Roth Conversions During the Current Low Tax Rate Environment

Roth conversions have increased in popularity over the past few years due to our current low tax rate environment. Because tax rates and rules are constantly changing, it’s important to note that the low tax rates we have become accustomed to are set to sunset (and return) to their pre-Tax Cuts and Jobs Act (TCJA) rates after 2025, not to mention the Build Back Better Plan is currently making its way through Congress and may increase taxes on many taxpayers even sooner. Given the various unknowns in the coming years, it may be a good idea to investigate Roth conversions this year to lock in low tax rates. Let’s explore the benefits, potential pitfalls, and various cost-benefit analyses taxpayers should consider before executing Roth conversions.

What is a Roth Conversion?

A Roth conversion occurs when a taxpayer sends money from a tax-deferred account (such as an IRA or 401(k)) to a tax-free account (such as a Roth IRA or Roth 401(k)). Money that is converted from a tax-deferred account is taxable in the year of distribution. Once the money enters the tax-free account, it is shielded from tax indefinitely and provides unique benefits for heirs.

Why Execute a Roth Conversion?

A Roth conversion is a tool that allows taxpayers to utilize tax-rate arbitrage to manipulate their tax rates by changing the timing of income recognition. Taxpayers in low tax brackets may elect to recognize more income now at lower rates to reduce the amount of income that is recognized at higher rates in the future. In addition to reducing tax over an individual’s lifetime, Roth accounts are advantageous to taxpayers’ heirs. The SECURE Act requires inherited IRAs to be fully liquidated within 10 years of the previous owner’s death. This means heirs of Roth IRAs can let their accounts appreciate completely tax-free for an additional nine years.

Who Is the Ideal Roth Conversion Candidate?

Roth conversions typically make sense for taxpayers who:

- Are recently retired but have not yet started taking their required minimum distributions

- Incurred a low-income year (e.g. their business had a down-year, they decided to take some time away from work, were laid off, etc.)

Ultimately, Roth conversions can be a great strategy for taxpayers who believe their income or tax brackets will increase in the future.

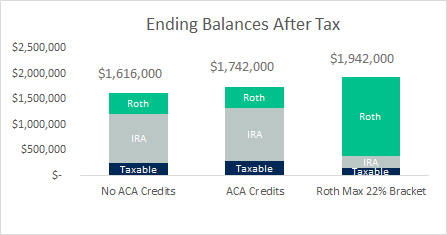

Marketplace Insurance and the Premium Tax Credit Versus Roth Conversions

Sometimes two tax strategies are mutually exclusive. For instance, early retirees can save thousands of dollars on health insurance each year by reducing their income to qualify for the premium tax credit. However, by pursuing the affordable premium tax credit strategy, taxpayers may unknowingly make a costly trade-off. Reducing income to save money in the short term means taxpayers are forgoing the opportunity to utilize Roth conversions to save money over the long term. These results are often substantially magnified if the taxpayer wants to pass their Roth accounts to heirs. Tax-free compounding for the rest of the taxpayer’s life plus 10 years until the heir must distribute the money can make for a substantial net worth increase.

For illustrative purposes only. Not representative of actual results

Net Investment Income, Social Security, and Medicare Premiums, Oh My!

It’s important to see the big picture when it comes to pursuing tax rate arbitrage strategies (such as Roth conversions). These strategies may impact other areas of a taxpayer’s tax and financial plan. Here are a few to be aware of.

- Net Investment Income Tax is an additional 3.8% tax on portfolio income for taxpayers who have modified adjusted gross income (AGI) greater than $200,000 (or $250,000 and married). Roth conversions typically increase modified AGI and can therefore increase taxes by another 3.8%. This additional tax should be taken into consideration prior to completing Roth conversions.

- Capital Gains Tax rates are 0%, 15%, and 20%. Many retirees enjoy 0% and 15% tax rates on their qualified dividends and long-term capital gains. Increasing income through Roth conversions may push capital gains taxes into higher tax brackets. For instance, married taxpayers can recognize $104,800 of income and pay zero tax ($104,800 – $24,800 (standard deduction) equals $80,000 taxable income (which is the top of the 0% capital gains bracket). Roth conversions might increase income that would have been in the 0% bracket into the 15% bracket.

- Social Security income is taxable, and the percent of taxable Social Security income changes based on your “provisional income.” Provisional income is calculated by adding tax-exempt income, non-Social Security income, and 50% of Social Security benefits. Depending on your provisional income, Social Security benefits may be exempt from tax, up to 50% taxable, or up to 85% taxable. IRA distributions increase provisional income, so it’s important to review the impact Roth conversions may have on increasing provisional income.

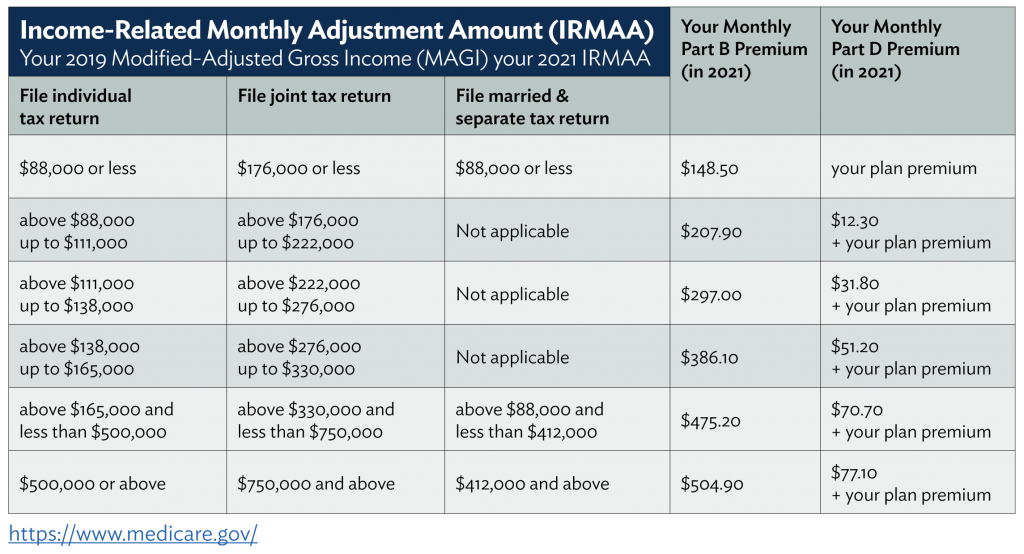

- Medicare insurance rates are based on taxpayers’ modified adjusted gross income from two years ago, and monthly rates increase significantly as they move into higher brackets (see the chart below). Medicare rates are unique because there is no phase-in between brackets – having just one dollar above the next Medicare tier increases rates to the next. It’s important to incorporate Medicare premium costs into Roth conversion analyses, both during Medicare and two years prior to being on Medicare.

Summary

Taxpayers who want to maximize wealth may benefit from taking advantage of the current low tax rate environment by utilizing Roth conversions to accelerate income recognition. Roth conversions can impact other areas of a taxpayer’s finances, so it is important to investigate its total impact from all angles. The tax code is complex, so we encourage you to talk to your financial adviser or accountant to help decide if Roth conversions are right for you.

Sources: Your Guide to Roth Conversions; Medicare costs at a glance.

This is intended for informational purposes only and should not be construed as personalized investment or tax advice. Please consult your investment and tax professional(s) regarding your unique situation.

Is a Roth Conversion Right for You?

Converting some of your retirement accounts into a Roth now could shield you from future tax increases and provide valuable tax diversification. Contact Savant to learn more.