When 3M RSUs Vest: What Happens and What Comes Next

You’ve waited patiently for the past three years, and the finish line is now in sight. The Restricted Stock Units (RSUs) you earned for your 2022 service and received in 2023 vest on February 7, 2026. This moment represents the delivery of compensation earned for your 2022 service.

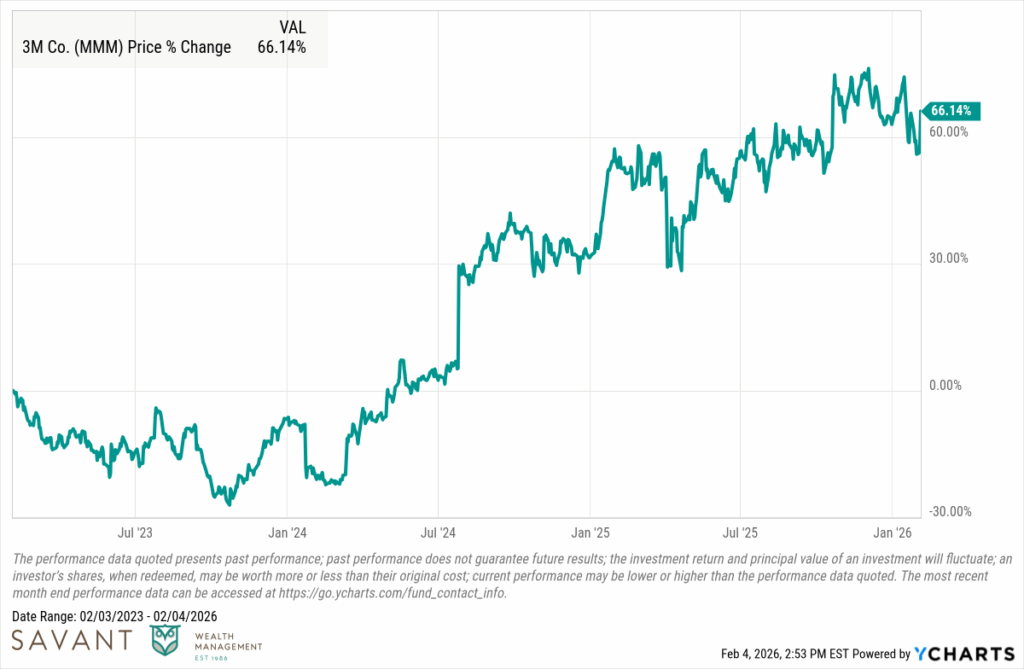

To add to the good news, 3M’s stock price has increased since February 2023, when the company granted the shares to you.

But what does vesting actually mean, and what should you do next?

Your annual incentive plan (AIP) payment feels simple. You receive cash, then decide whether to spend or save it. RSUs require a bit more thought. Once vested, they become unrestricted shares of 3M stock and may benefit from the same thoughtful evaluation as any other significant financial asset.

This isn’t a comprehensive analysis of RSUs. Instead, this guide focuses on two essential questions: what happens when your RSUs vest and how to decide what to do with them. Clear answers to both can help you navigate your RSU vesting with confidence and make the right decision for your needs.

What Happens When Your 3M RSUs Vest?

A useful way to think about RSUs is as a deferred bonus. The company could pay this compensation in cash, but it instead delivers it in shares of stock. This framing helps clarify what follows.

While your RSUs remain restricted (or unvested), 3M records them as a liability on its balance sheet. The company owes you the shares, and their final value depends on the stock price on vesting day. As long as you remain employed or meet retirement eligibility during the restriction period, the shares become your assets once they vest.

A few days after the stated vesting date, to allow for processing, Fidelity will remove the shares from the “3M Restricted Stock Unit” category in your account. The shares then appear as unrestricted shares of 3M stock in your Fidelity brokerage account, the same account you use for your GESPP purchases if you participate. From that point forward, you control the shares.

The mechanics may feel straightforward, but several important items occur behind the scenes. Taxes top that list.

Because RSUs count as earned income, they trigger federal, state, Social Security, and Medicare taxes at vesting. Your taxable income equals the fair market value of the shares on the vesting date.

Fidelity handles withholding automatically. The plan withholds a portion of your shares to cover the taxes and releases the remaining shares to you. For example, if 119 shares vest and only 76 appear in your account, Fidelity used the other 43 shares to satisfy tax obligations.

One important detail often surprises high earners. Federal withholding on RSU income stays fixed at 22%, regardless of your marginal tax bracket. State withholding also uses a flat rate. In Minnesota, that rate is 6.25%.

For many executives and long-tenured employees, these withholding rates fall short of actual tax liability. Without proactive planning, RSUs often lead to an unexpected tax bill the following spring. A full-year tax projection can identify any shortfall early and allow you to address it through additional payroll withholding or estimated payments.

On the positive side, you will receive the dividends that accumulated during the three-year vesting period as cash. In the 119-share example, that dividend payment would total approximately $1,000 at vesting.

What Should You Do with Your 3M RSUs When They Vest?

Here is a simple framing question.

If you received this award in cash instead of 3M shares, would you use that cash to purchase additional shares of 3M?

For most investors, that honest answer is no. If you wouldn’t buy the stock today with new money, holding the shares after vesting deserves careful reconsideration.

In many cases, selling the shares can be a consideration. You can then redeploy the proceeds toward goals that matter most to you or toward a more diversified investment strategy. This approach also may help manage concentration risk, especially if you already hold significant 3M exposure through past awards or retirement plans.

Here are several common ways employees use RSU proceeds to support broader financial objectives.

Investment-related uses:

- Reinvest in a diversified brokerage portfolio

- Fund a Roth IRA through a standard or backdoor contribution

- Contribute to a 529 college savings plan for children or grandchildren

Non-investment uses:

- Family travel or milestone vacations

- Planned home improvements

- Rebuilding or strengthening cash reserves

- Tuition or education-related expenses

You may already have a different priority in mind. What matters most is that these proceeds may help support your personal or financial goals, rather than accumulating by default. Holding the shares remains an option, but excessive exposure to a single company can complicate even well-funded financial plans.

As the 3M RSU vesting date approaches, Savant Wealth Management aims to provide clarity and perspective. Contact a Savant advisor to help you evaluate how these shares fit within a broader, long-term financial strategy.

Note to our clients: We will contact you individually in the coming days to review your RSUs and discuss personalized planning recommendations.

This is intended for informational purposes only. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant. Please consult your investment professional regarding your unique situation.