2020 In Review

We’re taking a brief look back at the events of 2020 through the lens of a famous road trip, Historic Route 66 – completed in 1938 to connect rural communities through eight states and 2,451 miles of road. This year’s pandemic elevated road trips to the vacation of choice which in themselves can have ups and downs whether it be the highs and lows of the U.S. topography, highlights of Americana, or the hiccups along the way that are an inevitable part of any travel (and also often make for the best memories).

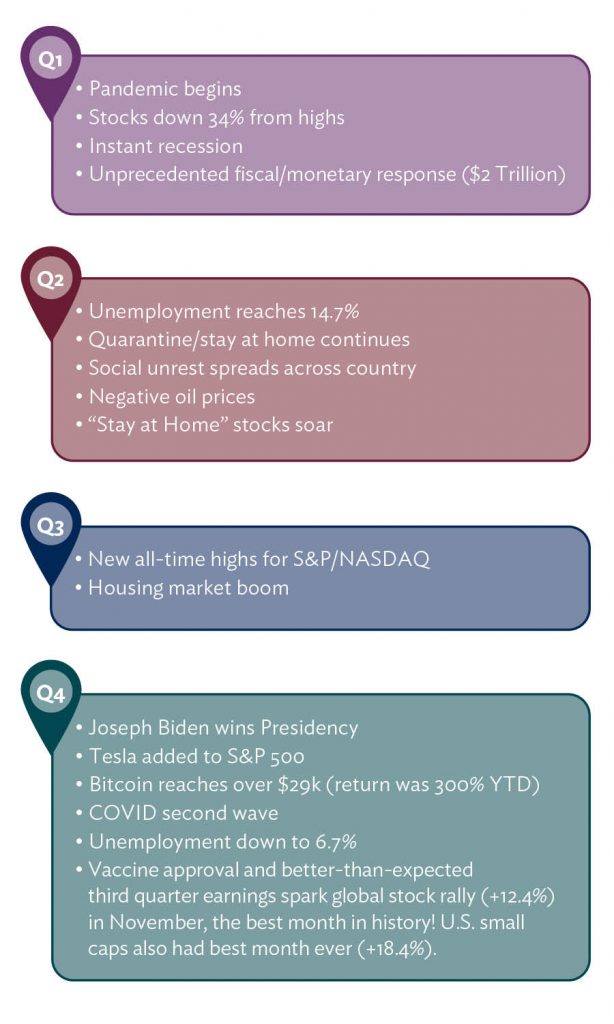

In a similar way, the events in 2020 generated their own highs and lows. It was natural during the year to think this time is different with respect to the markets and economy. There is no doubt that it has been a unique year, but what is not different is that we continue to persevere through the low points in human history. Thankfully, the second half of 2020 brought some optimism as markets rebounded, human ingenuity brought forth solutions to deal with social distancing, biomedical researchers raced to create vaccines, jobs were added back, and we had the highest election turnout ever. 2020 provided some important reminders – markets are resilient and forward-looking and it is nearly impossible to predict the magnitude, timing, and speed of market returns.

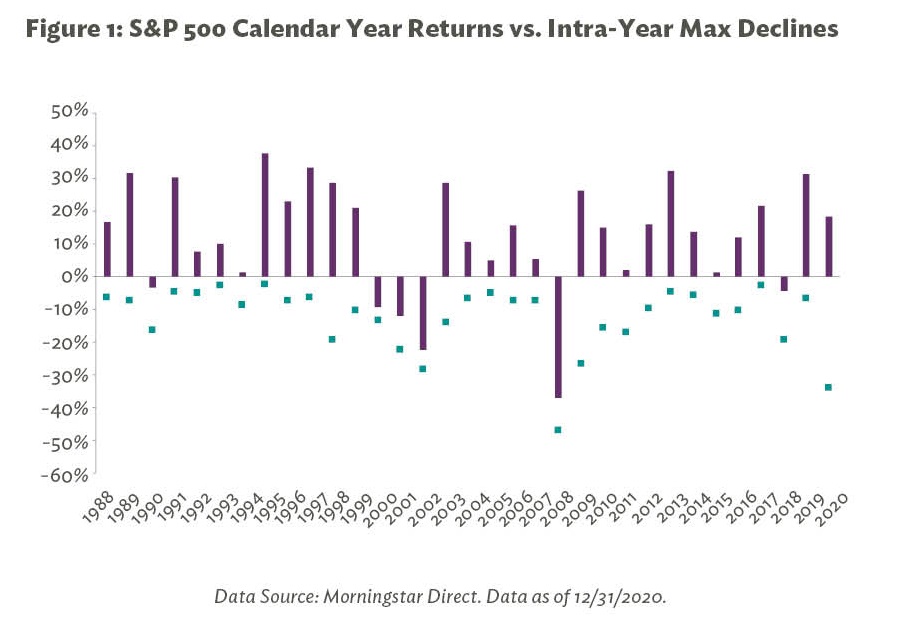

It Paid to Stay Calm

If one looked at just the year-end return for 2020, it might look like it was an average year for stocks. We know it was anything but average. We had a downturn, recession, and recovery all in one year. As a long-term investor, one should not overreact to short-term volatility. Despite average intra-year drops of 12.4% (see Figure 1), in 27 of the past 33 years (82% of the time), the market ended up positive.

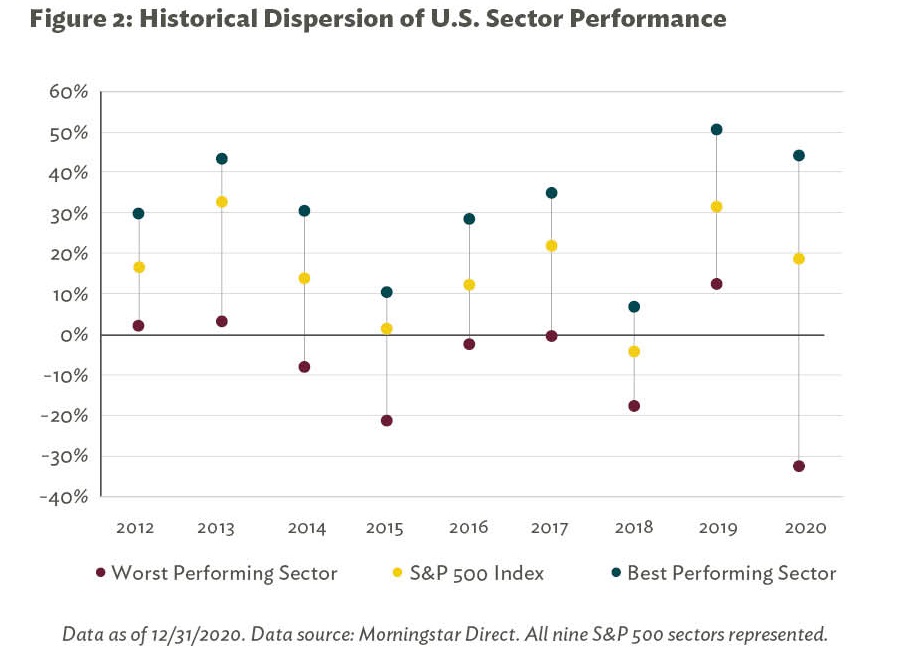

Predicting Sectors was Impossible

There was a huge dispersion between stock sectors compared to recent years as shown in Figure 2. Consumer cyclical and technology had the best performance with stay-at-home behavior fostering online retail and use of technology. Areas that were affected by lower demand experienced losses, including energy stocks, real estate, and utilities (driven by lower commercial utility usage during COVID). No one could have predicted this outcome or dispersion – staying invested and diversified produced a solid outcome for investors in 2020.

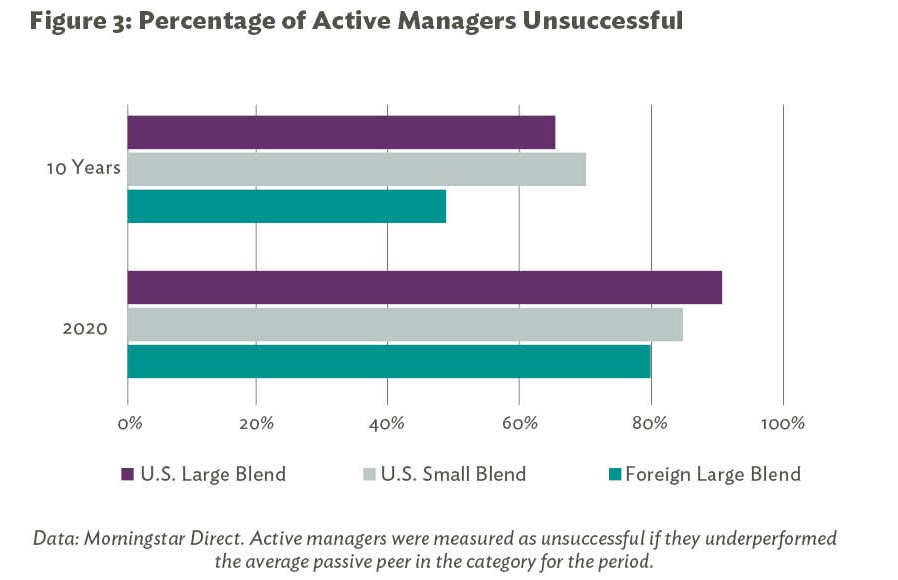

Active Stock Managers Weren’t Better Equipped

Active stock managers weren’t better equipped to navigate market volatility than their passive peers in 2020, as 65.1% of U.S. large blend active managers underperformed their passive peers (see Figure 3). Over the longer time horizon, the experience was even worse. For example, 1.5% of active large blend funds have either failed to survive or underperformed their passive benchmarks. Passive has performed better partially due to lower fees with the added bonus of generally being much more tax-efficient!

2020 in Review