Portfolio Spotlight: Direct Lending

Savant recently added a new asset class to its investment line-up: direct lending. While lending may seem straightforward, we would like to share some background on the asset class and why we think it’s attractive.

When raising capital for a project or business venture, large public corporations typically have two primary levers to pull: issuing shares of stock (equity) or bonds (debt). Focusing on the debt side, when a large firm issues debt, it typically works with investment banks that underwrite and sell the newly issued debt securities to a number of institutional and retail investors. While this may continue to be the preferred means of debt financing for large public corporations, smaller private companies (middle market) have more recently been fulfilling their debt financing needs through private direct lending.

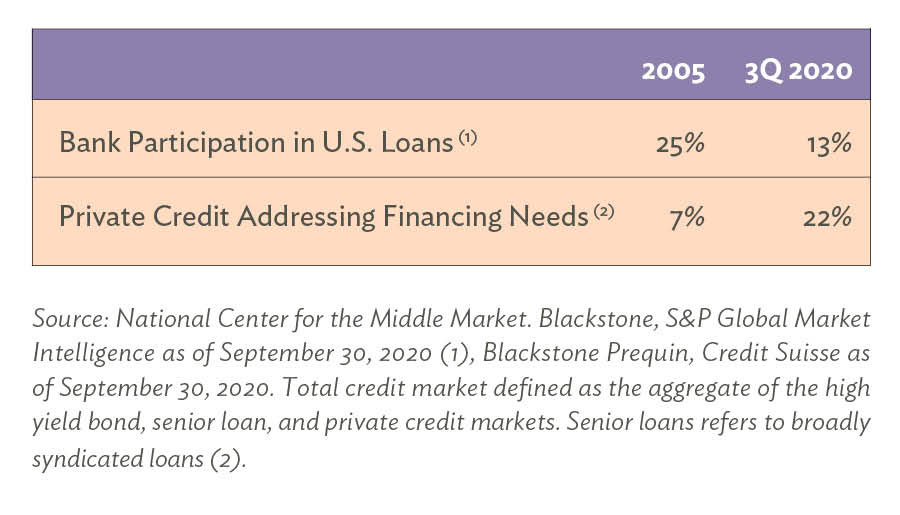

Middle market companies (as defined by the National Center for the Middle Market), with annual revenue typically ranging between $10 million to $1 billion, make up a significant portion of the U.S. economy. It is estimated there are about 200,000 companies of this size making up about one-third of U.S. private sector GDP. While not yet reaching the prestige of the Fortune 500, some middle market companies such as Topgolf, TaxSlayer, and Sotheby’s can hold national recognition for their products or services. Over the last few decades, companies of this size have increasingly sought private direct lender financing versus traditional bank lending.

Private direct lending has been beneficial for middle market companies and typically allows for faster execution, increased structuring flexibility, and increased efficiency with less burden on senior management. Other characteristics of direct middle market loans include:

- Loans are typically held to maturity

- Often floating rate (coupon payments linked to benchmark interest rates)

- Average effective maturity of 3-5 years

- Often senior and secured by a firm’s assets

- Loan-to-value ratios typically in the 45%-75% range

- Restrictive covenants in place to limit management from excess risk taking

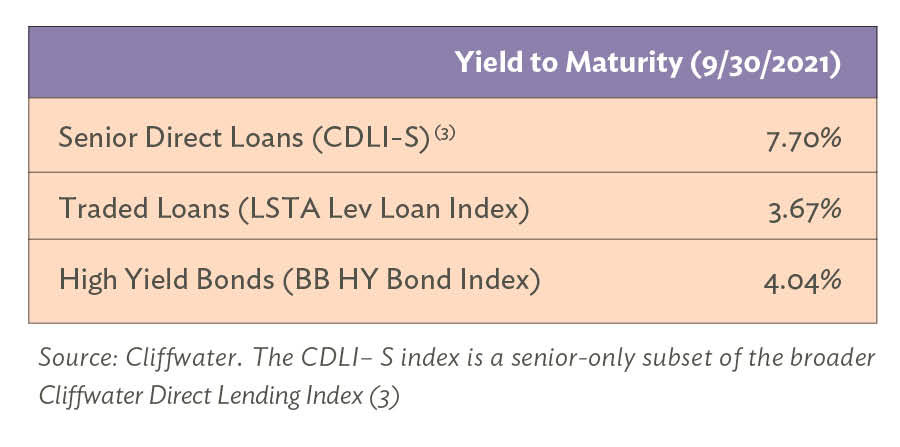

The growth of the asset class has also created opportunity for investors, as private direct loans may reward investors with higher yields compared to other fixed income asset classes.

Another important factor to consider is that the secondary market for private direct loans is typically less liquid compared to broadly syndicated loans (traded loans), high yield bonds, and investment grade bonds. As a result, Savant accesses this asset class through a modest allocation to a quarterly-liquid interval fund for clients with more relaxed liquidity needs.

The boost in yield associated with the direct lending asset class doesn’t come without a cost. Due to the smaller size and below investment grade credit quality of the borrower firms, losses from non-performing loans are expected to be greater than traditional investment grade corporate bonds. Even so, we still believe the potentially higher yields and floating rate nature of the asset class can help provide investors with attractive risk/reward characteristics to complement a traditional stock/bond portfolio.

An interval fund is a non-traditional type of closed-end mutual fund that periodically offers to buy back a percentage of outstanding shares from shareholders. Investments in an interval fund involve additional risk, including lack of liquidity and restrictions on withdrawals. During any time-periods outside of the specified repurchase offer window(s), investors will be unable to sell their shares of the interval fund. There is no assurance that an investor will be able to tender shares when or in the amount desired. As interval funds can expose investors to liquidity risk, investors should consider interval fund shares to be an illiquid investment. Because these types of investments involve certain additional risk, these funds will only be utilized when consistent with a client’s investment objectives, individual situation, suitability, tolerance for risk, and liquidity needs.