What Helps Drive International Stock Returns for U.S. Investors

When investors think about buying a stock, the focus is typically on the company’s business fundamentals—revenue, earnings, cash flow, and long-term growth potential. And rightly so. These are the core drivers of stock returns. But in today’s global investment landscape, especially when it comes to international stocks, returns can be multifaceted.

A common objection to international investing is the belief that U.S. companies already offer global exposure. After all, many of the largest U.S. firms—Apple, Microsoft, and Coca-Cola—generate significant revenue from overseas markets. Doesn’t this provide the same benefit as investing internationally? The answer is no. While these firms may operate globally, their stock prices still reflect the dynamics of the U.S. market. Research shows that U.S. companies with foreign revenues tend to correlate with the overall U.S. stock market—especially during market downturns. Their global revenue does little to insulate investors from U.S.-specific risks. In short, if you want exposure to foreign markets, you need to own foreign securities.

Exchange and Market Behavior Matter

True international investing provides exposure to different market structures—not just different companies. U.S. stocks, regardless of industry, tend to be highly correlated. They’re priced in dollars, shaped by Federal Reserve policy, and influenced by the same news cycle and investor sentiment.

Source: Dimensional Fund Advisors

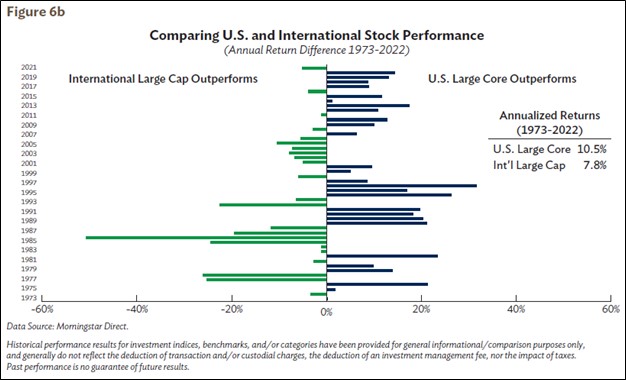

Foreign markets, by contrast, have exhibited a cyclical relationship of outperformance with U.S. stocks. Research shows that from 1975 to 2022, the correlation between international stocks and U.S. stocks was modest, with even lower correlation between international stocks and U.S. small stocks. In the 1980s, foreign markets provided the highest returns. In the 1990s the U.S. market dominated. Overseas markets again outperformed in the 2000s, while the U.S. market underperformed. This is known as exchange or market diversification, which helps reduce portfolio correlation. International diversification can become valuable when U.S. stock valuations rise or when a narrow group of sectors, such as tech, drives performance.

Source: Dimensional Fund Advisors

By investing internationally, you diversify not just by geography, but also by monetary policy, political risk, and investor behavior—factors that can be just as influential as company earnings.

The Dividend Advantage Abroad

Another important factor in international returns is dividends. International companies, particularly in regions like Europe and Australia, often pay higher dividends than their U.S. peers. This stems from structural and cultural differences.

International firms tend to be more conservative with capital. They favor returning cash to shareholders through regular dividend payouts rather than reinvesting earnings or pursuing aggressive buybacks. This is especially true in markets where shareholder expectations and regulatory norms encourage dividend stability.

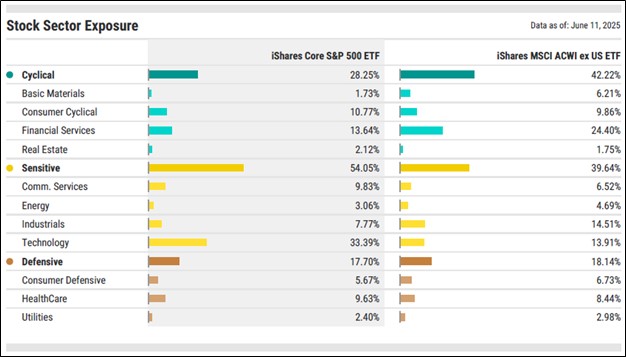

The sector mix plays a role, too. International markets are heavier in mature industries like financials, energy, and consumer staples—businesses that generate consistent cash flows and typically distribute more of their profits. In contrast, U.S. markets are more growth-focused, particularly in technology, where companies reinvest for expansion rather than income. For U.S. investors, international dividends can help offer a steady return stream that’s designed tohelp cushion volatility and provide income even when market prices are flat or declining.

Source: Y-Charts. Data as of 6/11/2025

The Currency Factor: Risk and Reward

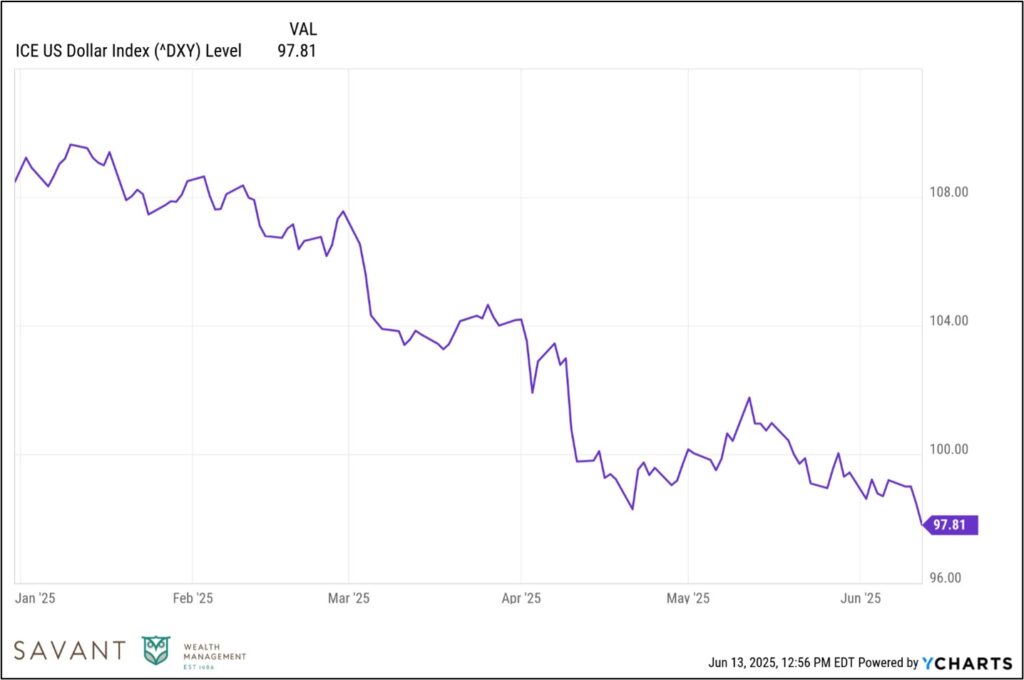

Currency movement is a third, often overlooked, source of international stock returns. When foreign currencies like the euro, yen, or pound strengthen against the dollar, the value of international investments increases when translated back into U.S. dollars.

This currency exposure is a double-edged sword: it can help enhance returns during dollar weakness or detract during dollar strength. But it also helps add valuable diversification. In fact, currency gains have helped drive recent international outperformance—especially in 2023 and 2024, when the euro and other currencies appreciated relative to the dollar.

That’s why some investors hedge currency exposure in fixed income, where stability is key, but leave it unhedged in stocks. Investors accept the added volatility as part of the broader risk-return tradeoff in global stock investing.

Source: Y-Charts. YTD Returns as of 6/13/2025.

Beyond Fundamentals: Building Better Portfolios

Equipped with this knowledge around the dynamics of international stocks, we believe you can help diversify your portfolio with exposure to assets with a different risk/return profile than U.S. stocks. By being proactive around diversification, we help ensure that we have a handle on what we can control within financial markets, rather than factors we cannot control. An allocation to international stocks can be a step forward in this regard.

Understanding these drivers—market behavior, dividends, and currency—helps investors make more informed decisions about international allocation. Investors aim to build portfolios that are globally diversified in structure, not just in appearance.

At Savant, we focus on building intentionally designed portfolios based around our Evidenced-Based Investing philosophy. Our goal is to build them for the long haul, not for chasing short-term returns or reacting to headlines. We believe international stocks play a vital role in well-constructed portfolios, with the goal of offering a diversified source of returns for U.S. investors.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only.

This is intended for informational purposes only. You should not assume that any discussion or information contained in this article serves as the receipt of, or as a substitute for, personalized investment advice from Savant.