Behind the Inflation Curve

It’s getting tougher to sugarcoat; inflation is a nuisance.

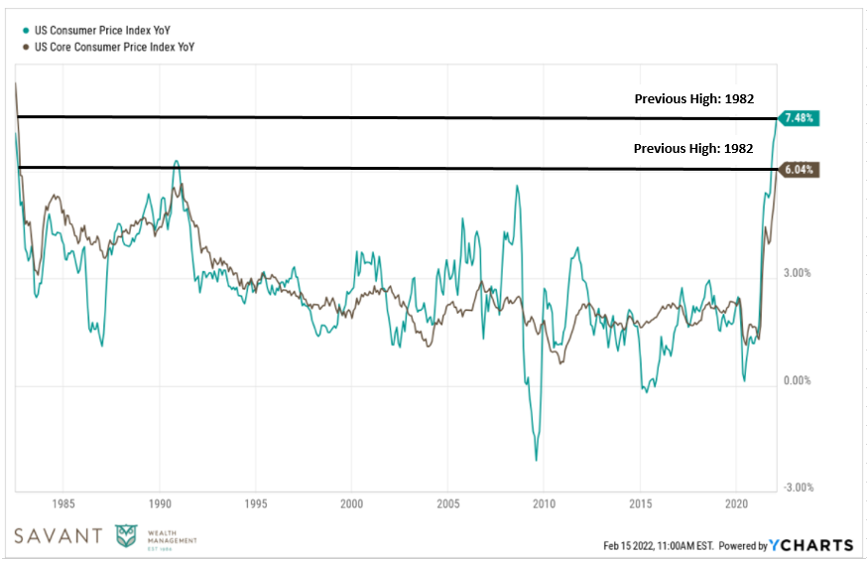

January’s inflation data confirmed the continuation of a trend – prices are climbing at their fastest rate in 40 years and impacting every corner of our economy.

Consumer prices rose 7.5% in January versus last year, the highest rate of increase since 1982. Even excluding food and gas, which tend to fluctuate more than other inflation categories, results are the same – inflation is running hot.

Source: Ycharts, 1980-2022

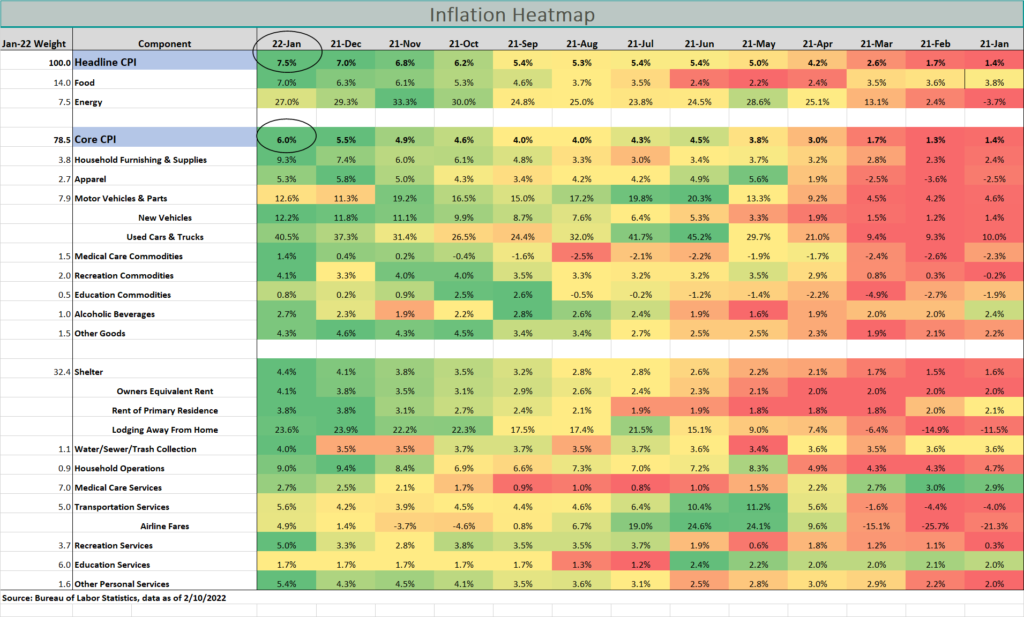

As you can see in the table below virtually every category in the inflation index is gaining steam:

- Headline inflation has increased every month since August.

- Food and energy prices, the largest constituents in the index, have increased 7% and 27% versus last year, respectively.

- Lodging away from home, mostly hotels, is up 24% versus last year.

- Motor vehicles, the fastest growing inflation sub-category, has seen used vehicle and truck prices increase 41% versus last year.

Source: Bureau of Labor Statistics, data as of 2/10/22

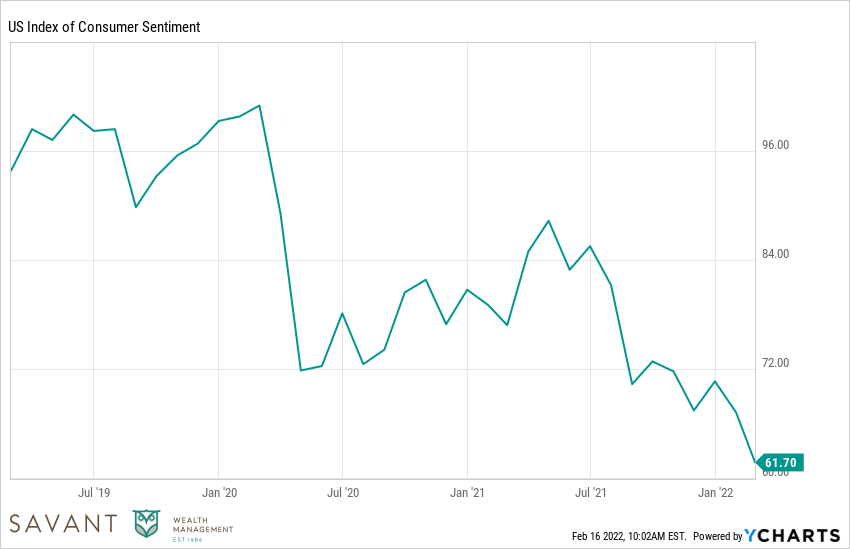

One profound side effect of inflation has been a serious decline in consumer confidence. The University of Michigan consumer confidence index is below levels from April 2020 when the world was locked down.

Source: Ycharts, 2020-2022

Milton Friedman once described inflation as “taxation without legislation.” While people tolerate taxes in April, patience runs thin when taxes are happening the other eleven months of a year.

Most of the debate now centers around the Federal Reserve’s “policy response” to inflation. The Fed has two primary responsibilities:

1) Maintain a low level of unemployment (11 million open jobs, 4.0% unemployment, check!)

2) Keep prices stable

The second mandate is clearly not being met.

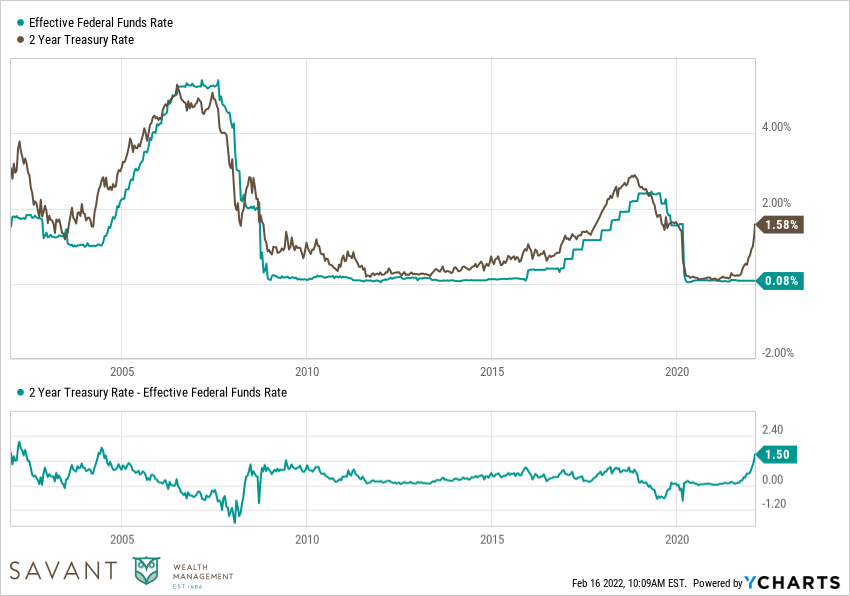

In inflation’s wake, “Is the Fed Behind the Curve?” has become the most popular segment on business television. For the uninitiated, a central bank gets “behind the curve” when they don’t raise interest rates fast enough to keep up with inflation.

One way to visualize where the Fed sits versus inflation is to look at the Fed funds rate spread versus the 2-year Treasury. As seen in the chart below, the spread between them has moved in lockstep for nearly 20 years. More recently, the spread has moved to its widest level since 2004.

Source: Ycharts, 2002-2022

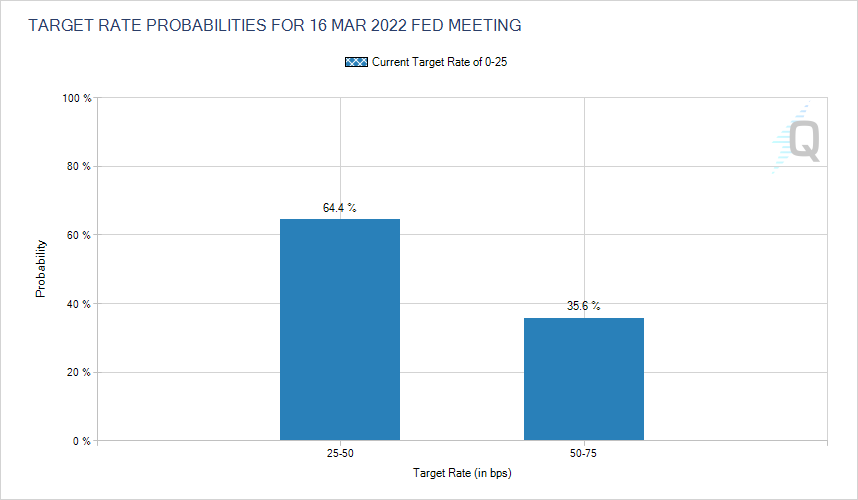

Because of this, the market is now pricing in Fed action to combat inflation. The Chicago Mercantile Exchange (CME) Fed Watch tool, which analyzes the probability of Fed rate moves, has adjusted rapidly since last week’s inflation report. The probability of a 50-75 basis point rate hike at next months’ meeting is about 55%, up from approximately 3% a month ago.

Source: CME Fed Watch Tool

From an investing standpoint, this period of higher inflation is something that can be managed.

We know the inflation problem is more problematic for the bond market than stock market. High inflation with low bonds yields means negative real returns for bondholders. The bond market eventually needed higher interest rates to provide higher future returns, so while uncomfortable, we think this is probably necessary.

The stock market is still one of the best bets for hedging against inflation over the long run. A period of sustained, higher inflation could put a dent in stocks in the short to intermediate-term but many companies can protect themselves against inflation by raising prices which can turn into higher dividend payments for investors.

We believe the most logical thing you can do is make sure you pair investments that work well together under different economic regimes because we don’t know when or why the economic environment will change. Nobody predicted higher inflation in 2020 and nobody can precisely predict the economic situation we’ll be living through in a few years.

Owning and holding a durable portfolio is likely the best path forward.