Retain, Relinquish, Repurpose: Three Ways to Manage Old Insurance Policies

Over time, it is natural for our financial goals to change. What happens when you make permanent decisions to address temporary situations? For those who find themselves with a whole-life insurance or annuity contract that no longer serves its original purpose, here are some options to consider.

Illustrative Scenario:

Mario and his wife Sandra are both 59. In 2000, at the age of 35, each of these new parents purchased a variable universal life insurance contract. Their rationale for purchasing insurance was to provide for their child, Jorge, should they pass away prematurely. The couple opted for a variable university life insurance contract over the lower annual premiums of a term policy because the cash value component could be invested to produce greater returns.

Fast forward to 2024. Jorge is a self-sufficient adult and officially off mommy and daddy’s payroll! The original rationale for the contract has been satisfied; however, Mario and Sandra still have their policies. What can they do to fit these policies into their financial plan now?

Invest in Your Financial Confidence:

Get the WealthConfidence Scorecard

Stop letting money worries hold you back. The WealthConfidence scorecard includes eight self-evaluation worksheets to pinpoint areas for improvement and track your progress toward financial independence.

Options:

Retain – One option is to simply keep the policies. Although they are no longer a necessity in their financial plan, the death benefit is greater than any amount they may have achieved from investing the premiums. If their cash flow cannot support the premiums or they no longer desire to fund it, the contract may allow them to use the built-up cash value to pay the premiums.

Relinquish/Surrender – Permanent life insurance policies include cash values that grow over the life of the contract. The growth of the cash value depends on how the subaccount is credited. Variable universal life contracts are credited based on the performance of specific mutual funds, while indexed universal life contracts have cash values that are credited based on the guarantees of the insurance company. Knowing the basis allows Mario and Sandra to begin calculating the potential tax impact. The basis for universal or variable life insurance contracts typically consists of premiums paid, and non-taxable withdrawals reduce the cost basis.

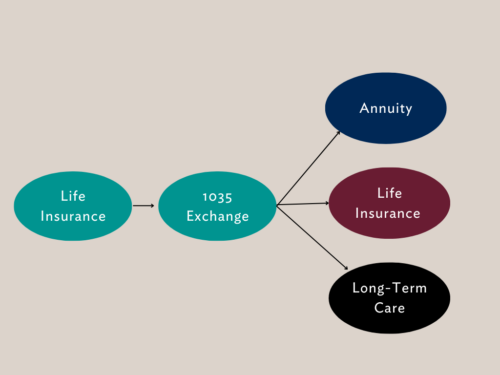

Repurpose – Repurposing the policy requires a comprehensive financial plan. A financial plan will reveal what areas need further attention. A 1035 exchange allows for a tax-free transfer from life insurance contracts to an annuity (income needs in retirement), long-term care, or another life insurance company. A financial advisor can help identify how the contract can be repurposed, and an insurance agent can match with the proper product. Repurposing doesn’t always mean a new product. It can be as simple as changing the beneficiary to a charity or other organization.

If your life insurance contract no longer suits you, you have options. Please speak with your financial advisor and insurance agent to find out what is best for your situation.

The example provided is intended for illustrative purposes only and is not representative of actual results. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment or insurance advice from Savant.