2021 Outlook: Are We There Yet?

After a year like 2020, the idea of presenting an outlook for the year ahead seems futile. In thumbing through last year’s outlook article “Our Vision for 2020,” there was not a single mention of COVID-19 nor a global pandemic. That is not a knock on our research team here at Savant – the fact of the matter is no one saw 2020 coming. Not a single market outlook piece published at the end of 2019 by any bank, brokerage, or mutual fund company had a global pandemic on their list of things to worry about in 2020. Such is the nature of surprises – they are, well … surprising.

The virus – and its associated health, economic, and social impacts – was certainly the story of a year that most of us were glad to put behind us. But as happy as we are to have 2020 in the rear-view mirror, we shouldn’t lose sight of the valuable lessons learned and why humility is one of the most valuable attributes an investor can have.

If we lack the prescience to identify the big surprises ahead of time, you might (correctly) ask – why bother making forecasts at all? We couldn’t agree more, which is why our annual Outlooks are meant to serve as a basis for expectations rather than forecasts. Those two words sound similar but are quite distinct.

Consider these two statements: The stock market crashes from time to time. vs. The stock market is going to crash next year.

The former is an expectation, the latter a forecast. Expectations are rooted in historical evidence and examined probabilistically. Forecasts require clairvoyance. We would rather be vaguely right than precisely wrong.

As skeptical as we are of forecasts, we must maintain an awareness of the world around us – even if it doesn’t influence our short-term positioning. As much as 2020 market returns surprised us to the upside, many of us may still feel a sense of fatigue, much like a child on a road trip who asks, “Are we there yet?”

Because we can’t predict with precision when we will reach our destination of a return to normalcy, we enter 2021 with mixed feelings. We see glimmers of light at the end of the tunnel but also maintain a sense of caution as the virus continues to resurge and we risk continued complacency.

As we turn from the macroeconomic outlook to financial markets, we must remind ourselves that those are two related, yet distinct things. If we constantly look to the stock market to support or reaffirm what has happened in the economy, we are certain to be continually perplexed. The past year has reflected this dichotomy better than just about any year in history.

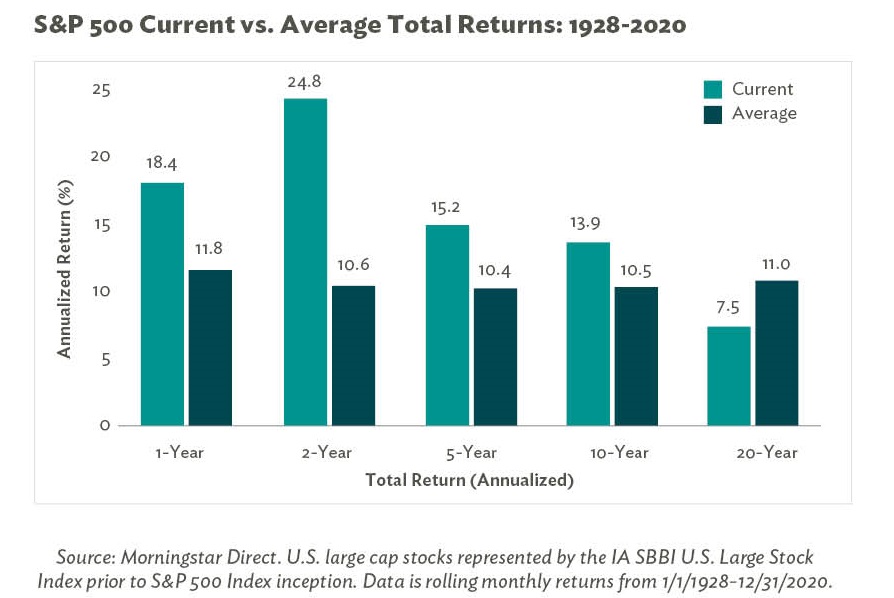

Looking at the numbers, the returns ending 12/31/2020 for U.S. large cap stocks exceed the historical averages over the 1, 2, 5, and 10-year timeframes. The mean-reversion believers among us might take that as a sign that below average returns are around the corner. However, the current 20-year return for U.S. large cap is well below the historical 20-year average. Like most things in investing, we can support whichever narrative we believe by moving the goalposts.

With that caveat out of the way, we think the odds are high that an inflection point is nearing, if not already underway, within stocks. Today, the five biggest companies in the S&P 500 are all technology stocks, collectively worth more than $7 trillion. For context, that is almost twice as much as ALL the banks and energy companies in the global MSCI All World Index combined. As believers in the long-term value premium in stocks, we know that there will be painful periods relative to growth stocks (i.e. technology) such as the past several years.

The pandemic’s effect on the global economy significantly depressed corporate earnings for 2020. History suggests that value stocks tend to outperform as we enter periods of acceleration in the profits cycle. If we assume that the effects of the pandemic will subside as 2021 progresses, then it seems likelier that the welcomed rotation that began in late 2020 may just have some legs to it. The benefits of such a rotation would likely benefit small cap stocks and international companies as well.

If 2020 taught us one thing, it’s to expect the unexpected. Therefore, we will always advocate maintaining a diversified approach – even when we think the odds are heavily tilted toward one area of the market relative to another. Surprising events often counterintuitively lead us to seek out certainty about what lies ahead. Yet as much as we crave reassurance and certainty in our lives, as Morgan Housel, author of the book The Psychology of Money so eloquently states, “the correct lesson to learn from surprises is that the world is surprising.”

Our 2021 Outlook

Economic Growth and Unemployment

Despite the potential for above-average economic growth rates next year and beyond, the long-term employment picture remains challenged.

Inflation

The unprecedented dual stimulus from both the government and the Fed in 2020 has left many wondering whether we will see inflation rear its ugly head. A return to 1970s-like high inflation is not likely for technological and demographic reasons. A more modest cyclical bounce, on the other hand, would not be out of the question.

Interest Rates

It seems like every time we think rates can’t go any lower, they surprise us to the downside. With the short end of the yield curve effectively anchored near zero for the foreseeable future, we may see some additional steepening (higher yields) in the longer-term maturities as the economy regains its footing. Yields will likely remain fairly range bound given the current central bank policy.

Washington D.C.

On January 20th, President-elect Joseph Biden and his administration were inaugurated. The widely projected “Blue Wave” failed to manifest in November’s election, potentially limiting the legislative agenda of the new administration. Some early executive action is anticipated in areas like climate change, immigration, healthcare, and education. While gridlock is expected, it will be interesting to see if compromise can be achieved on other issues. The crossing of party lines in the interests of economic prosperity would be welcomed by many.

Monetary and Fiscal Policy

More than any other recession in history, policymakers were aggressive and swift in their actions as the global pandemic unfolded. With the Fed having exhausted just about every conventional and unconventional tool in their toolkit, the baton has been handed to the government to provide additional support. All signs point to policy remaining extremely supportive and accommodative in 2021 and beyond.

Public Health

Human ingenuity and grit remain undefeated. Along with improved therapeutic treatments and more readily available testing, we continue to inch closer toward putting this devastating period behind us and resuming normal economic and social activities. Ultimately, the recovery will hinge upon our ability to alleviate health concerns.

Consider This

After years like 2020, it’s easy to fall prey to pessimism. But consider this: Most vaccines take upwards of ten years before they finally reach people. The research process alone usually takes 2-5 years. By contrast, three COVID-19 vaccines – all with efficacy rates greater than 90% – took mere months to develop. Prior to this, the mumps vaccine held the record for the fastest distribution time, which was four years.

As we look ahead to 2021, we are reticent to make short-term market bets with any high degree of confidence. We know the year ahead will surprise us along the way. But one thing we will never bet against is the human spirit.