Why International Diversification is Essential for Building Timeless Portfolios

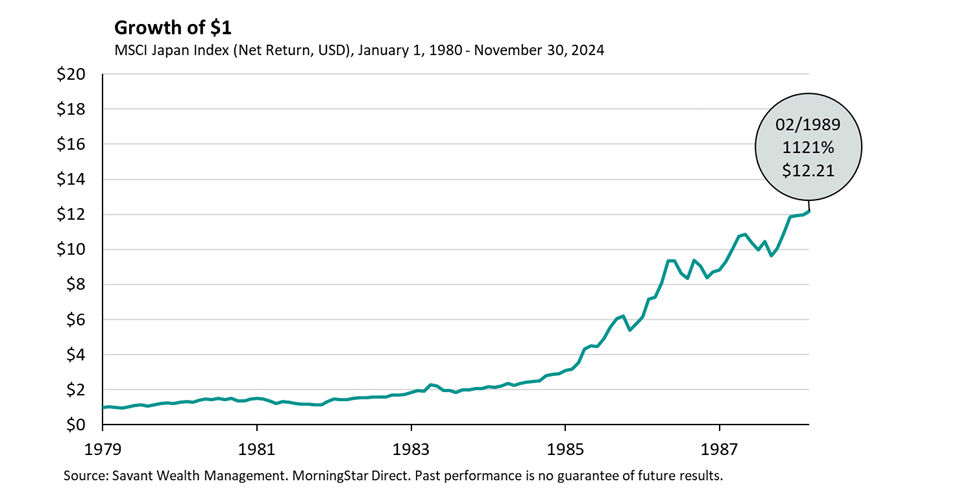

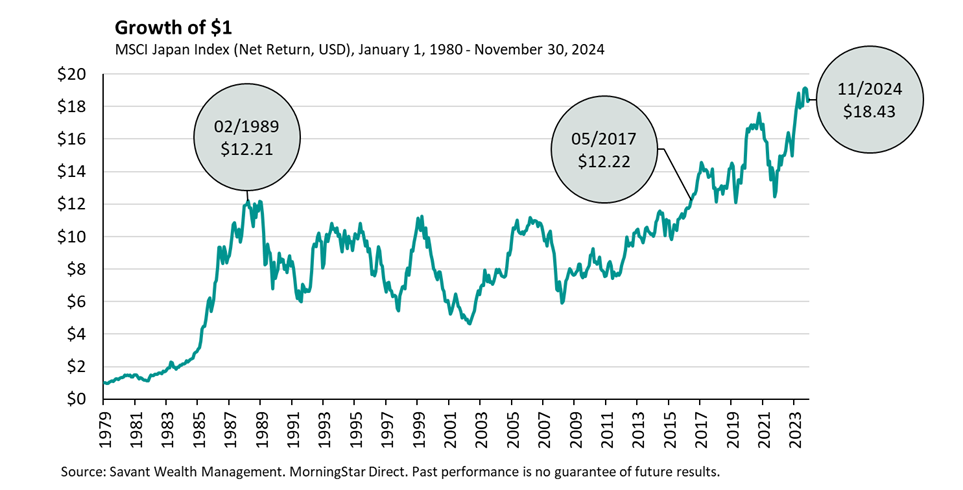

Why International Diversification is Essential for Building Timeless Portfolios – Imagine it’s the late 1980s. Japanese stocks are soaring due to a combination of economic policies, financial liberalization, and seemingly limitless optimism. Investors globally are piling into Japanese stocks, certain they’ve found the market of the future. From January 1980 to February 1989, Japanese stocks rose an astonishing 1,121%, and the world’s four largest companies were Japanese banks. Many believed that Japan’s dominance was inevitable.

And then, it wasn’t.

The bubble burst, and Japanese stocks entered a decades-long decline. Investors who concentrated their portfolios in Japan experienced years—if not decades—of disappointment. This story is one of the most vivid reminders of why diversification matters and why assuming that today’s winners will always lead is a dangerous game.

The Allure of the Present Leader

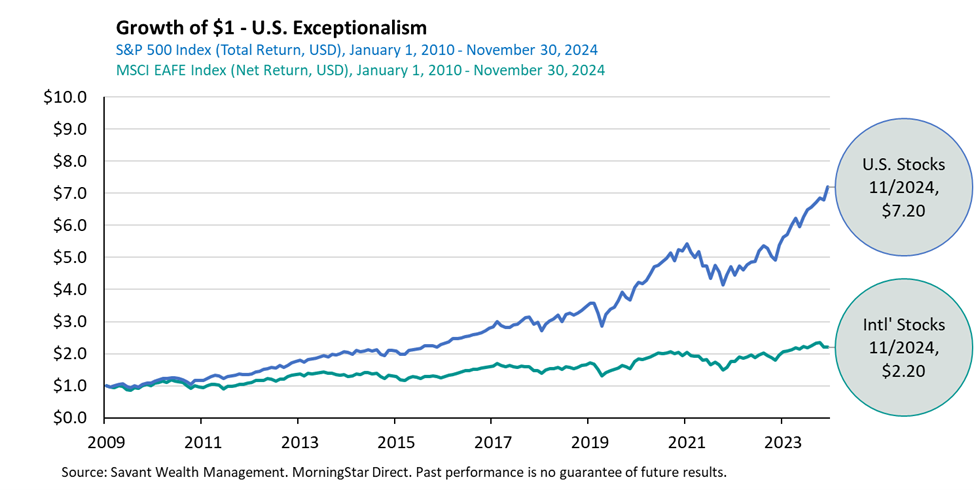

Fast forward to today. U.S. stocks have been the darling of global markets for the past 15 years, consistently outperforming international equities. Investors see this streak and understandably ask, Why bother with international stocks? The reasoning seems simple—why not focus on what’s working?

This mindset, however, falls into two common traps: recency bias and relativism. Recency bias convinces us that the past decade is a reliable predictor of the next. Relativism makes us compare current results to past outcomes, tempting us to chase returns instead of sticking to a sound strategy.

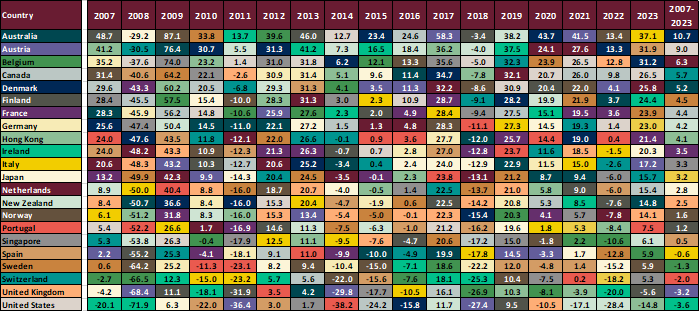

But history has shown time and again that no single market leads forever. Even during this period of U.S. market dominance, since 2007, the U.S. has only been the top-performing developed equity market in one calendar year—2016. Leadership among countries rotates, often unpredictably, and concentrating portfolios in one region can create unnecessary risks.

A Broader View of International Investing

It’s essential to recognize that international equities are not just one market—they represent a collection of countries, economies, and industries. In 2023, for example, Italy was the best-performing country, delivering a 37.1% return compared to 15.4% for the U.S. Should we have shifted all portfolios to Italy after 2023? Of course not.

Similarly, the best-performing stock of 2024 as of Nov. 30 is MicroStrategy. Does that mean we should allocate everything to MicroStrategy? The answer is clear: concentrating investments based on recent performance is risky and shortsighted.

The same logic applies to avoiding international stocks altogether. Future returns are unknowable, and a diversified portfolio is designed to help you capture growth wherever it occurs while helping reduce the risks of over-concentration. Additionally, when growth occurs, rebalancing gains across the portfolio helps to institute a “buy low, sell high” process and can keep risk levels in balance.

Lessons from the Past

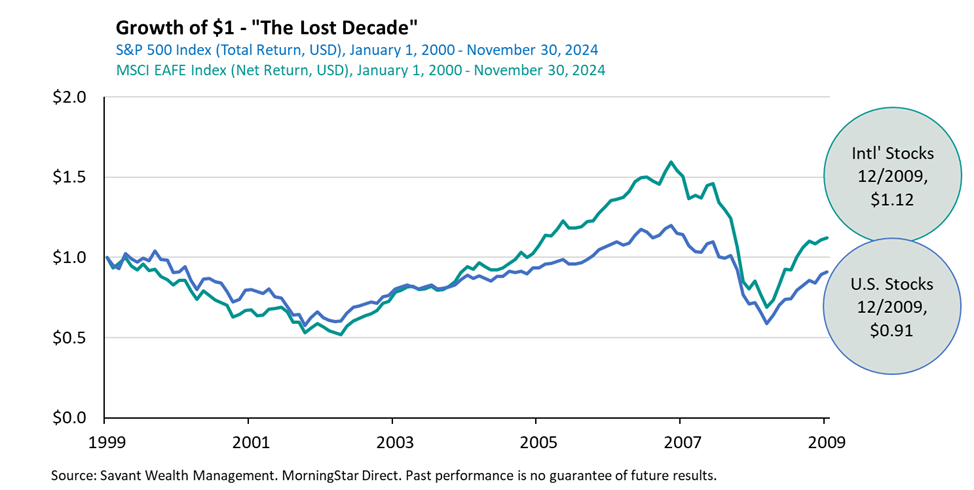

Japan’s story isn’t the only example. The 1970s and 1980s were decades where international stocks outperformed U.S. equities, and from 2000 to 2009 (also known as the “U.S. Lost Decade”), developed international markets delivered far better returns than the U.S. Leadership cycles are a natural part of market behavior. If we focus solely on recent performance, we risk missing opportunities when markets rotate. Past performance is no guarantee of future results.

The unpredictability of returns is not a flaw of investing; it’s the reason diversification exists. By holding a mix of U.S. and international equities, we reduce reliance on any single market and build resilience against the unexpected.

The Best Defense Against the Unknown

As much as we’d like to predict the future, markets remain inherently unpredictable. Chasing the latest outperformer—whether it’s a country, sector, or stock—often leads to disappointment when trends inevitably shift. Diversification isn’t just a strategy; we believe it’s a safeguard against the uncertainties of tomorrow.

Criticism of holding onto international equities after a period of underperformance often reflects resulting—judging a decision solely by its outcome rather than the quality of the decision-making process. At Savant, we focus on the ex ante process: making decisions based on evidence, discipline, and a commitment to long-term success.

At Savant, our mission is to help you pursue your ideal future. We do this by constructing portfolios grounded in evidence and built to endure, not by reacting to headlines or the allure of short-term gains. Sticking with international stocks, even during periods of underperformance, is a key component of this approach. It helps you prepare for shifts in market leadership and be positioned to capture growth wherever it occurs.

Let’s Talk About Your Portfolio

If you’re concerned that your portfolio isn’t properly diversified or you suspect it’s overweight in U.S. stocks after nearly 15 years of outperformance, we believe now is the time to reevaluate. Contact us to review your allocations for the long term.

This is intended for informational purposes only and should not be construed as personalized investment advice. Please consult your investment professional regarding your unique situation.

Diversification is a strategy to help manage investment risk. It does not guarantee a profit or protect against losses in a declining market. All investments are subject to risk, including the loss of principal. Past performance is no guarantee of future results.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.