Articles, Market Commentary

& More

Past Commentary & Articles

Longing to trade snow boots for flip-flops? You’re not alone. Many people dream of escaping winter’s grip, and two enticing options exist: becoming a snowbird or permanently relocating to a sunnier climate.

As we step into 2025, navigating the unpredictable currents of change will be inevitable. From geopolitical shifts to market surprises, the past year reaffirmed that uncertainty is the only constant. Here are three critical investing traps to avoid in the year ahead.

Whether you’re working or retired, Q1 is the perfect time to revisit your financial goals. Are you on track for retirement, saving for a major purchase, or adjusting to changes in your lifestyle? Reviewing and updating your goals can help you make informed decisions about your spending, savings, and investments.

Losing a loved one is a deeply personal and difficult experience. During this challenging time, financial security may be the furthest thing from your mind. However, Social Security survivor benefits can offer some much-needed stability as you navigate this new normal.

Discover 10 tax-free alternatives to withdrawing from your retirement accounts, including using your HSA, exploring margin loans, and leveraging home equity.

Widowhood brings a profound life shift, impacting emotions, finances, and daily routines. While overwhelming, taking small, organized steps—such as tracking contacts, creating a phone log, and establishing a filing system—can provide clarity and calm during this challenging transition.

In a world of rapid transformation, adapting to change is vital. From evolving technologies like AI to shifting market trends, 2024 highlighted the resilience of people, markets, and innovation. Savant’s Chief Investment Officer Zach Ivey explores the year’s key insights.

In this on-demand webinar, Financial Advisors Jeff Lewis and Chris Ruedi expose the truth behind some of the most popular investment myths.

Reaching a financial milestone is a significant achievement. But what comes next? How do you transition from a focus on accumulation to a strategy for maximizing your wealth and enjoying life to the fullest? Let’s explore the possibilities.

Managing utility bills during the colder months doesn’t have to be daunting. You can reduce energy consumption and save money by adopting simple, mindful habits.

The possibility of a delayed or semi-retirement is more relevant than ever. With many working remotely from home, semi-retirement provides an opportunity to leverage these new possibilities to leave corporate life sooner and develop work/life balance at a younger age.

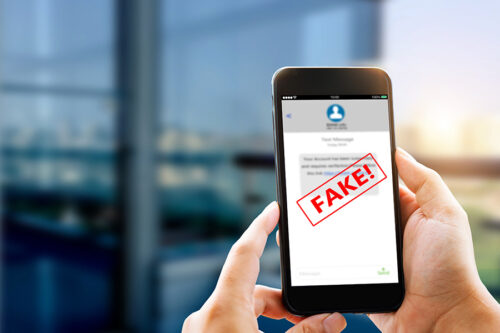

To minimize the risk of smishing, always be cautious with unsolicited text messages. Never click on links or attachments in messages you weren’t expecting, especially if they seem urgent. Instead, go directly to your financial institution’s website by typing the address into your browser.