Time for a Commercial Break?

If there is one thing The Fed has been transparent about over the last 12 months, it is that they were going to keep raising interest rates until they successfully defeat inflation in the U.S. economy via demand destruction — the subtext being that if something were to “break” along the way, so be it.

As we are all now aware, something broke (or at the very least, cracked) in March of this year: U.S. Regional Banks.

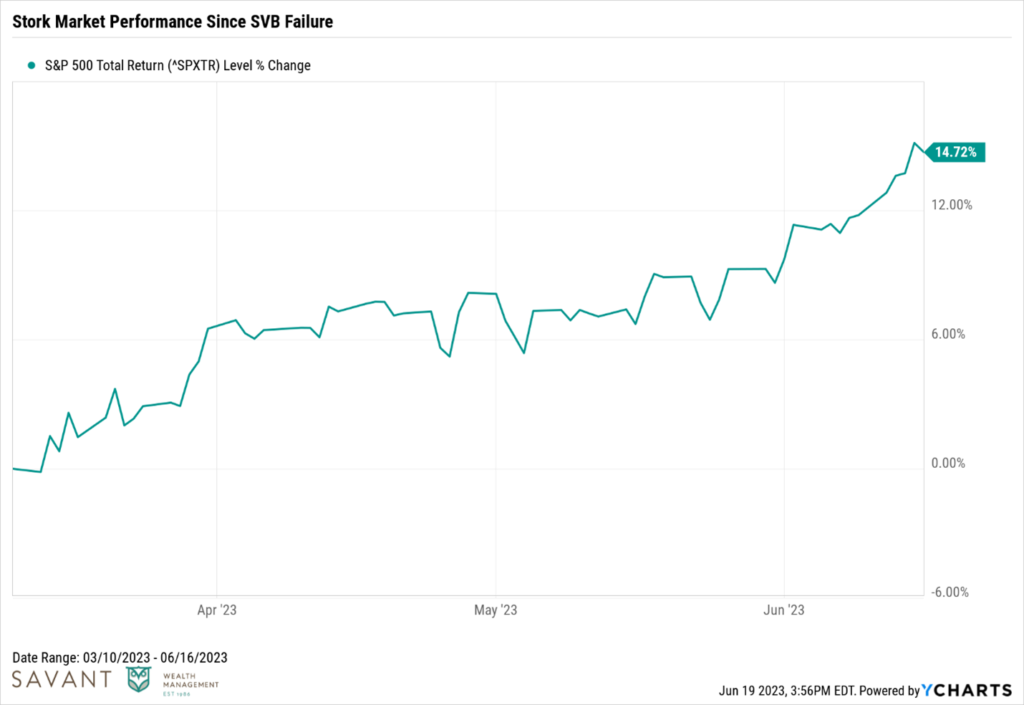

To everyone’s surprise (and relief), the dreaded contagion into the broader financial system never quite manifested. Markets have since moved on, as evidenced by the S&P 500 returning 15% since that fateful Friday when Silicon Valley Bank (SVB) met its maker.

Of course, that doesn’t stop the prognosticators from worrying about what monster might still be lurking around the corner. The next shoe to drop.

And boy, is there consensus on what that next shoe might be.

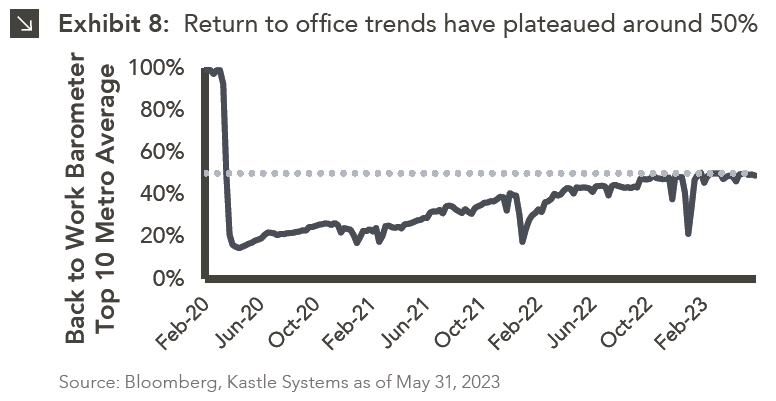

Higher borrowing costs and rising vacancy rates have triggered worry among investors about the fate of office real estate. If you are reading this and are still in the workforce, odds are you are not spending five days a week in the office. I know I’m not. It’s more likely you are going in two to four days a week. Some of you still might not be going in at all.

You’ve probably seen a chart that looks like this recently, highlighting the apparent plateau in return to office activity.

Source: Marquette Associates

It’s natural to extrapolate trends like these and assume that the “end of office” is the only inevitable outcome. And there is indeed likely to be more pain ahead in U.S. office real estate, particularly in private markets where valuations operate with a lag against their public market counterparts.

The Market is Just as Aware as You Are

Before we get too far over our skis, it’s helpful to remind ourselves that everything we’ve been reading, watching, and listening to has already been digested by the financial markets.

Markets have an uncanny ability to process information as it develops. Let’s look at an example:

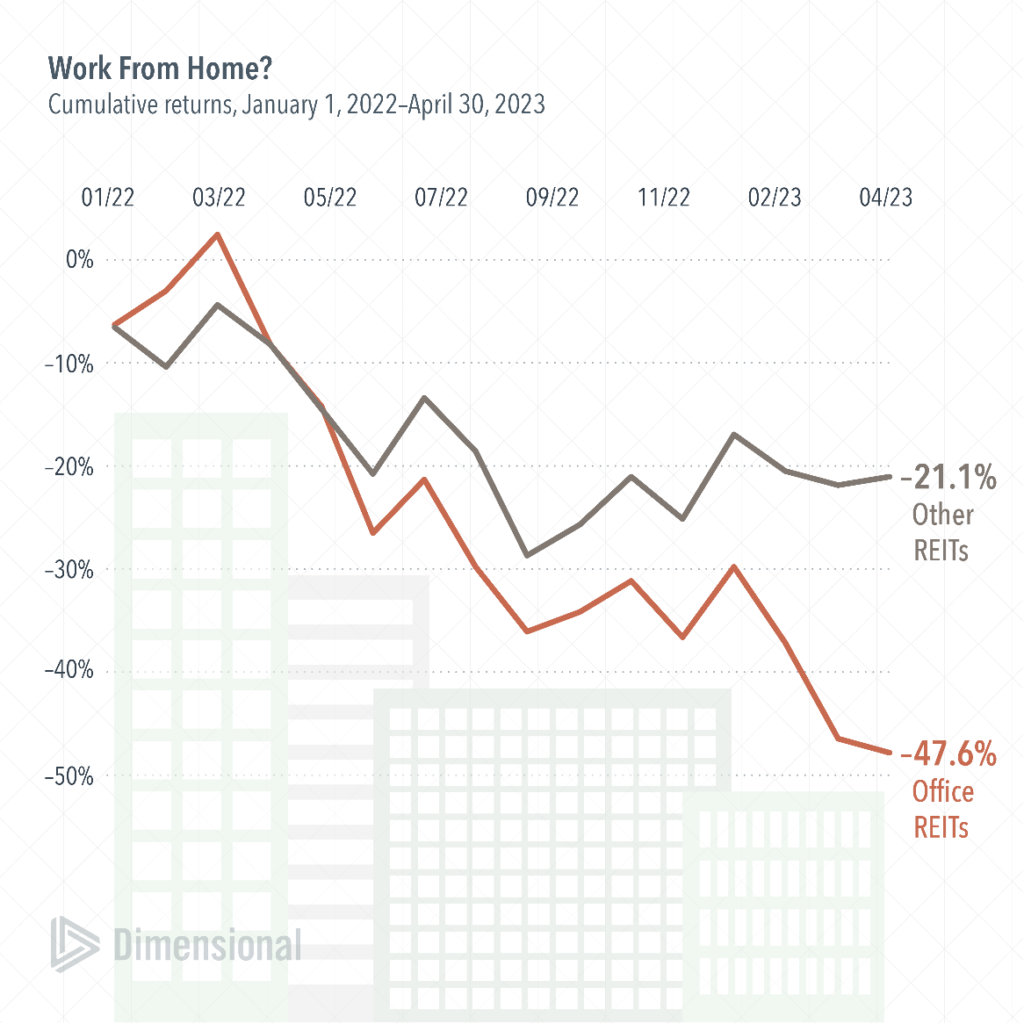

Publicly traded real estate investment trusts, or REITs, have taken it on the chin over the past year and a half. As illustrated in the chart below from Dimensional Fund Advisors, REITs focused on office properties have been particularly bruised, shedding 47% of their value from the start of 2022 through April of this year. That’s more than double the decline of all other “non-office” REITs, which lost 21% over the same period.

Source: Dimensional Fund Advisors

Worrisome as the landscape might be, the question remains just how much of that pessimism is already priced in.

Commercial Real Estate is More Than Just Office

You can invest in real estate in many ways: From public to private markets, through equity, debt, and hybrid structures, and across a spectrum of risk profiles from income-focused (core/core plus) to return-seeking (value-add/opportunistic).

When it comes to property types, real estate has expanded quite a bit beyond the four basic food groups of residential, retail, office, and industrial.

As American society and business have evolved, so have the variety of real estate categories to reflect that change. As such, we are seeing trends toward additional and modernized real estate sectors that reflect the monumental shifts in the way we live, work, and consume.

While the core four property types can still serve as a solid foundation, we believe there is a strong case that alternatives within real estate can be critical complements to existing portfolios in years ahead. Demographic tailwinds and secular demand trends will only help serve to support alternative and niche real estate sectors that are generally more resilient during recessions.

Examples of the more alternative, niche, and cycle-resilient sectors include:

- Medical Office

- Student Housing

- Self-Storage

- Life Sciences

- Senior Living

- Data Centers

- Cell Towers

- Single-Family Rentals

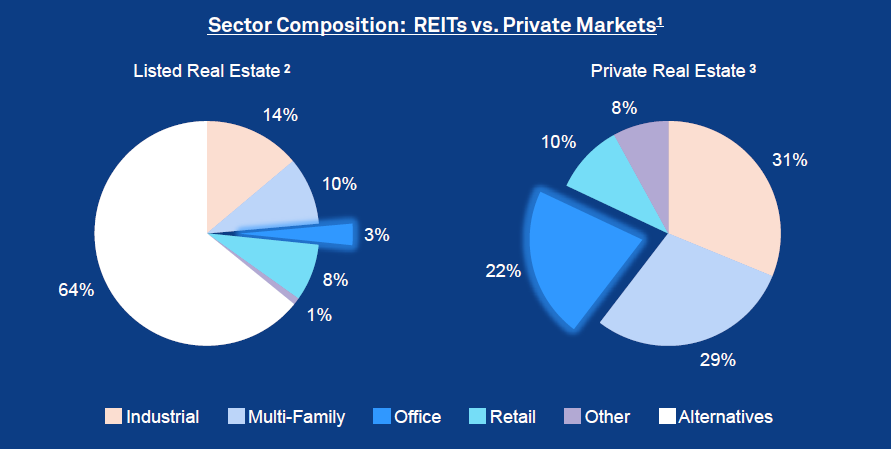

As much as we’ve been conditioned to hear “office” when someone speaks the words “commercial real estate” like some sort of auditory illusion, it’s quite remarkable to see how little of the modern real estate market value is comprised of office. According to research from CenterSquare, the office sector only represents 22% of the private real estate market and a measly 3% of the listed real estate market. Ironically, the majority of public REITs are in alternative property types. Perhaps they’re not so alternative anymore.

Source: CenterSquare. Data as of March 31, 2023. Listed Real Estate based on the FTSE/Nareit All Equity REITs Index. Private Real Estate measured by the NFI-ODCE Index.

This Is Not 2008 All Over Again

For those who lived and invested through the Global Financial Crisis (GFC), the scars are all too real. Investors should take comfort that the real estate market today is, broadly speaking, much healthier than that of 2007-08.

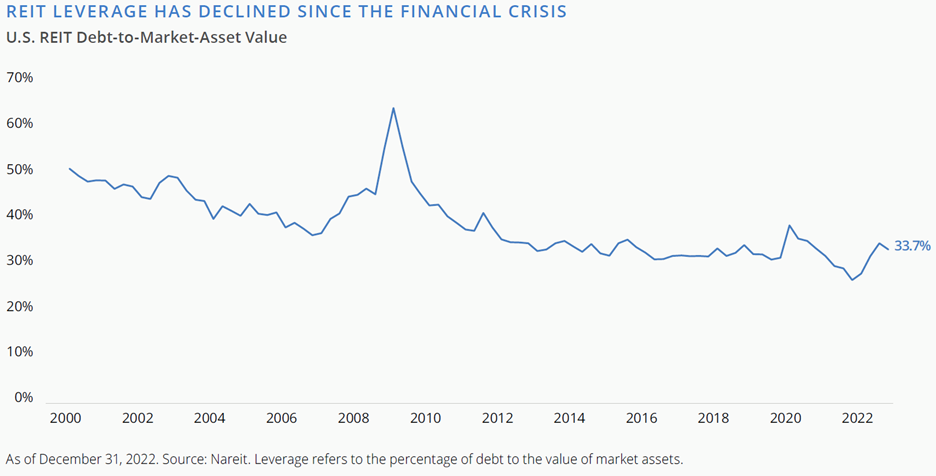

Balance sheets of REITs are in much better shape today. Excessive leverage, a key contributor to the GFC damage, is significantly less pervasive today.

Source: Brookfield

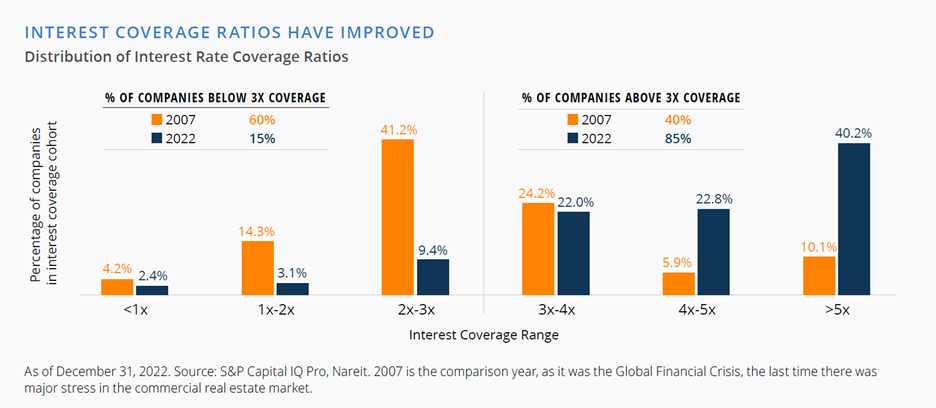

As leverage levels have fallen, interest coverage ratios have risen, as illustrated below. High interest coverage and long-term maturities may limit the interest rate and refinancing risks for the broad real estate asset class, according to research from Brookfield.

Source: Brookfield

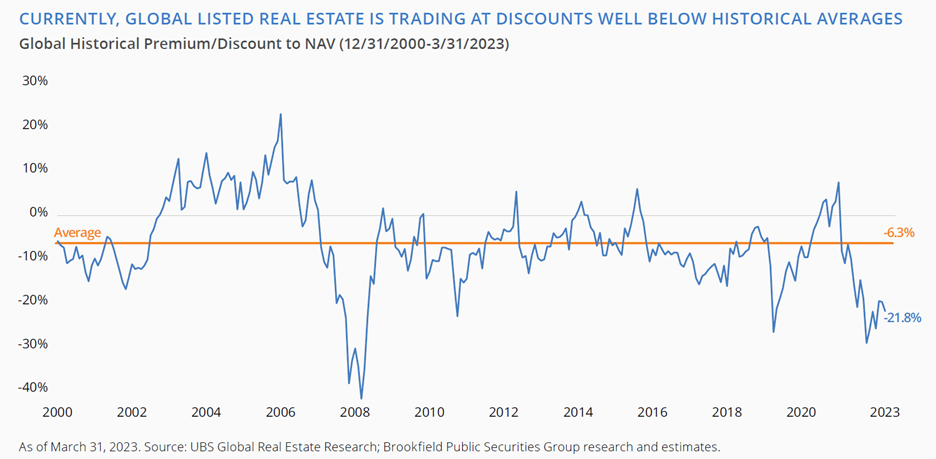

Current valuations may also provide investors a margin of safety. Publicly listed REITs globally have historically traded at a ~6% discount to their underlying net asset value (NAV). As of March 31st, that discount was 21% — a stark contrast to the premium valuation that REITs traded at heading into the GFC.

Source: Brookfield

Today’s uncertainty often leads to tomorrow’s bargain.

Real Estate: Still A Compelling Component of a Diversified Portfolio

There is no doubt that the post-COVID economy and current interest-rate environment have had a dramatic impact on commercial real estate, namely office. Signs of stress in the real estate capital markets following the regional banking issues have emerged and public markets have repriced accordingly.

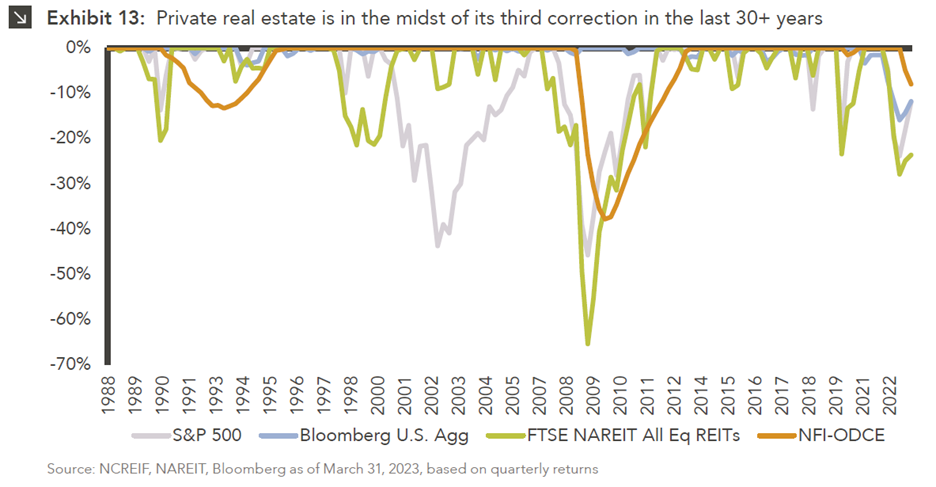

We can acknowledge the challenging fundamentals while also recognizing that this is not the first correction real estate markets have witnessed. Nor will it be the last.

Source: Marquette Associates

Through its ups and downs, real estate – both public and private – has delivered solid risk-adjusted returns, demonstrated modest-to-low correlation to other asset classes, and can serve as a long-term hedge against inflation.

In many ways, real estate is the original alternative investment. And it’s probably the easiest alternative for most investors to grasp. There is a tangibility and realness (pun intended) that accompanies it—the homes we reside in, the office buildings we work in, the hotels we stay in and the stores we shop in.

At its core, real estate offers the ability to preserve value over time, net of inflation, through the scarce nature of the land it sits on and the replacement costs of the raw materials in the structure itself. Through leased properties, real estate owners may also benefit from rental income as a significant component of total return on top of that.

Real estate has historically been—and will likely continue to be—an attractive asset class warranting a strategic spot in a diversified portfolio. The sectors comprising real estate and the vehicles and methods in which we allocate to it will continue to evolve, but its primacy as an asset class and the premise of capturing durable cash flows derived from contractual rents will likely remain intact.

If you happen to own (or have lent money against) commercial office space in major metros such as New York, Chicago, or San Francisco, you may have cause for concern. For the rest of us, the commercial break can end so that we can get back to our regularly scheduled programming.

Past performance is no guarantee of future results. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant.