All That Glitters Is Not Gold

I’m a bit embarrassed to admit it, but I’ve always thought the saying was “all that glitters is gold.” Perhaps I’ve listened to the Smash Mouth hit, “All Star,” one too many times.

Mea culpa.

Turns out the actual aphorism – all that glitters is not gold – predates the movie Shrek and traces all the way back to William Shakespeare in the 16th century. And it makes sense – often the things we perceive to be treasured and true are anything but.

Whether it glitters or not, there is no denying that gold as an asset class has once again captured investor attention. Prices going up and to the right will have that sort of effect.

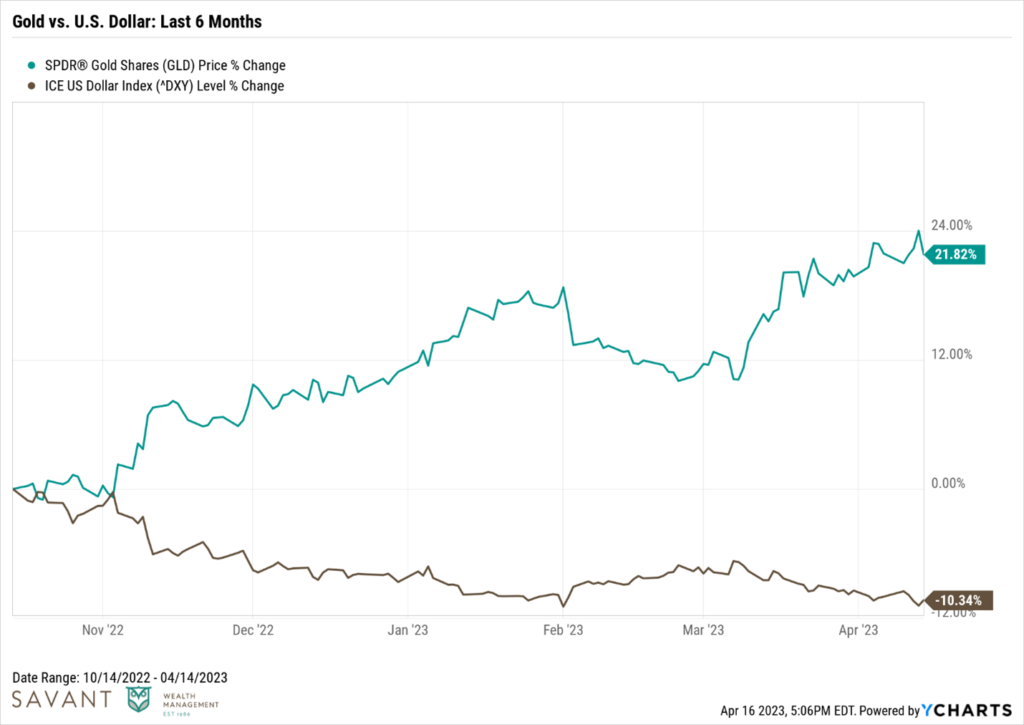

On April 3, gold closed above $2,000/ounce for just the ninth time ever. Over the last six months, gold is up over 20% while the U.S. Dollar Index is down over 10%.

Gold is one of the most polarizing assets in existence, right up there with Bitcoin. Its detractors view it as a non-productive pet rock that generates no income or earnings. On the other hand, you have the so-called “gold bugs” who view the precious metal as the premier hedge against skyrocketing debt, rising prices, dollar devaluation, and global economic calamity. The answer, of course, lies somewhere in the middle.

While gold is technically a commodity, it is distinct from broad-based commodity exposure given its dual purpose as a currency whose value is traded in relation to fiat money. Gold can best be thought of as a monetary store-of-value asset. Like any other monetary asset, it can be argued it is only worth whatever someone else is willing to pay for it.

Unlike many other alternative investments, gold has long been a democratized asset class. Several gold ETFs, backed by bullion, are just a few clicks away for the average investor. And even prior to the availability of gold funds, investors who appreciated its investment characteristics had ways to own and store it in various forms. In many ways, gold has been the everyman’s alternative.

The critique of gold lies in its utility and lack of cash flow. You could even argue it’s a negative cash flowing asset, given that holding physical bullion can incur storage and insurance costs. The challenge with gold (and commodities generally) is reconciling their expected returns with any sort of risk-based or behavioral reason why investors should expect a positive return premium over time.

Advocates will take the other side, noting its rich history as a reliable store of wealth given its persistence over thousands of years and its scarcity from relatively low supply growth. And the income argument doesn’t hold as much water in a world of low real interest rates. The lower rates go, the lower the opportunity cost hurdle for an asset like gold.

One thing is certain – whatever your preferred narrative, you can find a quote to support it.

Fans of the precious metal might cite J.P. Morgan, stating in testimony to Congress in 1912, “Gold is money. Everything else is credit.”

The gold naysayer will then provide a rebuttal, offering up a classic Warren Buffett quote:

“Gold gets dug out of the ground in Africa or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

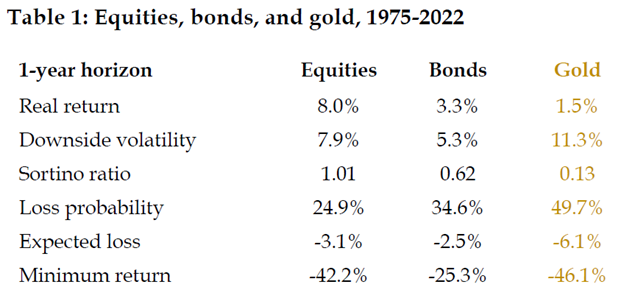

A recent paper from Robeco Asset Management studied the role of gold in multi-asset portfolios. First, it reviewed the historical risk-reward characteristics of gold relative to stocks and bonds from 1975-2022. The results were not very supportive of gold as a standalone investment relative to other options. Compared to stocks and bonds, gold delivered lower real (inflation adjusted) returns, greater downside volatility, and a higher probability of loss.

Source: Robeco Asset Management, The Golden Rule of Investing (April 5, 2023)

But standalone results are not all that matters. We must also examine how gold behaves in the context of a portfolio. In other words, the low expected returns and high volatility might still be worth it if the asset can provide valuable diversification when it is needed most – during recessions and inflationary regimes.

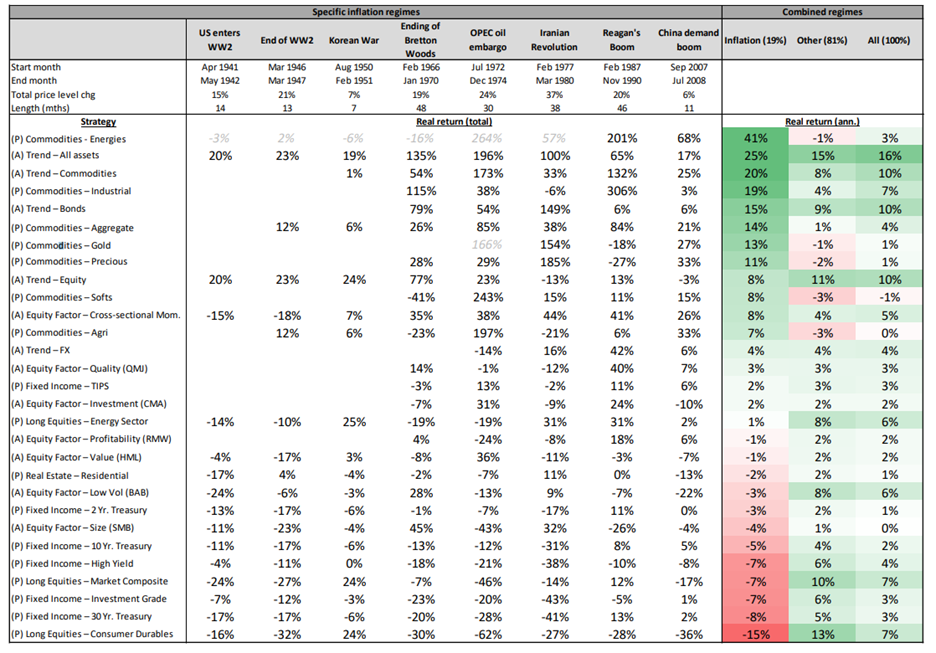

Let’s start with inflation and review the findings of a recent academic study titled, “The Best Strategies for Inflationary Times.” The authors analyzed a variety of passive and active strategies to see which have historically held up best (and worst) in periods of high inflation. The results might be surprising to those who perceive gold to be the ultimate inflation hedge.

Source: Henry Neville, Teun Draaisma, Ben Funnell, Campbell R. Harvey, and Otto Van Hemert, The Best Strategies for Inflationary Times (May 25, 2021)

Of all the asset classes and strategies examined, gold ranked seventh in terms of average real return during inflationary episodes. Several other commodity subsectors, as well as active trend-following strategies, delivered better results. In addition, gold’s hit rate was less than 100% – it declined 18% in real terms during the inflationary spike from 1987-1990. It’s also worth highlighting the three columns on the right in the above table. Inflationary regimes only accounted for 19% of all periods historically. And while gold did well during those times, it fared quite poorly the other 81% of the time.

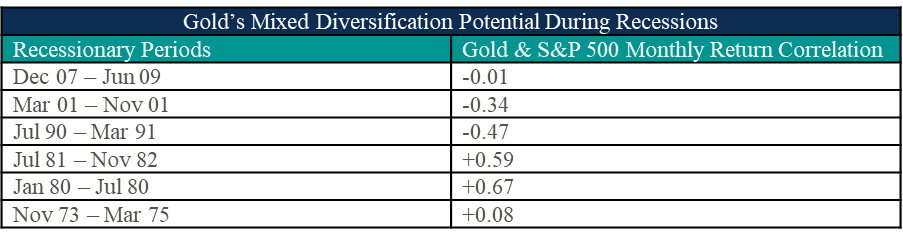

As for recessions, again it is a mixed bag. Gold did benefit investors during the Global Financial Crisis, gaining over 25% relative to the 50+% decline in equities. Yet data in the following table from BlackRock demonstrates gold’s inconsistent correlation with stocks during recessions. (Correlations can range from -1.00 to +1.00.)

Source: BlackRock

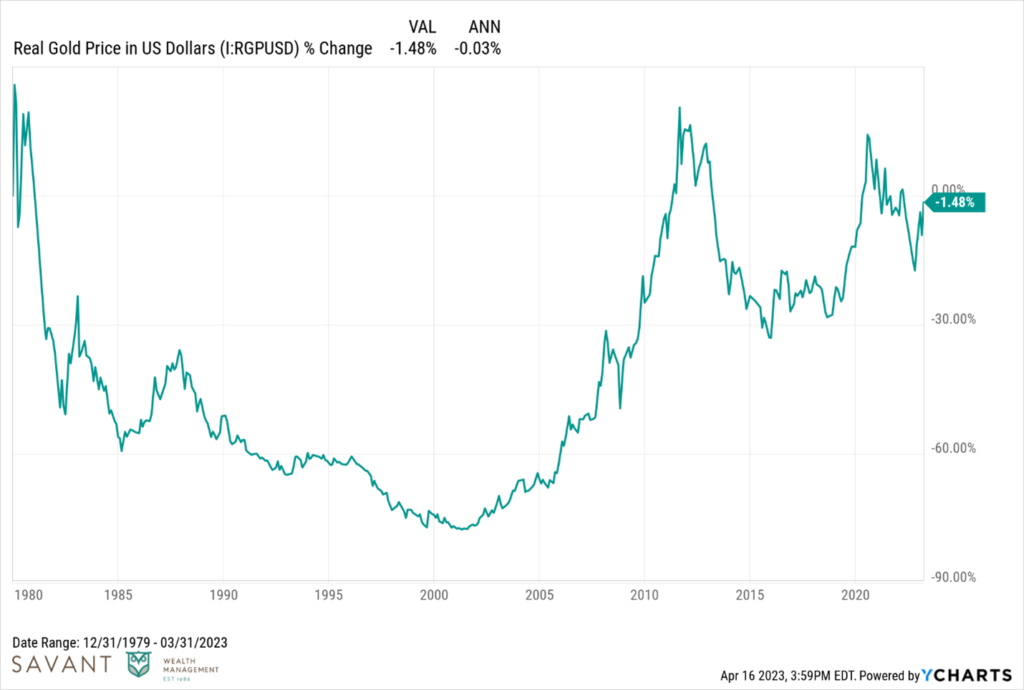

While gold can be a heck of a trade at times, as a buy-and-hold investment it can spend a lot of time treading water. Gold has experienced very lengthy periods where it lost purchasing power. As Morningstar’s Alex Bryan writes, “Investors who bought gold at its record high real price in January 1980 are still waiting to be made whole on an inflation-adjusted basis.”

I have no idea where gold goes from here. Nor does anybody else. While gold tends to move in the opposite direction of the U.S. dollar, no universal law exists governing that relationship. Gold’s role as a hedge is only as strong as its perception.

As we have examined, the case for gold as a strategic component of a diversified portfolio is unclear. While there are certainly worse ways than gold to augment stocks and bonds, we are confident there are better alternatives to include as part of a broader asset allocation plan. Savant favors alternative investments with:

- Intuitive and explainable risk premiums.

- A history of meaningful risk-adjusted and inflation-adjusted returns.

- Reliable sources of diversification with low correlation to traditional assets.

Gold can evoke strong emotions, but investors may be better off having it fulfill their material desires rather than their portfolio objectives – no matter how much it may appear to glitter at the surface.

Past performance is no guarantee of future results. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.