

- Timberland: building materials, packaging materials, paper, and furniture

Historically, these income-producing assets have provided competitive returns with positive inflation hedging effects. In addition, they have done it with lower correlations to more traditional stocks and bonds while also providing enhanced yields, helping investors diversify their sources of return.

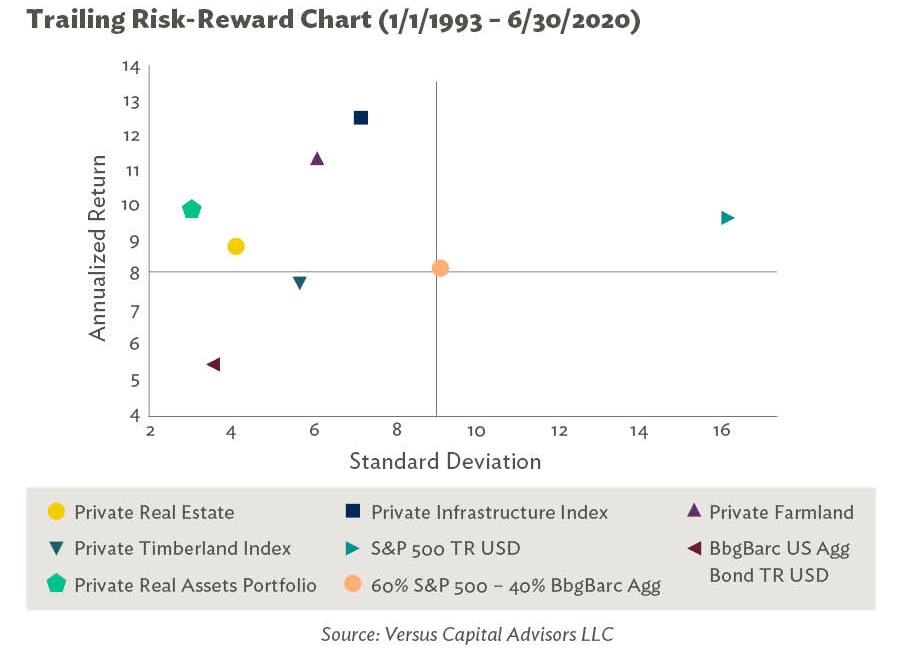

The figure below illustrates that real assets have historically generated more return with less risk than a traditional 60 percent stock, 40 percent bond portfolio.

And while financial markets generally do a good job of pricing assets for expected inflation, unexpected inflation always remains a risk.

While there are individual securities or asset classes that help provide some inflation hedging benefits, a diversified approach that uses various real asset classes may be a more efficient and effective way to invest. The opportunity exists to access private and public real assets by investing through a private fund structure that still offers investors liquidity on a regular schedule, typically every 90 days.

One of the best ways to fight inflation, and even win the game against it, is through inflation hedging investments like real assets.