Suspension of Disbelief

$32 Billion to zero in the blink of an eye.

I am, of course, referring to the downfall of Sam Bankman-Fried and his crypto empire FTX, all of which came crumbling down in a matter of days.

On Nov. 7, Mr. Bankman-Fried, a.k.a. SBF, tweeted this (which he later deleted):

Four days later, on Nov. 11, FTX – sporting a private valuation earlier this year of $32 billion – filed for bankruptcy.

This quickly became THE financial news story of 2022 – even for non-crypto people — garnering comparisons to Enron, Bernie Madoff, and everything in between. With a hole in its balance sheet so large you could drive a truck through it, FTX lost billions of dollars in customer deposits.

For years, FTX had carefully curated the image that it was one of the responsible players in the Wild West of crypto.

And we all fell for it hook, line, and sinker.

The stadium naming rights. The celebrity endorsements from the likes of Tom Brady, Gisele Bündchen, and Steph Curry. The Super Bowl commercial featuring Larry David. The lobbying in Washington, D.C.

All of it a facade.

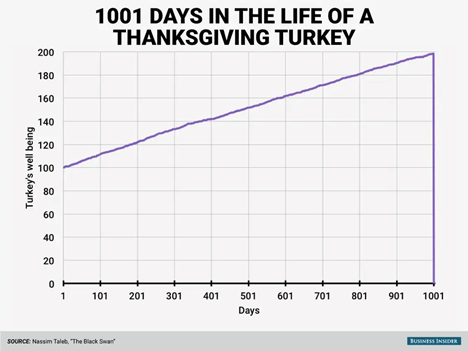

In the end, crypto’s “golden goose” was nothing more than one of Taleb’s turkeys:

People are rightfully very angry and seeking answers to questions beyond the scope of this article.

Will Sam go to jail?

Where did all the money go?

When, if ever, will customers get any of their money back?

It may take a while, but clarity will come in due time for all the above.

In the meantime, it’s worth examining another question:

Why did any of this even happen in the first place?

Notice I said why, not how.

How this happened seems like an obvious cocktail of deception, malfeasance, hubris, inexperience, incompetence, and gross negligence by SBF and others in “leadership” at FTX.

But why?

Why did some of the most venerable investors from Silicon Valley and Wall Street miss what we now know were obvious due diligence red flags as they were lining up with wheelbarrows full of money to pour into FTX’s coffers?

The answer, in its simplest form: a willing suspension of disbelief.

The concept of suspension of disbelief is as old as the art of storytelling itself.

It’s what allows millions of children across the world to believe in the magic of Santa Claus.

It’s what permits viewers of Jurassic Park to sit back and enjoy one of cinema’s greatest achievements while tolerating a premise we would never accept in the real world.

It’s the semi-conscious ignorance to the implausibility in front of our eyes, for the pure sake of enjoyment.

Perhaps more than any other medium, suspension of disbelief is paramount to the success of one of America’s great pastimes – professional wrestling. In fact, the entire edifice of this sports-entertainment hybrid is built upon it. Heck, the industry even has a word for it: kayfabe.

Wrestling historian David Shoemaker defines kayfabe as “the code of secrecy that undergirds the pro wrestling industry by which the secret of its unreality is protected. Keeping kayfabe is the act of staying in character before, during, and after shows so as to maintain the illusion.”

As a lifelong fan myself, I get this question all the time: “You know it’s fake, right?”

My typical response: “Yeah, that’s the point.”

It’s the unwritten contract between the performers and the audience – a subtle wink and nod – that makes the whole thing work, that allows you to give yourself over to the show.

For as much joy and entertainment suspension of disbelief can bring us, it becomes quite dangerous if we allow if to infiltrate our investment decisions.

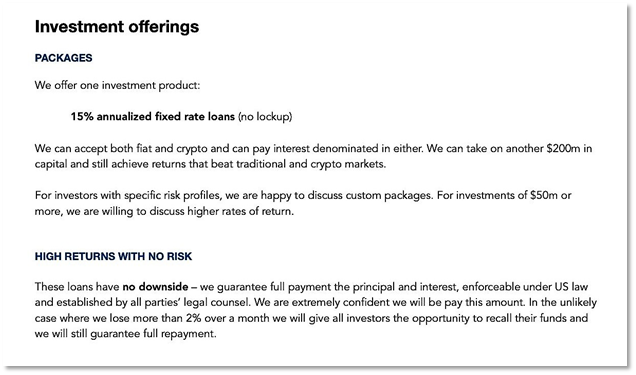

Just look at this slide below from a 2018 pitch deck for Alameda Research (FTX’s supposedly “unaffiliated” hedge fund):

A stated rate of return in the mid-teens and the literal use of the phrase “high returns with no risk.” Most rational folks would correctly recognize that as hogwash, but clearly many others didn’t. Such is the seduction of what Ben Hunt calls the Magical Money Machine.

FTX is just one high profile example. Collectively, investors suspended quite a bit of disbelief in recent years, fueled by cheap money and raging animal spirits in hopes that the good times would roll in perpetuity and trees would grow to the sky. In hindsight, it was everywhere – meme stocks, Dogecoin, stay-at-home stocks, SPACs. Much of it has come hurtling back to Earth over the past year. The risk-free rate going from 0% to 4% in less than twelve months will have that sort of effect.

Case in point: Carvana, the now troubled online used-car dealer.

At its peak, Carvana’s stock had a market capitalization of $60 billion in the fall of 2021. It is now down 98% YTD and teetering on the edge of bankruptcy.

Just one of many illustrative examples that just because something is down a lot, doesn’t make it cheap.

Or as famed hedge fund manager David Einhorn put it:

“What do you call a stock that’s down 90%? A stock that was down 80% and then got cut in half.”

No investment is immune to the laws of financial gravity.

So how do we move forward when we are confronted with the massive wealth destruction and loss of trust that accompany financial scandals and the bursting of bubbles?

How do we minimize the risks of being exposed to bad actors or other “hero to zero” falls from grace?

How do we stay invested and remain confident without falling prey to suspension of disbelief?

Here are a few suggestions:

- Focus on numbers over narratives: An evidenced-based approach to investing embraces data and eschews dogma. It does not require fantastical assumptions or giant leaps of faith to work. It simply relies on common sense, logic, and decades of financial history to tilt the long-term odds of success in your favor.

- Diversify, diversify, diversify: The best way to avoid ruin as an investor is to make lots of small independent bets instead of one massive one. A well-balanced portfolio should have no single point of failure. If you insist on maintaining a speculative bucket for entertainment purposes, just be sure to size it modestly.

- Automate good decisions: Suspension of disbelief is just like most other behavioral investment foibles in that we’re often not consciously aware we’re engaging in them when they’re happening. The fewer decisions we make, the better. This is doubly true in periods of elevated agony and ecstasy.

- Actually DO due diligence: Benchmark Capital’s Bill Gurley recently posted a red flag checklist for venture capital investors. It’s unfortunate many of FTX’s enablers did not heed the items on this list. If you’re evaluating an investment or a manager, ask tough questions. And if you get unsatisfactory answers? Run, don’t walk, away.

- Swim in regulated waters: There’s a reason FTX/Alameda chose to be headquartered in the Bahamas and it wasn’t the nice weather. It’s highly unlikely something of this magnitude would have happened if FTX were a regulated entity under U.S. jurisdiction.

- Maintain realistic expectations: Avoid lofty promises like the plague. Immediately discard “high reward, no risk” opportunities. If it sounds too good to be true, it 100% is. To quote Charlie Munger, “The first rule of a happy life is low expectations. If you have unrealistic expectations, you’re going to be miserable your whole life. You want to have reasonable expectations and take life’s results, good and bad, as they happen with a certain amount of stoicism.”

There’s a good reason investing is sometimes referred to as the “Triumph of the Optimists” – it has paid off over centuries to have a glass-half-full bias and benefit from human ingenuity across the globe. But that positivity shouldn’t go unchecked. There is such a thing as being too optimistic.

A healthy amount of disbelief is a countervailing force to the requisite optimism that allows creativity and capitalism to flourish. It’s when disbelief runs rampant that expectations become untethered from reality and bad things happen. Due diligence becomes an exercise in rubber stamping. Hive mind behavior permeates. Confirming opinions are sought from the comfort of our personal echo chambers.

If there is one lesson to take away from the FTX saga, it’s this:

Stay positive but keep your disbelief within arm’s reach.