Is ESG Investing Right for You?

The theme for this year’s Earth Day celebration is “Invest in Our Planet.” With ESG investing, which stands for environmental, social, and governance investing, many people are already doing just that. ESG investing uses independent ratings to help investors understand how well companies adhere to specific ESG criteria. Through an understanding of these data points and engagement with companies held in the portfolio, investors can support corporations applying best practices from an environmental, social, and governance standpoint. At the same time, a portfolio screened for ESG characteristics often withdraws support from organizations taking serious missteps in these areas.

While it may seem straightforward, ESG has many different definitions depending on who you ask. Different data providers and asset managers have their own idea of what is “right” and what key metrics best measure their approach. In Exhibit 1, MSCI lays out a broad classification of what issues should be considered under each branch of an ESG mandate.

Exhibit 1

Source: MSCI

From an environmental standpoint, the criteria may consider a company’s manufacturing process and supply chain. Social factors may include equality, diversity, and inclusion, while governance may take into account how well the company’s leadership advocates for change.

But What About Performance?

While many investors like the idea of going green and supporting positive initiatives, they also want to be sure their investment returns support their investment goals. In the early days, some believed incorporating ESG metrics into a portfolio would materially detract from performance. While there are limitations to ESG investing as disclosed below, increasing evidence demonstrates that with ESG investing, you can potentially have your cake and eat it too – or perhaps have green in your portfolio and your wallet too.

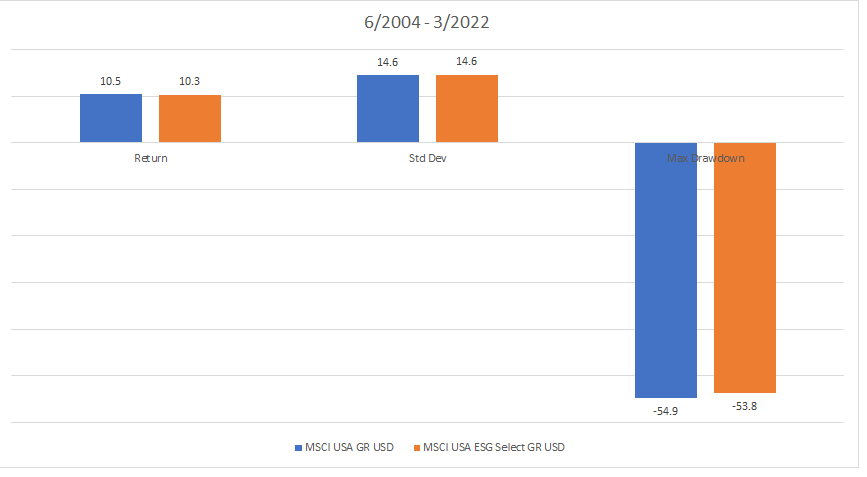

Exhibit 2 below showcases a nearly 20-year period in which a portfolio of U.S. ESG-screened stocks generated similar risk and return as a broad U.S. stock index. At times an ESG portfolio may slightly outperform or marginally underperform a non-screened portfolio, but historically this ESG index, as illustrated, has experienced remarkably similar results.

Exhibit 2

Source: Morningstar Direct. Data as of 3/31/2022. Max Drawdown is the maximum cumulative decline (peak to trough) in return percentage during the period illustrated. Return and volatility are annualized. Past performance may not be indicative of future results.

At Savant, we believe that by focusing on key environmental, social, and governance metrics, investors can potentially construct an ESG portfolio that allows them to invest in accordance with their personal philosophies of corporate responsibility without sacrificing the return necessary to power their financial plan. Your financial advisor can provide you with more information about incorporating ESG-screened investments into your portfolio.

ESG Investing Limitations: There are potential limitations associated with allocating a portion of an investment portfolio in ESG securities. The number of these securities may be limited when compared to those that do not maintain such a mandate. ESG securities could underperform broad market indices. Investors must accept these limitations, including the potential for underperformance. Correspondingly, the number of ESG mutual funds and exchange-traded funds are few when compared to those that do not maintain such a mandate. As with any type of investment, there can be no assurance that investment in ESG securities or funds will be profitable or prove successful. Please discuss with your financial advisor if this approach is appropriate for your unique situation.