Beyond Index Funds: Advanced Strategies for High-Net-Worth Investors

In recent years, index funds have become a go-to choice for many investors aiming to build wealth. They’re simple, low-cost, tax-efficient, and grounded in decades of academic research. In fact, we use index funds in many of our portfolios as well. But are they enough for High-Net-Worth investors?

If you’ve built a portfolio using index funds, especially one that’s grown to $2 million or more, you’ve done a lot right. That kind of success reflects discipline, consistency, and a long-term mindset—all traits we deeply admire.

But here’s the truth: what got you here may not be enough to get you where you want to go next.

As your wealth grows, so do the complexities around taxes, risk management, legacy planning, and income generation. And while index funds remain a core component of a sound investment strategy, managing a multi-million-dollar portfolio effectively requires more than just buying the market.

Index funds are a brilliant start, but a $2M+ portfolio demands more than simplicity.

What Simplicity Leaves Behind: Advanced Strategies for High-Net-Worth Investors

The goal isn’t to abandon simplicity—it’s to refine it. Index funds are a brilliant baseline. But once your portfolio reaches a certain size, optimization becomes more important than just allocation. It’s no longer about “beating the market”; it’s about making sure your wealth works smarter for you.

Here are several strategies that go beyond basic indexing and start to matter—sometimes significantly—as wealth grows:

1. Custom Indexing

Custom indexing allows you to replicate an index at the individual stock level. This unlocks opportunities for:

- Tax-loss harvesting at a granular level

- Factor tilts (like emphasizing quality or value stocks)

- Personal values alignment (such as excluding specific industries)

It maintains the low-cost, diversified spirit of index investing—while adding precision and control.

Studies have quantified the benefits of this strategy. For instance, research indicates that direct indexing portfolios may generate an average of 1.08% in additional annual return—often referred to as “tax alpha”—through effective tax management practices.1

While custom indexing offers flexibility and tax benefits, it’s not without trade-offs. Managing individual securities can introduce complexity, higher trading costs, and the potential for tracking error compared to traditional index funds. It’s important to evaluate whether the added customization justifies the operational demands and costs based on your specific goals and portfolio size.

2. Alternative Investments

In today’s environment, where inflation and interest rates remain volatile and the historical negative correlation between stocks and bonds can no longer be taken for granted, alternative investments have become an increasingly attractive portfolio diversifier. Alternatives provide access to return streams that behave differently from stocks and bonds making them a valuable complement to traditional allocations.

While not appropriate for everyone, alternatives can offer:

It’s important to understand that alternative investments carry specific risks. They are often less liquid, may have higher fees, and can involve complex structures that are not suitable for all investors. Additionally, performance can be volatile and may not be correlated with traditional markets, which can be both a benefit and a risk depending on market conditions and portfolio needs. They can also offer:

- Low to uncorrelated sources of return to traditional markets

- Positive expected outcomes and income generation

- Better risk-adjusted performance over time

At Savant, our alternative allocation includes reinsurance, trend following, real assets, private credit, and multi-strategy approaches. These strategies are designed to perform across different market conditions. They can help reduce portfolio volatility and potentially enhance long-term results.

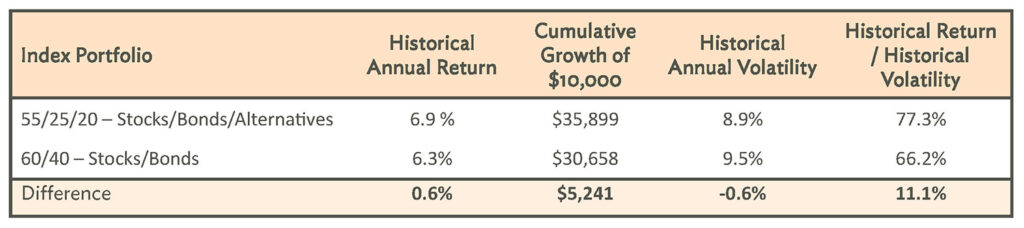

In the illustration below, adding alternatives showed it can potentially improve annual returns of a traditional 60/40 stocks/bonds portfolio by 0.6% while also lowering volatility by 0.6%.

Alternatives are not one-size-fits-all and require careful evaluation. But for the right investor, we believe they can be a powerful tool in building a more balanced, adaptive, and forward-looking portfolio.

Download the Savant White Paper on Alternative Investments.

3. Advanced Tax Strategy

As portfolio value rises, so does tax complexity—and opportunity. High-net-worth investors can benefit from:

- Asset Location Planning: This strategy involves strategically placing assets in different types of accounts based on the tax characteristics of those accounts and how income is recognized. Vanguard research indicates that proper Asset Location can potentially boost returns up to .3% per year.

- Tax-Smart Withdrawal Sequencing: Coordinating withdrawals from taxable, tax-deferred, and tax-free accounts can help minimize lifetime taxes.

- Gifting Appreciated Assets: Donating long-term appreciated securities directly to charity avoids capital gains tax and provides a charitable deduction, creating a double tax benefit.

- Roth Conversions and Income Smoothing: Converting assets from a traditional IRA to a Roth IRA in low-income years can reduce future RMDs and overall tax liability. A study by Kitces.com estimates that well-timed Roth conversions can save hundreds of thousands of dollars in taxes over retirement for affluent households.

These strategies, and others, have the potential to significantly reduce your lifetime tax liability.

Download Savant’s “Approaching Zero Taxes” White Paper.

Smart tax strategies can help save millions over a lifetime for high-net-worth investors.

4. Ongoing Behavioral Coaching and Rebalancing

At higher levels of wealth, the consequences of emotional investing are greater. Staying disciplined—especially during market turbulence—becomes both harder and more important. Having a clear process for rebalancing, de-risking, and staying the course isn’t optional. It’s essential.

Vanguard’s Advisor Alpha study suggests that behavioral coaching and structured oversight can add up to 3% in net returns annually.

Optimal rebalancing also becomes an art at higher account balances. A separate Vanguard study showed that “optimal” rebalancing strategy which included the right frequency and thresholds for rebalancing, led to an additional .28% annual return.

A Portfolio Is Not a Plan

You’ve done the hard part. Building significant wealth—especially with the discipline and humility it takes to embrace index funds—is no small feat. But managing wealth is a different challenge than accumulating it. It requires a coordinated plan between investments, tax, estate planning, and goals.

Success for high-net-worth investors hinges on coordinating investments, taxes, estate planning, and goals into a unified strategy.

It’s tempting to believe that a well-diversified portfolio is the plan. That if you’ve set up automatic contributions and rebalanced occasionally, you’ve checked all the boxes. But as your net worth grows, the cost of inattention—or over-simplicity—grows with it. Small changes can have huge impacts.

At Savant, we believe in evidence-based investing, disciplined planning, and aligning money with meaning. We don’t replace the simplicity of index funds—we help elevate it into a plan that’s tax-smart, purpose-driven, and built to adapt over time.

If you would like to learn more about the strategies discussed reach out for a free consultation.

Disclosures

This is intended for informational purposes only. Custom indexing and alternative investments are complex strategies that are not appropriate for every investor. These strategies involve risks and are dependent on the investor’s individual investment objectives and risk tolerance. Please consult your financial advisor regarding your unique situation.

1 An Empirical Evaluation of Tax-Loss-Harvesting Alpha, Chaudhuri et al Financial Analysts Journal (2020

Index Portfolio Weights

60/40 Traditional: 30% U.S. Stocks, 30% International Stocks, 20% U.S. Bonds, 20% International Bonds.

55/25/20 Including Alternatives: 27.5% U.S. Stocks, 27.5% International Stocks, 12.5% U.S. Bonds, 12.5% International Bonds, 4% to Reinsurance, Multi-Strategy, Trend Following, Real Assets, Direct Lending each.

Please Note: Limitations of Index Portfolio discussion. Savant has provided the Index presentation solely to demonstrate the benefit of diversification. Different types of investments and/or investment strategies or allocations involve varying degrees of risk and volatility, and at any specific point in time, or over any specific time-period, any investment or investment strategy can and will suffer losses, at times substantial losses. Therefore, it should not be assumed that the future performance of any specific investment or investment strategy, including the investments and/or investment strategies or allocations recommended and/or undertaken by Savant, will be profitable, equal any historical performance level(s), or prove successful. Please Also Note: The referenced graphs do not reflect the rebalancing, composition or performance of any current Savant investment strategy.