Market Wise: Election Update

U.S. stocks rallied as news of Donald Trump’s election as the 47th president unfolds. Small and value stocks led the way Wednesday morning, buoyed by expectations of lower taxes and reduced regulations over the next four years. Meanwhile, bond yields are climbing in anticipation of larger budget deficits and higher inflation, as rising yields lead to a dip in bond prices.

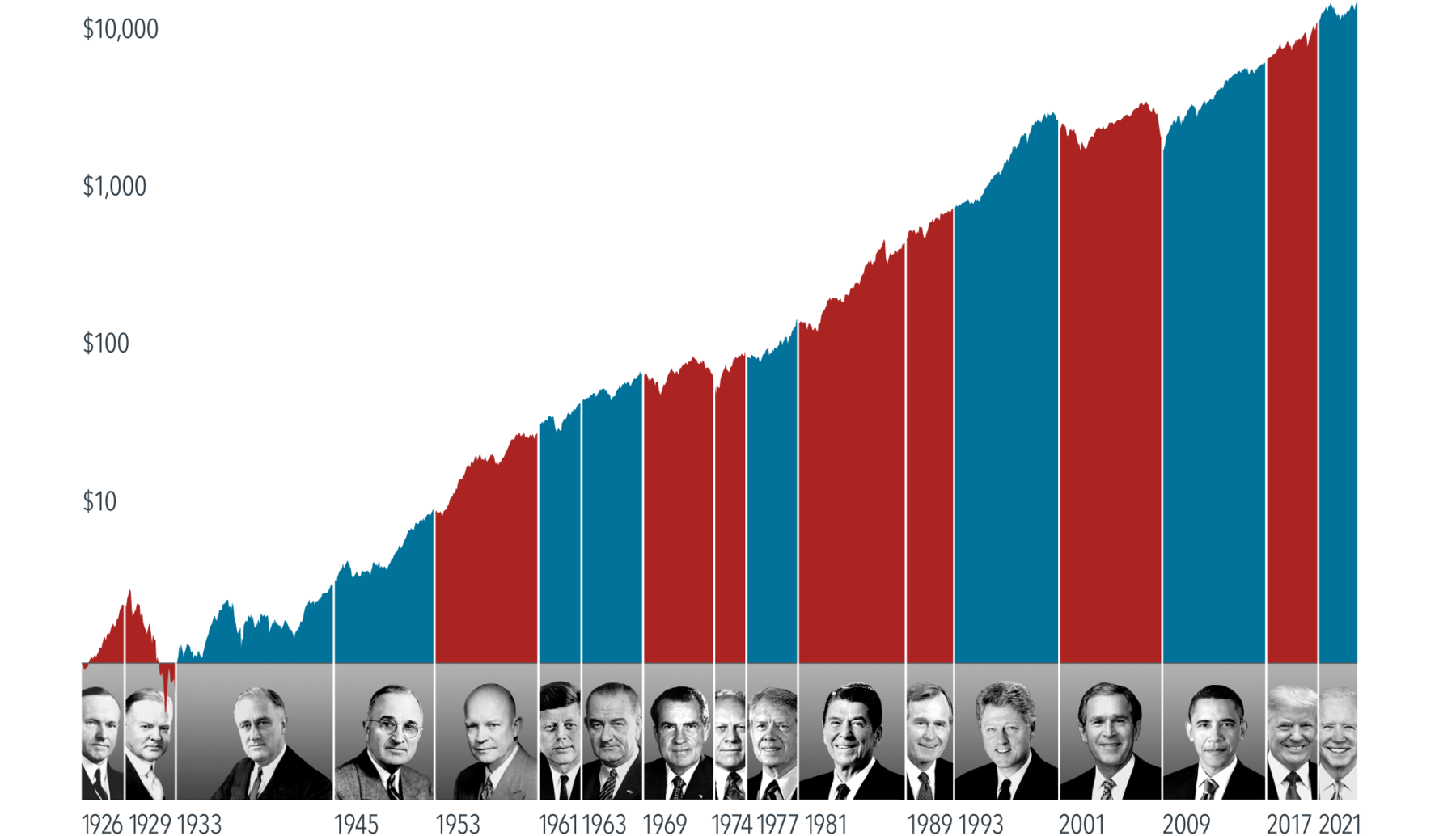

While half the nation celebrates, the other half may feel disheartened by the election results. Today’s outcome, while significant, is a moment in a broader democratic process—and it’s important not to let immediate emotions dictate financial decisions. History shows that across nearly a century of diverse presidential terms, markets have historically trended upward, driven by companies focused on growth, innovation, and customer value rather than political shifts.

Hypothetical Growth of $1 Invested in the S&P 500 Index

1926-2023

Source: Dimensional Fund Advisors LP. Chart in USD. Growth of wealth shows the growth of a hypothetical investment of $1 in the securities in the S&P 500 index. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Data presented in the growth of wealth chart is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The chart is for illustrative purposes only and is not indicative of any investment. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

At Savant, we adhere to an evidence-based investment philosophy that prioritizes disciplined, objective decision-making over emotion or speculation. We believe this approach enables us to help construct portfolios that are built to weather different market environments and reduce unnecessary risk. Our research shows that markets are highly efficient, and we believe that information about the election outcome is already priced in. While we cannot predict the future, history reminds us that investors who stay patient and focused on the long term have consistently seen rewards through cycles and changing leadership.

If you have questions about the election’s impact on your financial plan or portfolio, please reach out to your Savant advisor. We are here to discuss how recent changes may affect you and guide you in navigating the path forward.