Another Increase in Interest Rates: Will It Be the Last?

The Federal Open Market Committee (FOMC) wrapped up its most recent meeting on May 3, 2023, with an announcement of a 0.25% rate hike – its 10th consecutive interest rate increase. The Fed also noted that it would maintain its target range for the federal funds rate between 5.00% and 5.25%.

Leading up to the meeting, concerns over persistent inflation, banking system stresses, and growing fears of a U.S. recession remained top of mind. Signals on when the current hiking cycle would end were also top of mind for investors.

Fed officials, along with many investors, were closely watching economic indicators ahead of the meeting. Some Fed officials had publicly commented that more interest rate increases were needed. The U.S. economy has shown signs of cooling in recent months, despite a tight labor market. Economic data releases last week showed that while wage growth remained elevated during the first quarter, consumer spending stagnated in both February and March.

In March, the committee also lowered its expectations for economic growth in 2023. Real GDP for the full year of 2023 is now projected to rise just 0.4%, down from its previous estimate of +0.5%. Although headline inflation in March eased to its lowest level in nearly two years, the Fed maintained its stance that inflation is still higher than where it needs to be.

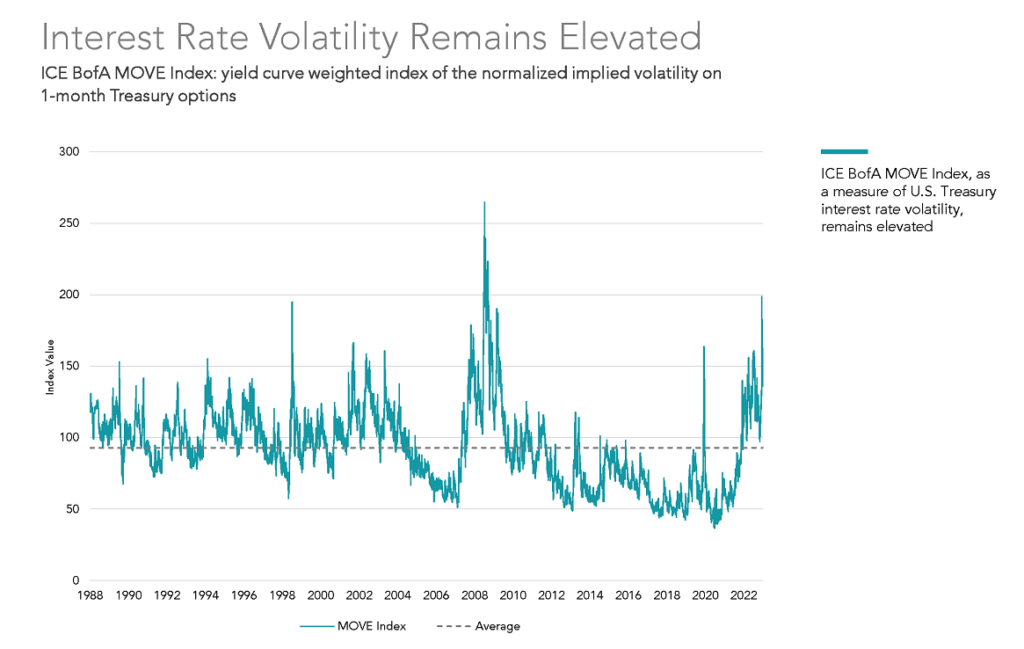

The market has already priced in the Fed’s decision to raise interest rates. The Bloomberg U.S. Agg Bond (+4.0%) and the S&P 500 (+7.1%) are both still up year-to-date, as of May 3 (source: Morningstar Direct – Data as of 5/3/2023), showing investor optimism for a soft landing. However, even with the positive bond market return so far this year, Figure 1 shows volatility in that market spiked to a level not seen since the global financial crisis of 2008-2009.

Figure 1:

Disclosure: Data as of 3/31/2023. Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Data sourced from Bloomberg on 3/3/2023. ICE BofA index data © 2023 ICE Data Indices, LLC.

Looking to the future, the Fed emphasized it will closely monitor readings on labor market conditions as well as inflation pressures and expectations to adjust its stance as necessary. Tightened credit conditions from stress in the banking sector may have negated the need for additional monetary policy tightening. The Fed even acknowledged that the U.S. banking system is currently sound and resilient. As for when this current hiking cycle will end, the Fed did omit a comment that was in its March policy statement that said additional rate increases could be appropriate. This omission could be signaling a potential pause but without a crystal ball, it’s hard to tell.

Overall, the Fed’s decision to increase rates yet again was largely in line with market expectations. This increase reflects the ongoing uncertainty and challenges facing the U.S. economy and banking sector. Ongoing economic data releases will continue to drive markets between now and the next Fed meeting on June 14.

If you’re worried about how these rate increases might affect your everyday life, read this related blog. If you’re concerned about how this could affect your retirement, it’s crucial to remember that uncertainty is unavoidable, which is why it’s important to maintain a long-term perspective. Headlines often cause investors to want to make changes to their portfolios, but we believe remaining in a globally diversified portfolio can be an effective tool for reducing many of the risks investors face. Your advisor may have additional suggestions to help you regain peace of mind.

Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant.