A Value-able Roadmap

From accumulators to retirees and all those in between, investors are always looking for a roadmap revealing the path to market-beating returns. For long-term investors, we can look to one of the market’s worst kept secrets: value investing.

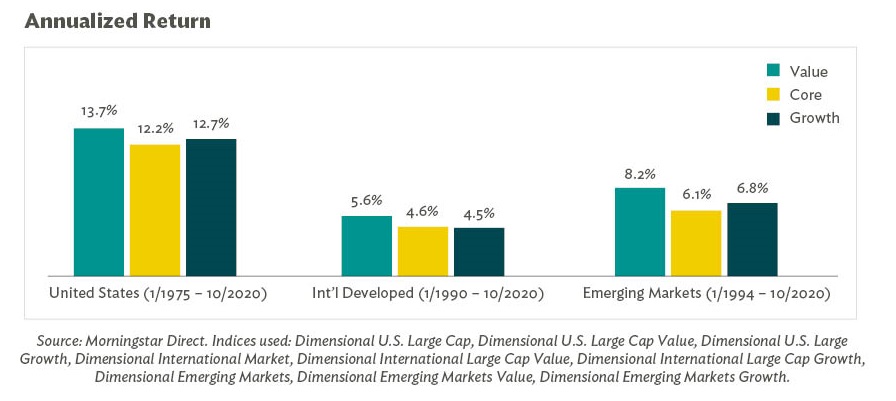

Value investors purchase stocks trading at a low price relative to its fundamentals in comparison to other securities in the same category. Cutting through the industry jargon, low relative price is synonymous with inexpensive stocks, and value investors believe that buying these inexpensive stocks will lead to outperformance versus buying expensive stocks. The figure below demonstrates that over time, regardless of region, inexpensive value stocks have outperformed not only their expensive growth counterparts, but also the broad markets.

Just like dad’s “shortcuts” on family road trips, systematic value investing does not always work. Investors who want to earn the long-term premium associated with owning value stocks must be willing to stick with the strategy during periods of underperformance. Value stocks failed to outperform the broad U.S. market in rolling five-year periods since 1927 just over one-third of the time. Of course, the flip side is that value did outperform the broad market almost two-thirds of the time. It can be challenging for investors to look and feel different than the market. At one point, value stocks underperformed the broad market by an average of over 10% per year for five straight years – certainly a test of patience for long-term value investors. But as the figure above illustrates, investors who maintained an allocation to value stocks throughout their journey were rewarded with higher returns at the end of their trip.

Now that 2020 has drawn to a close, rather than looking in the rear-view mirror, we find ourselves checking the side mirrors and looking out the front windshield to focus on what’s ahead. Value stocks are always less expensive than growth stocks, by definition. That said, value stocks today are historically cheap relative to their growth counterparts regardless of what country’s “map” we’re using. Frustratingly, this tells us nothing about what might happen in the near term. But history does demonstrate that periods of such “cheapness” are typically followed by strong relative returns of value relative to growth. We feel confident that a decade from now we will look back at this period as a rare and wonderful entry point for value investors. Capturing it will require investors to remain disciplined and steadfast in the years ahead.