Navigating the Fiscal Dilemma: What Investors Need to Know

The word dilemma comes from the Greek roots di (“twice”) and lemma (“premise”), describing a problem presenting two equally undesirable choices. A dilemma has been likened to facing a charging bull with two choices: Option A, the left horn; Option B, the right horn. Neither is appealing. For over a decade, the federal government has faced its own charging bull: growing national debt fueled by deficit spending, leaving two unpleasant options—raising taxes or cutting spending. Neither choice is painless, yet avoiding the bull entirely no longer seems feasible.

Understanding the Federal Fiscal Landscape

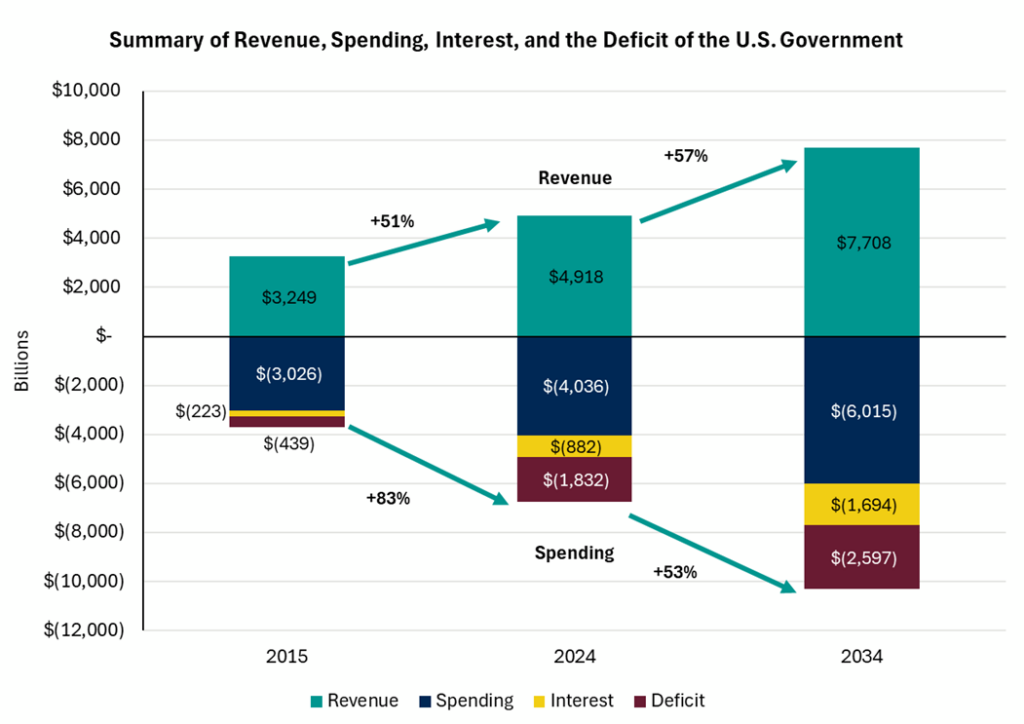

To better understand this dilemma, let’s break down federal finances into four parts:

- Revenue: Money collected from taxpayers, businesses, and sources like estate taxes. In fiscal year 2024, revenue totaled $4.9 trillion, a 51% increase since 2015.

- Spending: Funds allocated to defense, education, Social Security, Medicare, interest on debt, and more. In 2024, spending hit $6.8 trillion, 83% higher since 2015, including $882 billion on interest alone.

- Deficit: Occurs when spending exceeds revenue. The deficit was $1.8 trillion in 2024 (27% of spending), forcing the government to borrow.

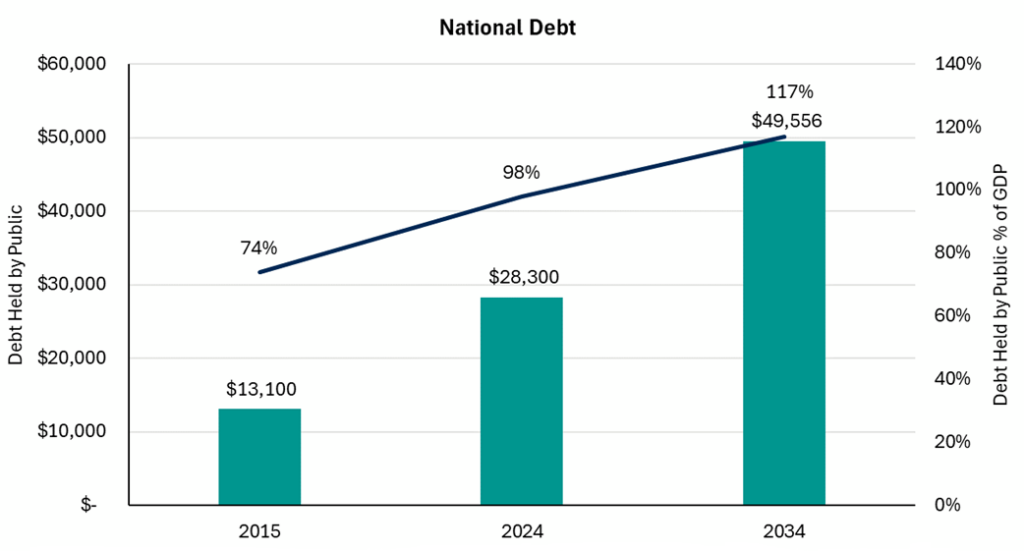

- Debt: The cumulative result of borrowing, now $28.3 trillion, or 98% of GDP. This is debt held by the public (individuals, institutions, and foreign entities) and excludes intragovernmental debt.

Source: Department of Treasury, Bureau of the Fiscal Service, Congressional Budget Office, The Budget and Economic Outlook: 2025 to 2035 – January 2025.

Imagine a household spending $1.37 for every $1.00 collected, with the difference charged to a credit card. That’s the U.S. today. At the end of 2024, our national “credit card balance” hit $28.3 trillion, nearly equal to the entire economy. With rapidly growing interest payments, meaningful reform is increasingly urgent. By 2034, interest payments alone are projected to reach $1.7 trillion annually—more than today’s entire U.S. military budget. Another ten years from now, that debt could approach $50 trillion.

Source: Department of Treasury, Bureau of the Fiscal Service, Congressional Budget Office, The Budget and Economic Outlook: 2025 to 2035 – January 2025.

The Dilemma’s Horns: Raise Taxes or Cut Spending?

Two clear solutions exist, but both are politically charged and economically difficult:

- Horn A: Raise taxes to boost revenue.

- Horn B: Cut spending on defense, education, healthcare, Social Security, or Medicare.

Neither option is politically attractive. Tax hikes trigger resistance from taxpayers and businesses, while spending cuts threaten programs relied on by millions. Over the past decade, most leaders have opted for a third approach: avoid the bull entirely. They’ve distracted it, downplayed its significance, or pretended it doesn’t exist. But this strategy is failing—the bull is bigger, faster, and harder to ignore.

A New Approach: Trump, Musk, and DOGE

Enter President Trump’s return to the White House, bringing with him the Department of Government Efficiency (DOGE)—an initiative spearheaded by Elon Musk and Vivek Ramaswamy. Their mission: Cut $2 trillion in spending and streamline government operations. If successful, this bold move would represent the first serious attempt in decades to wrestle the fiscal bull.

Investor Concerns: Solvency, Bonds, and the Dollar

Could the bull threaten government solvency or the U.S. dollar’s reserve currency status? Not yet. Let’s separate fear from fact:

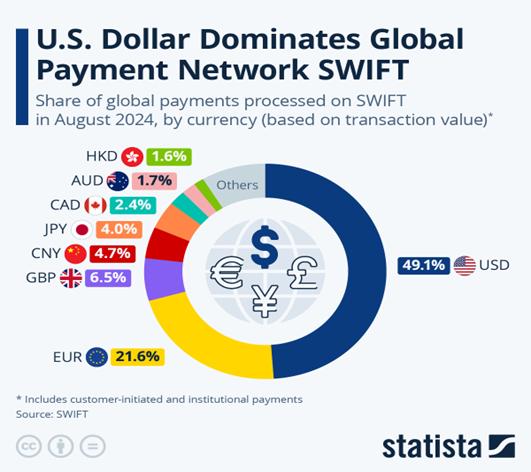

- The U.S. Dollar Still Reigns Supreme: Despite concerns about long-term fiscal management, the U.S. dollar remains dominant globally. According to SWIFT, the dollar’s share of global payments reached 49%, the highest in 12 years, having risen by 9 percentage points over the past two years alone. Simply put, the dollar remains the most dominant global currency, and it’s not even close.

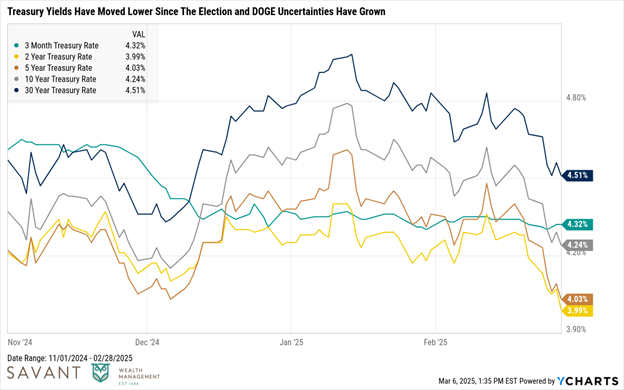

- Treasury Bonds Remain a Bedrock for Safety: Despite worries, U.S. Treasury bonds remain among the world’s safest investments. Debt-ceiling debates and budget uncertainties may cause short-term volatility, but history shows these conflicts are always resolved. The scale of the U.S. economy, the Federal Reserve’s flexibility, and dollar dominance ensure stability.

- Markets Have Priced in Deficits: Investors have long recognized U.S. borrowing levels. If deficits were an existential threat, Treasury yields would spike dramatically, and the dollar would weaken substantially. Instead, yields remain relatively stable, demonstrating that markets prioritize economic fundamentals—growth and inflation—over short-term political headlines.

The Smart Investor’s Playbook

At Savant Wealth Management, we follow an evidence-based investment philosophy grounded in academic research and empirical evidence. We don’t pretend to know the bull’s next move; instead, we focus on what we know:

- Markets Work: Investors collectively determine fair asset prices based on all available information. Overreacting to short-term political and economic news typically leads to poor investment decisions. At the end of the day, we invest in companies, not countries; we believe owning strong, innovative businesses positioned for long-term growth matters more than transient political concerns or government deficits.

- Control the Controllables: Costs, tax efficiency, and behavioral discipline are within your control.

- Diversification is Your Friend: Because predicting the future is impossible, a globally diversified portfolio helps position investors for the widest range of outcomes and may provide a greater chance for long-term success.

How Should Investors Respond?

The U.S. remains among the world’s most resilient economies, and its global influence maintains its unique position issuing the world’s reserve currency. This, combined with strong institutions and economic power, keeps default risks exceptionally low. Despite challenges, markets adapt, policymakers act, and the U.S. maintains its strength in the global financial system.

The debt dilemma isn’t new, but it’s growing louder. Raising taxes, cutting spending, or reforming government programs all have trade-offs. However, history demonstrates markets don’t require perfect conditions to deliver returns.

For investors, the key is avoiding panic and not getting caught on the horns of fear. While headlines amplify concerns about fiscal solvency, emotional decision-making is counterproductive. Instead, we advocate staying focused on long-term goals, maintaining a diversified portfolio, and practicing patience. By following these principles, we believe investors can remain spectators in the arena, avoiding both horns, no matter how the bull charges next.

The Level-Headed Investor’s Guidebook

5 best practices during uncertain times. When volatility strikes, keep calm and carry on toward your investment goals!