Custom Indexing – The Great Unwrapping

Commonly referred to as the “Great Unwrapping,” custom indexing appears to potentially be the next disruptive force in asset management. In the same way the invention of the exchange-traded fund (ETF) took assets away from mutual funds, custom indexing will likely compete for assets with ETFs and mutual funds in the years ahead.

What is Custom Indexing?

Custom indexing refers to a separately managed account that tracks an index, or a blend of indexes while holding the individual stocks that comprise the index. Said differently, mutual funds and ETFs are wrappers that sit between investors and the stocks they own. Custom indexing removes that wrapper and allows investors to hold the individual stocks that sit inside the index.

Much like owning a fund that tracks an index, custom indexes invest and rebalance according to a defined methodology. But with custom indexes, an investor can customize the methodology according to their preferences and adjust as circumstances change.

Owning the individual stocks rather than a bundled product gives investors greater control and customization options in addition to tax management opportunities.

Life Before Custom Indexing

In the past, an investor needed to sell an entire mutual fund or ETF from a taxable account to generate a tax loss – an all-or-nothing proposition. With custom indexing, an investor holds the individual securities, which opens possibilities for deeper tax-loss harvesting at the individual stock level.

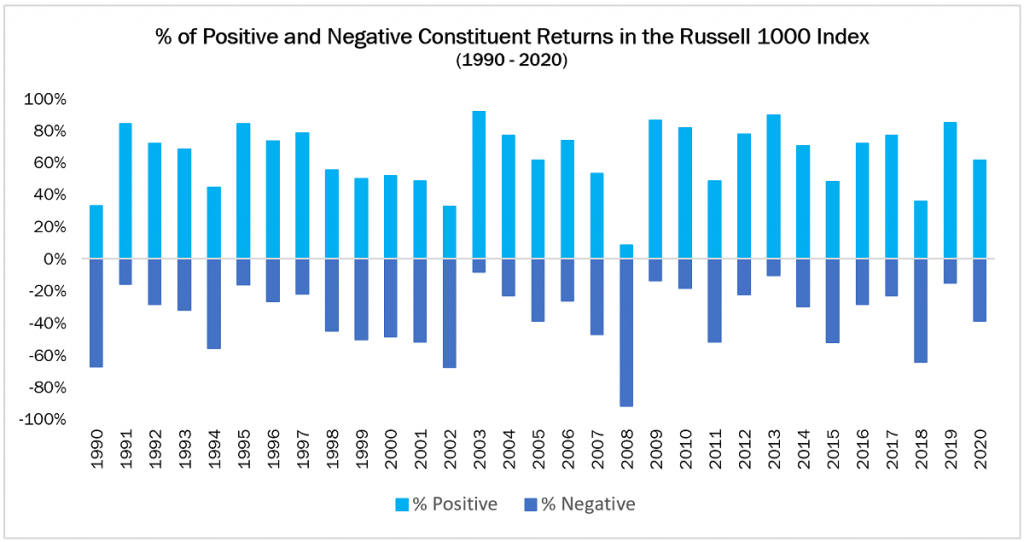

According to O’Shaughnessy Asset Management, on average, 31% of the stocks in the Russell 1000 deliver a negative return in any calendar year. By owning the stocks rather than the index, investors can capture those losses to offset gains and in effect earn additional tax-management benefits.

Source: O’Shaughnessy Asset Management

In addition to tax-loss harvesting, other use cases include the ability to express values-based investing preferences (also known as ESG) and to manage a portfolio around a concentrated stock position. For example, an investor with high exposure to a specific healthcare company could underweight that sector in a custom indexing portfolio to mitigate the overall healthcare concentration risk. Custom indexing is generally most advantageous for investors with large taxable accounts and a large asset base, which allows them to broadly diversify across individual stocks. This strategy creates the potential to generate higher after-tax returns by managing the individual stock positions in a tax-efficient manner.

Historically, custom indexes were referred to as “custom SMAs” because they are customized separately managed accounts. Because of the trading costs and manual labor involved, this service was typically reserved for institutions and high-net-worth investors. However, over the last few years, several factors have made custom indexing available to a broader group:

- Commission-Free Trading: in October 2019, Charles Schwab eliminated trading commissions. This decision was copied by their brokerage competitors, and a new era of lower cost investing began. Prior to commission-free trading, the price per trade would have made custom indexing too costly to implement in smaller accounts.

- Technology Advancement: new software providers and platforms have taken the complexity out of custom indexing. Advances in cloud storage, data tracking, and the ability to buy stocks in fractional amounts have reduced barriers and friction, making it easier to replicate indexes without intensive manual labor.

- Investor Demand: impact investing has become more popular among investors. Whether someone is interested in sustainability, gender diversity, or broader issues, custom indexing can provide custom solutions for unique requests.

Custom indexing likely marks a significant evolution in the asset management industry. Innovation often comes from improving things that already work. The first automobile was built in 1908 and we have been improving cars for the last hundred plus years. Similarly, custom indexing is a technology that will improve upon an existing infrastructure. Funds and ETFs have been good to investors and were great inventions. But custom indexing, through improvements in software, commission-less trading, and fractional share ownership, will allow more investors to own shares directly rather than through a fund structure.

Custom indexing is the latest innovation to democratize investing and provide custom portfolios to investors; like upscale dining, portfolios are made to order!

This is intended for educational purposes only and should not be construed as personalized investment advice. Please consult your financial professional regarding your unique situation.

Socially Responsible Investing Limitations: Certain clients desire to invest all, or a portion, of their investment portfolio in socially responsible mutual funds (the “Funds”) (i.e., mutual funds that have a mandate to avoid, when possible, investments in alcohol, tobacco, firearms, oil drilling, etc.). The number of the Funds are substantially few when compared to those that do not maintain such a mandate. The Funds may have historically underperformed broad market indices. Please discuss with your financial advisor if this approach is appropriate for your unique situation.