Oil & Water: Why Geopolitics and Investing Don’t Mix

Markets dislike uncertainty, but not as much as many investors assume. Each year brings a steady stream of global flashpoints: conflict in the Middle East, rising tension between major powers, elections that shift alliances, and debates over tariffs and sanctions. These events feel dramatic and hard to ignore. Yet for long-term investors, quick reactions to geopolitical news often work against their goals.

In many historical instances, markets have absorbed geopolitical shocks more calmly than contemporaneous headlines might suggest, although outcomes have varied across time periods and market conditions. In 2025, several geopolitical developments, including tariff announcements and military escalations, were associated with periods of market volatility. In some markets, the longer-term impact on calendar-year returns appeared more muted, though results differed by asset class and region. These observations are consistent with a widely held investment principle that disciplined, globally diversified portfolios may play a meaningful role in long-term investment strategies, rather than trying to predict geopolitical developments.

Geopolitics Feels Investable, but Usually Isn’t

Humans naturally look for cause and effect. When global tensions rise, it seems logical to expect markets to move in a clear and lasting direction. Sometimes they do, but not in ways investors can consistently anticipate.

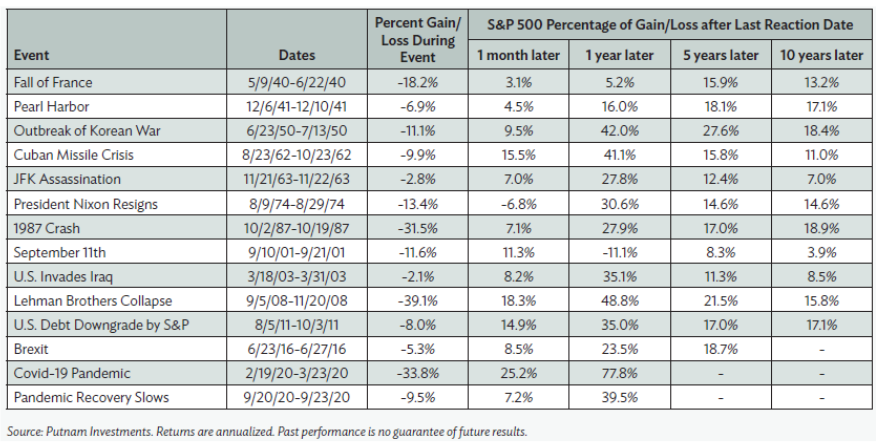

Even when geopolitical risks materialize, investors may overestimate their long-term impact on broad markets. In certain historical examples, markets have posted positive returns in the months following major geopolitical events. However, market responses have not been uniform and depend on a wide range of economic, policy, and market factors.

These observations highlight an important consideration. Markets are forward-looking, and geopolitical risk is always present. Investors understand the world is unpredictable, and market prices may reflect, to varying degrees, investor expectations about uncertainty and risk.

MARKETS ARE RESILIENT

S&P 500 Performance During and After Historic Crises

The real challenge is that no reliable playbook exists. Markets respond differently to similar events depending on valuations, monetary policy, liquidity, and investor sentiment. The geopolitical event itself is only one factor, and often not the most important one.

A Better Approach: Process Over Panic

Geopolitical events can affect specific sectors or regions, but diversified portfolios spread that risk across global markets. This diversification can be beneficial in periods when regions previously viewed as higher risk perform differently than expected. For example, certain emerging market asset classes experienced strong performance in 2025 despite ongoing geopolitical concerns. Results varied significantly across countries, sectors, and investment vehicles.

Trying to avoid geopolitical risk is difficult for several reasons. In some instances, attempts at market timing after negative news have resulted in investors missing subsequent market recoveries, though recoveries are not guaranteed. Increased trading activity can introduce additional costs and tax considerations, which may negatively affect net returns.

Fortunately, investors can help reduce the effect of geopolitical shocks. At Savant, our approach emphasizes factors that investors may be able to control, including:

- Maintaining a globally diversified portfolio to help avoid heavy exposure to any single economy or region.

- Rebalancing systematically instead of reacting to the news cycle.

- Paying attention to valuations rather than headlines.

- Staying mindful of costs and taxes.

- Focusing on your financial plan and time horizon.

Geopolitics and investing may share space in the news, but they follow different rules. Geopolitics moves through unpredictable human events. Markets move through steady economic activity, innovation, and compounding. Trying to mix the two is like mixing oil and water: they simply do not stay together.

This is intended for informational purposes only. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant. Please consult your investment professional regarding your unique situation.