Achieving and Maintaining Financial Independence in Uncertain Times

- Inflation

- Stagflation.

- Bear territory

- Recession.

- Higher interest rates

- The war in Ukraine

- The pandemic

We’ve seen these words in the news many times in 2022, along with numerous ups and downs in the stock market. As these headlines persist, it’s not uncommon to become anxious – or even fearful – for your financial well-being.

If you’re approaching retirement or you recently retired, you may be looking for a way to hang on to your hard-earned savings, stem losses, and stay on track to achieve or maintain your financial independence.

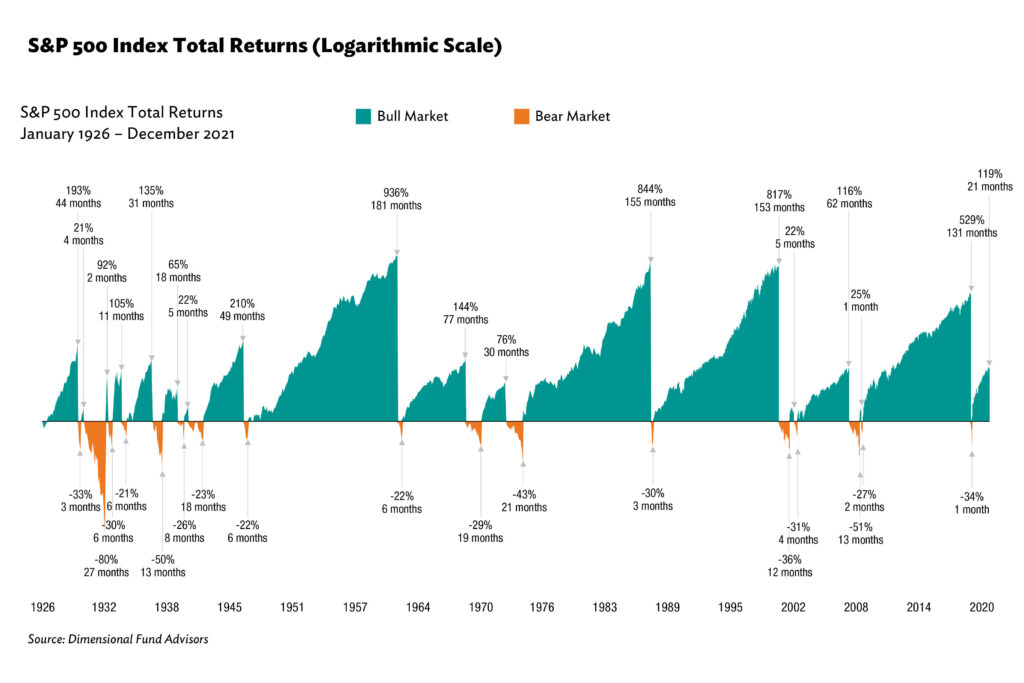

Remember, we’ve been here before. From 1926 through 2021, the S&P 500 Index experienced 17 bear markets (which is defined as at least a 20% drop from a previous peak). According to Dimensional Fund Advisors (DFA), the declines ranged from -21% to -80% over an average length of approximately 10 months.

But during the same period, the S&P 500 Index experienced 18 bull markets (defined as a gain of at least 20% from a previous trough). These bull markets tended to last longer – an average of 55 months – and advances ranged from 21% to as much as 936%.

During times like these, start by acknowledging what you can’t control – the volatility of the markets – and focus on what you can control: knowing that the markets will recover and that staying the course can help position you to take advantage of the upside potential.

Talk to Your Advisor

If you’re nervous about the future, start by talking with your advisor. You may want to discuss some of the following topics:

- Your timeline to retirement (if you aren’t already retired)

- Your risk tolerance and whether your investment strategy still reflects your wishes

- The importance of staying appropriately diversified

- Whether you should rebalance your portfolio now

- Whether you can take advantage of tax-loss harvesting opportunities

- What you can do to stretch your income (if you are already retired)

Your advisor can also discuss how best to manage short-term volatility while also maintaining enough growth potential to help withstand a lengthy retirement.

Develop or Examine Your Retirement Spending Strategy

For those planning to retire soon, consider developing a retirement spending strategy, or doing a “gut check” if you have already created your strategy. For example, how much of your income will you need to replace in retirement to maintain the lifestyle you desire? What are your expenses now, and how might they change after you retire? What will your income sources be?

If you’re already retired, take stock of how well your spending strategy is working, and estimate how well it will continue to serve you in the future. While retirees tend to reduce expenses in retirement, you may need to consider other options, such as a part-time job, if you have to tap your savings to pay for essentials.

Stash Your Cash

Having an emergency fund for large, unanticipated expenses can mean the difference between financial security and potential calamity, before and after retirement. But if you’re approaching retirement and are concerned about market volatility, saving enough to cover your spending needs for a couple of years could provide you with a buffer in a down market. By spending your cash instead of drawing on your investments, you can give your portfolio a little extra time to recover from a down market.

Consider Contingencies

When it’s time to retire, financial independence can go a long way toward supporting your peace of mind. However, if your finances aren’t quite where they need to be, be flexible. Consider working longer and using the time to pay down debt and build up your cash. This may involve staying with your employer and delaying retirement, or taking a “victory lap” – a period in which you pursue work on your terms, providing you with a better work/life balance, more flexibility, and greater meaning. Having income from a job, an income-producing hobby, or a victory lap plan can help you cover expenses and potentially delay claiming Social Security benefits, enabling you to receive a higher benefit when you do claim.

Savant Has Your Back

As your fiduciary, Savant follows a consistent process, reviewing studies and analyzing the evidence to help ensure client portfolios stay efficient. We also layer in tax management and other resources to meet our clients’ individual financial planning needs.

If history has shown us anything, it’s that it’s impossible to predict how the markets will perform at any moment. But when the markets turn volatile, Savant strives to employ timely strategies to address your concerns and help prepare you for the eventual upside.