The Year Ahead: Stick to Your Plan

“I’m more worried about the world broadly than I’ve ever been in my whole career… I’d be worried we’ll have another 10 years of zero returns.”

– Seth Klarman

Seth Klarman, billionaire investor, hedge fund manager, and author, may not possess the notoriety of other famous investors, but his track record stands up against almost anybody’s. It’s a scary quote, and at face value, investing with caution would seem warranted.

But that quote is from May 2010. From May 2010 through the end of the decade, the S&P 500 tripled in value.

Predictions are hard. The cemetery for seers has a large section set aside for market forecasters. Every market environment is unique. 2022 will be remembered for the severity and persistence of negative returns across asset classes, most notably the “safest” assets.

Turning the page to 2023, it’s the land of the unknown. It’s fair to ask: “Will things get better?” An easy rebuttal would be that it’s hard to imagine there’s much left that can surprise the markets. Markets don’t like surprises. An absence of them this year could be a catalyst for a more favorable investing environment.

Inflation was arguably the biggest surprise last year, but in recent months it has leveled off. There are signs inflation may be coming down in the year ahead. The Fed’s aggressive path of rate hikes in response to inflation would be unlikely to continue in 2023 if inflation doesn’t get a second wind. The COVID excess – record levels of cash in consumer pockets and unsustainable equity valuations in the “stay at home” trade – has self-corrected.

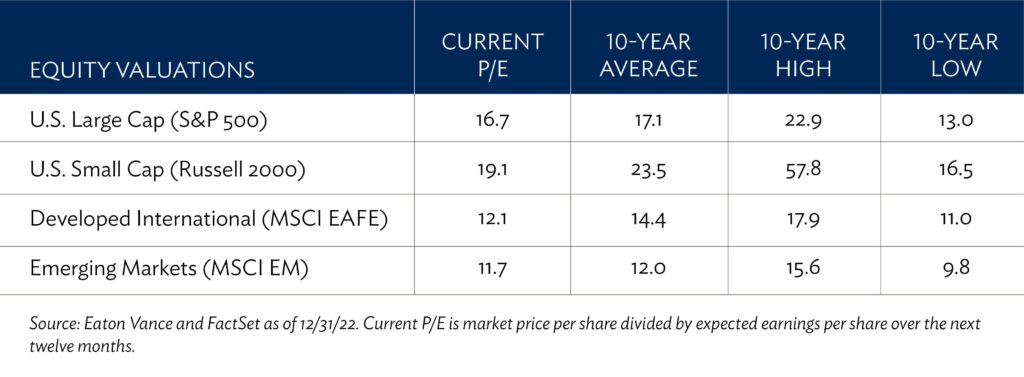

Equity valuations have become more attractive. Last year’s price declines could be this year’s opportunity. U.S. large cap stock valuations are back in line with historical levels, while U.S. small caps and international stocks are the cheapest they’ve been in some time.

Valuations can’t tell us anything that will happen in 2023, but lower valuations do put equities in a position for considerable upside in the coming years.

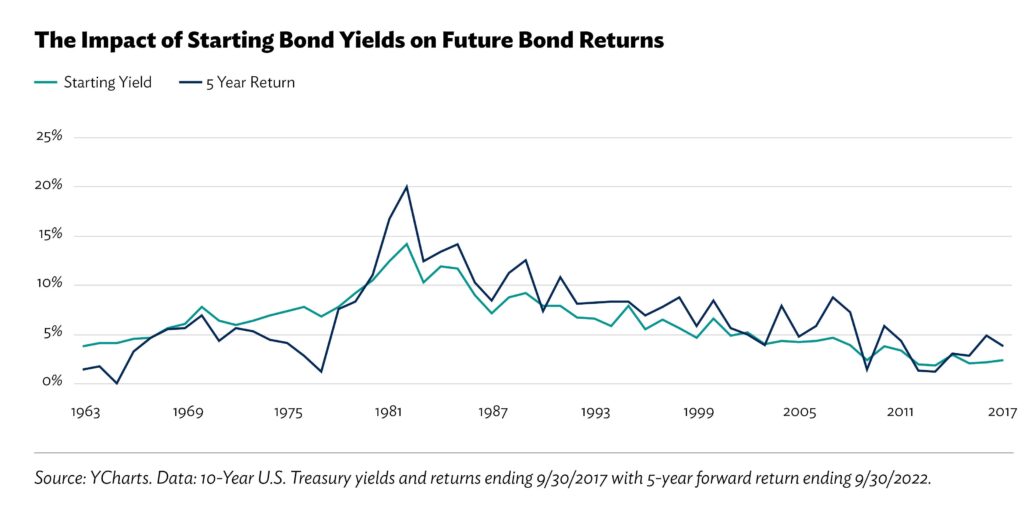

The story is similar for fixed income. The future is brighter for bonds than at any time in recent memory. In government bonds with little credit risk, starting yields predict future bond returns with reasonable precision. In effect, higher yields will pave the way for higher returns in the future.

Oaktree Capital founder Howard Marks recently referred to the current environment as “the zone of reasonableness.” A bear market was a reasonable outcome given the Fed’s actions to fight inflation.

Marks added he believed the market was in “fair territory” and in these periods there’s nothing brilliant to be done.

If you have a plan, stick with it. There’s no short-term trade that will fix the problem, and moving a portfolio to cash waiting for the economic environment to improve has generally achieved poor results.

To quote Robert Frost, “The only way out is through.”

The unfortunate truth about markets is that things often get very ugly before they get better. Since things have been very ugly, hopefully the stage is set for better things to come.

Indices are unmanaged, do not reflect fees and expenses, and are not available as direct investments. Returns are calculated in U.S. dollars and reflect the reinvestment of dividends and other earnings.