Preparing for Landing

“If you can walk away from a landing, it’s a good landing. If you use the airplane the next day, it’s an outstanding landing.”

— Chuck Yeager

Let’s talk about landings.

Odds are you’ve heard about them quite a bit lately.

Turn on CNBC these days and you’d be forgiven for thinking it was an aviation channel rather than one focused on business and finance.

Just about every sentence is peppered with references to hard landings, soft landings, and even the occasional no landing scenario. Throw in the mentions of headwinds and turbulence, and congratulations – you’ve just won airplane analogy Bingo!

But back to landings.

First, let’s clearly establish what each landing scenario means so we’re all on the same page:

- Hard Landing: The economy enters a recession, with significant declines in economic growth and corporate earnings.

- Soft Landing: The Fed can thread the needle of bringing inflation down to the ~2% target through interest rate hikes and tightening financial conditions without stepping on the brakes so hard that they cause a recession.

- No Landing: Economic data continues to remain strong, which in turn means inflation is likely to remain sticky. In this scenario, interest rates should move higher for longer.

It shouldn’t be surprising that the financial media commentariat is laser-focused on this debate. Inflation and recessions affect all of us in some shape or form.

But each of us experiences recessions – and inflation – differently. Very few people, if any, have a personal consumption basket that exactly mirrors the components and weights of the Consumer Price Index (CPI).

Similarly, there is little uniformity when it comes to the impact of recessions. Sure, unemployment rises in the aggregate, but whether you are directly affected will ultimately depend on what industry you work in, what company you work for, and myriad other factors.

A hard landing for one person might be a soft landing for someone else. Or as former U.S. President Harry S. Truman once said, “It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.”

We all know that recessions vary in duration and magnitude, but try telling someone who just got laid off that it’s a “mild” recession. Context matters.

The question isn’t whether any of this stuff matters – of course it does. The important question for investors is whether it is actionable.

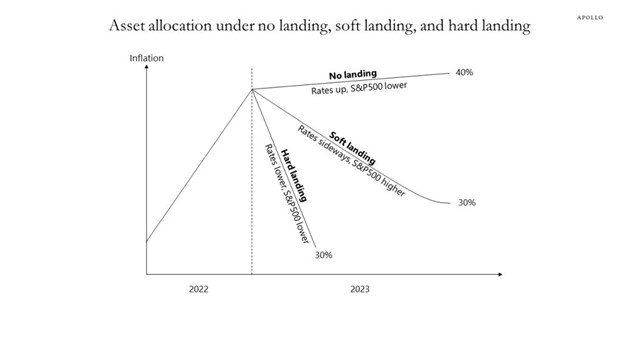

From an investment perspective, the allure of nailing the “landing” call is that, if correct, one could presumably position their asset allocation accordingly to take advantage of it. Below is a hypothetical illustration from Apollo Global Management on how stocks and bonds might be affected under the three landing scenarios.

Source: Apollo Global Management

Their conclusions are fairly intuitive and hard to debate. But notice the numbers to the right of each line above: Those represent probabilities. Any probability under 100% represents uncertainty and probabilities by nature are constantly shifting as new information emerges.

And therein lies the challenge.

Making bold portfolio adjustments based on economic forecasts is troublesome in that our plans often get punched in the mouth.

Just two weeks ago, the consensus seemed to be shifting from soft landing to no landing.

And just a few months prior, the market narrative migrated from hard landing to soft.

And now things seem to be shifting yet again toward higher odds of a hard landing.

So, what has changed between then and now? Something broke.

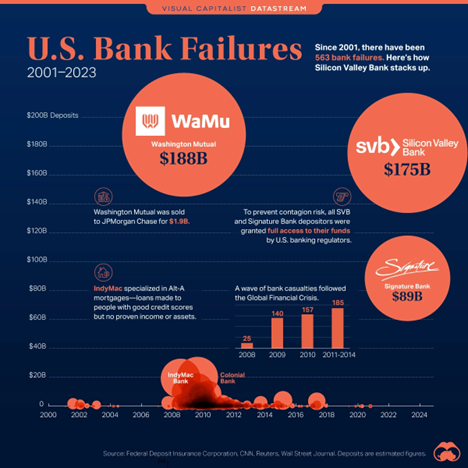

Source: Visual Capitalist

Seemingly out of nowhere, we witnessed the second and third-largest bank failures in U.S. history with Silicon Valley Bank and Signature Bank, respectively.

It has long been known that monetary policy decisions operate with long and variable lags – meaning their impact can take a while to flush through the system. Many were surprised by how orderly last year’s market volatility was, given the rapid pace of interest rate increases.

Now, we are finally starting to see some cracks emerge, namely in the banking system and housing markets – two areas that conjure bad memories for anyone who lived through the Global Financial Crisis.

As committed as the Fed has been to taming inflation, faced with the prospect of continued inflation or an all-out banking crisis, I would imagine they would choose the former ten times out of ten.

All eyes were on the Fed this week following their Federal Open Market Committee meeting. It is there that committee members released their latest policy decision to raise rates another 25 bps.

What’s fascinating about this meeting is just how quickly the narrative shifted regarding what they would or wouldn’t do. Up until two weeks ago, all signs were pointing to a 50-bps rate hike. At one point earlier this week, fed funds futures were basically pricing in a coin flip between a 25-basis point hike or no hike at all.

Only time will tell how close we are to the eventual pause in rate hikes.

What we can say for certain is that many possible future outcomes still exist, all priced accordingly based on the market’s assigned probability. And some asset classes will perform better than others in each of those possible futures. If there was ever a commercial for diversification, this is it.

We’ve all heard the phrase, “the stock market is not the economy,” but it bears repeating. And this is true from multiple angles. First, the composition between the two is just different. Technology, for example, represents a much larger weight in the S&P 500 than the percentage of technology workers in the total U.S. economy.

But the main difference between the stock market and the economy is that one is forward-looking (stocks) while the other consists primarily of backward-looking data (economy).

While the economy is still refueling and making repairs at the gate, the stock market is likely to be accelerating down the runway for takeoff.

Great portfolios – particularly those designed in service of a personalized financial plan – are built with the assumption that turbulence will be the rule, not the exception.

Good pilots don’t wait to put together their flight plan until they’re in the air. They do it while they’re still on the ground. Likewise, a well-constructed portfolio is worthless if not tailored to your unique time horizon, risk tolerance, and financial goals at the onset.

Whether the economic landing ends up being hard or soft is anyone’s guess and beyond everyone’s control.

Landings, airplane or otherwise, can be uncomfortable. But they are also temporary.

The economy will eventually prepare for takeoff again. But you need a seat on the plane to eventually enjoy the view from 30,000 feet.