Traditional vs Roth IRA: What’s the Difference?

Which is a better way to save for retirement—in a traditional or Roth retirement account? At a glance, it may be difficult to know which savings option makes the most sense. Choosing the best account for your stage in life and tax bracket can impact your future account balances at retirement.

Let’s review the basics.

First, both traditional and Roth accounts, whether an individual IRA or a 401(k) retirement account provided by an employer, receive preferential tax treatment. This treatment can either be tax-deferred or after-tax.

A traditional account is taxed when money is withdrawn, while a Roth is taxed before money is deposited. The advantage of using one type over the other is actually not a matter of tax deferral–the two types of accounts actually generate the same after-tax account value, as long as tax rates remain constant. Instead, the determining factor in which type of account is most favorable is how an individual investor’s tax bracket changes over time.

Let’s use an example to compare the two savings options.

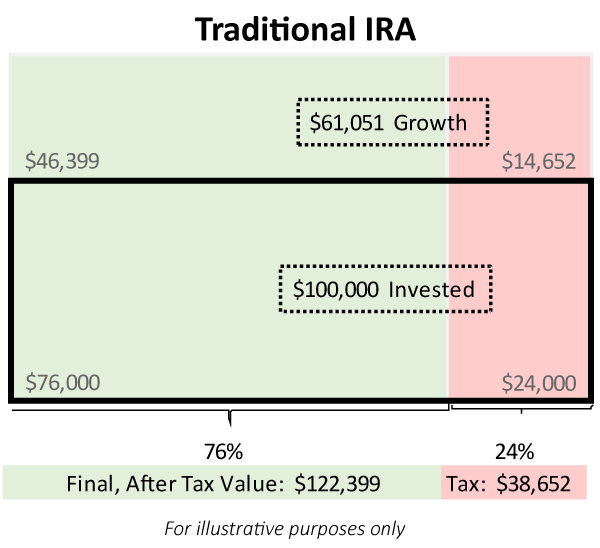

Consider a taxpayer with $100,000 to invest in either a traditional or Roth retirement account (ignoring contribution limits). She is in the 24% tax bracket and her portfolio grows 10% annually for five years. She can either deposit the full $100,000 in a traditional account or pay taxes first and then deposit the remaining $76,000 in a Roth account. Both accounts grow tax-free; the difference comes upon withdrawal. Starting with a pre-tax, higher balance, the traditional account grows by $61,051, while the post-tax Roth account earns $46,399. Upon withdrawal, however, the traditional account owner will have to pay ordinary income taxes on both the original investment and on the growth. If the investor is in the same tax bracket as when she deposited the funds, then she will owe $38,652 in taxes. (This is equal to $24,000 of taxes on her original earnings invested plus $14,652 of taxes on the growth). Both accounts will have a final, after-tax account balance of $122,399¹. This is because the after-tax balances from the traditional and Roth accounts are the same as long as the tax bracket does not change.

The following graphs demonstrate this example.

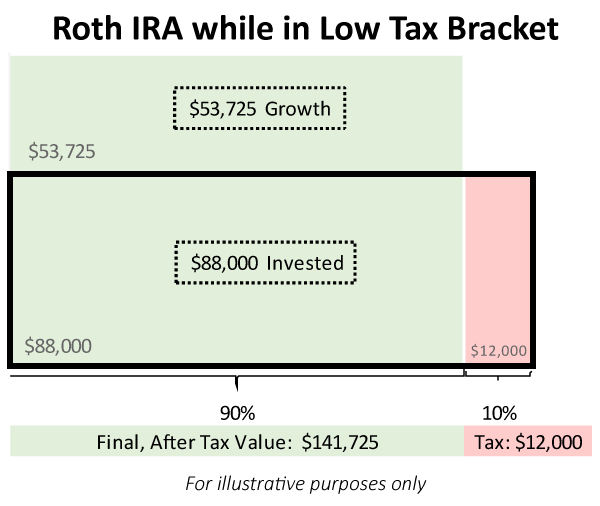

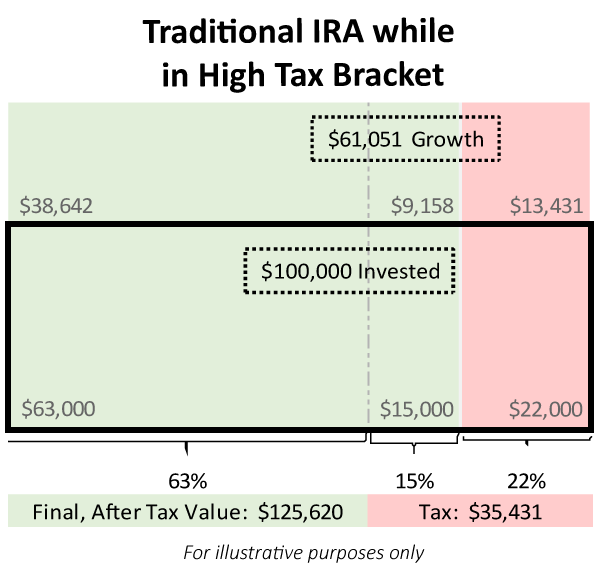

An optimal savings strategy quickly emerges: pay taxes when in a low tax bracket and avoid taxes when in a high tax bracket. People experience different tax brackets over their lifetime due to two factors: changes in tax law or changes in income. It is hard to predict how the first will change, but we often have a good sense about the second. Typically, young workers start out at a lower wage, increase their earnings with experience, and then drop to a lower income at retirement. In retirement there may be a second increase in taxable income when required minimum distributions begin from a traditional IRA at age 70½. This typical “tax lifecycle” suggests saving in a Roth account when in a lower tax bracket during low wage years. Then, upon entering a higher tax bracket, switch to saving in a traditional retirement account. At retirement, there may be an opportunity to use Roth conversions to convert funds from a traditional IRA to a Roth IRA, paying taxes during a second period of low income before required minimum distributions begin.

The charts below demonstrate the benefit of these strategies. The first chart shows the larger, final account value that results from saving to a Roth account when in a lower tax bracket before reaching a higher bracket—more money is invested and allowed to grow tax free. By paying the taxes when in the 10% bracket, the taxpayer increases her final, after-tax account value to $141,725.

The final graph shows the impact of deferral during high wage years. These funds are invested in a traditional account when the investor is in the 37% tax bracket. She avoids this higher rate, allowing the full earnings to grow. The monies are not taxed until withdrawal during retirement, when she is in a lower, 22% tax bracket. The investor ends up with $125,620 of after-tax money, compared to the $101,642 she would have had if she had invested in a Roth account.

Traditional vs Roth IRA: Summary

Timing of taxes is the most important factor in choosing the most appropriate retirement account. There are also other items to consider, such as required minimum distributions and contribution limits. In addition, every taxpayer will have his/her own specific strategy related to their individual situation. Please consult with your tax and financial advisors as you handle these decisions.

¹ Mathematically, the final, after-tax value of a traditional IRA is P(1+r)n(1-t) while the final account balance for a Roth IRA is P(1-t)(1+r)n , where P is the principal invested, r is the rate of return, t is the tax rate and n is the number of years invested. These two formulas are equivalent, according to the commutative property of multiplication.

This is intended for informational purposes only and should not be construed as tax or investment advice. Please consult your tax and investment professional(s) regarding your unique circumstances.