Tag: Health and Wellness

Healthcare, Wellness, and Financial Planning

Staying healthy and financially fit go hand in hand. Just like regular workouts build physical strength, consistent financial habits can help create long-term stability. From healthcare choices to smart savings strategies, here are five ways to strengthen your financial health.

How to Plan for Healthcare Costs in Retirement

Planning for healthcare costs in retirement is essential but often overlooked. With an estimated $165,000 needed for medical expenses, understanding Medicare, supplemental insurance, and savings options like HSAs can help secure your financial future while maintaining your desired lifestyle.

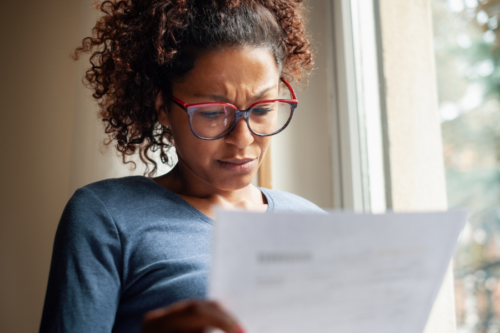

Financial Triage: Navigating a Poor Health Diagnosis

Securing the right care is paramount when facing a challenging health diagnosis. Addressing urgent financial tasks to protect your future and reduce stress for loved ones is also critical.

Are You Making the Most of Your Health Savings Account (HSA)?

A Health Savings Account (HSA) offers a triple tax savings benefit and can be a powerful tool in your retirement portfolio. Financial advisor Nicholas De Jong provides more details in his latest blog post.

Do I Have Enough?

What does having enough mean to you? Let’s examine some possible meanings and how you may want to explore all aspects of having enough. Though it can mean something different to everyone, the question is worth exploring.

Managing Financial Stress in the New Year

Financial stress can be especially acute at the start of a new year, when most of us are setting financial goals and trying to get our finances in order. Here are some tips to help keep stress at bay.

This Holiday Season, Pay It Forward to Support Your Well-being

During the holidays, money concerns, a packed social calendar, and strained relationships with family members can contribute to mental and physical health issues. But acts of altruism or kindness to others can actually improve mental and physical health.

The Heart of Healthspan and Longevity [On-Demand Webinar]

Extending healthy, active years appeals to everyone. Plus, there’s no question that investing in heart health plays the lead role in supporting healthspan and longevity.

Three Important Medicare Considerations – If Age 65 or Older and Still Working

In their mid-60s, many people need to make important decisions about Medicare and when to start claiming Social Security. Learn more about how it may affect your situation.

Financial Stress Got You Down? Manage It with These Five Tips

If financial stress is a problem for you or a loved one, knowing that you’re not alone may bring some solace. But perhaps the greatest comfort comes from actively managing the anxiety you’re feeling through these five steps.

Preserving Your Health in Retirement [On-Demand Webinar]

Longevity educator Scott Fulton shares the science behind how we can influence our rate of aging and how to make health investments that can pay us back in years.

What’s Your Post-Pandemic Ideal Future?

As we move closer to normalcy and post-pandemic life, Brent Brodeski, Savant’s CEO, offers seven thought-provoking questions. Taking the time to think about and answer them can help you get deliberate and focused as you travel further down the road toward your ideal future.