Confused about Medicare? Let’s Break it Down

If you’re approaching age 65 or are already enrolled in Medicare, you may find the program’s coverage options and costs confusing. Medicare is a federal health insurance program divided into four parts, each with its own coverage options and costs. Understanding what each part covers and when you can enroll in the program is crucial to ensure you have appropriate coverage for your healthcare needs.

In this article, we break down the different parts of Medicare, enrollment periods, and costs associated with each part, including Medicare Advantage plans and Medicare Supplemental, or Medigap, policies.

The Parts

Parts A and B are our country’s government-operated health insurance

| Part A (Hospital Insurance) | Helps pay for in-patient care in a hospital or limited time at a skilled nursing facility (following a hospital stay). Part A also pays for some healthcare and hospice care. |

| Part B (Medical Insurance) | Helps pay for services from doctors and other healthcare providers, outpatient care, home healthcare, durable medical equipment, and some preventive services. |

The following are operated by private insurance companies under rules set by Medicare

| Supplemental (Medigap) | Helps pay for medical expenses not covered by Parts A and B. There are several standardized plans from which to choose depending on your needs. |

| Part C (Known as Medicare Advantage) | Plans are offered by approved private insurance companies that include services covered in Parts A and B and typically offer extra coverage including prescription drug coverage. Service providers typically must be in-network. |

| Part D (Prescription Drug Coverage) | Helps cover the cost of prescription drugs. |

When Can I Enroll in Medicare?

Initial Enrollment

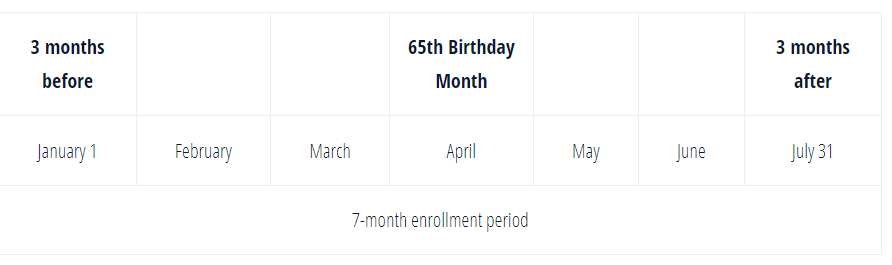

You are eligible for Medicare when you turn age 65. There is a seven-month enrollment period that begins three months before the month you turn 65 and ends three months after the month you turn 65.

Suppose you turn 65 on April 15. Your enrollment period runs from January 1 to July 31.

General Enrollment

If you do not sign up for Medicare during your initial enrollment period, you can sign up during the general enrollment period, which is from January 1 to March 31 of each year. In this case, coverage will start July 1 of that year. However, you will likely be subject to a late enrollment penalty each month for as long as you have Medicare coverage – unless you are eligible for a special enrollment period.

Special Enrollment Period (SEP)

If at the time of your initial enrollment period you were covered under a group health plan based on your or your spouse’s current employment, you may be eligible for the special enrollment period.

The eight-month special enrollment period begins the month after employment ends or the group coverage ends, whichever comes first. Once you turn 65, you can switch from group coverage to Medicare any month. For purposes of the special enrollment period, COBRA and retiree health insurance are not considered coverage based on current employment.

There is no late penalty during a special enrollment period.

Medicare Supplemental, or Medigap

As the name implies, there are gaps in the coverage provided by Medicare Parts A and B. Medigap policies are sold and operated by private insurance companies under rules established by Medicare.

These policies can help you cover costs related to deductibles, copayments, coinsurance, and more. Some Medigap policies provide coverage for medical services that don’t fall under original Medicare.

Doctor or hospital visits that take place when you’re traveling in another country are examples. A Medigap policy will typically pay the difference between the total healthcare cost and the Medicare-approved amount.

You must have Medicare Part A and Part B to obtain a Medigap policy, which can be purchased from any licensed insurance carrier in your state.

Medicare Advantage Plans

Medicare Advantage plans are offered by private insurance companies and must follow rules set by Medicare – it’s another way to get Medicare coverage. Medicare pays a private insurance company a fixed amount for your coverage. Medicare Advantage plans cover all services under Parts A and B, but some may provide extra coverage. Most plans include prescription drug coverage (Part D).

In addition to paying your Medicare Part B premium, you will also pay a premium for the Medicare Advantage plan and you cannot have a Medigap policy. Furthermore, you must use in-network providers.

There are many factors to consider when determining if a Medicare Advantage plan is right for you.

Medicare Part D (Prescription Drug Coverage)

Part D is an optional benefit available to anyone who has Medicare. You may enroll in a Medicare Part D plan during your initial enrollment period. The plans are provided by private companies that charge a monthly premium. The cost of each plan can vary based on the specific drugs that are covered. If you enroll in a plan at a later date, you will be subject to a late enrollment penalty for as long as you have coverage.

What Will it Cost?

Medicare Part A

Generally speaking, if you are eligible to receive Social Security benefits, Medicare Part A is free.

Medicare Part B

In 2023, the standard monthly premium for Part B is $164.90. If you are receiving Social Security, the monthly premium is deducted from your benefit.

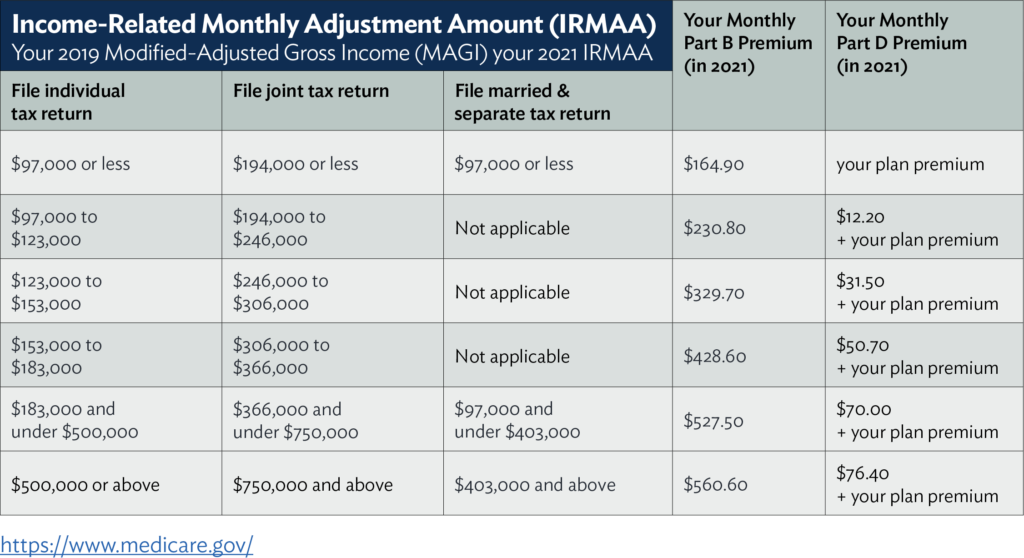

Your monthly premium is means-tested, which means that if your modified adjusted gross income reported on your income tax return two years ago exceeds certain amounts, you will pay additional monthly premiums.

As you will see in the table below, your income tax planning should take into consideration the various income thresholds and increased premiums.

As with most financial planning matters, there may be nuances and complexities that are unique to your situation. If you have questions, please consult with your financial advisor.