Articles, Market Commentary

& More

Past Commentary & Articles

In this week’s chart pack: new cases continued to rise, but risk assets sustained their rebound as well as continuing unemployment claims drifted slightly lower.

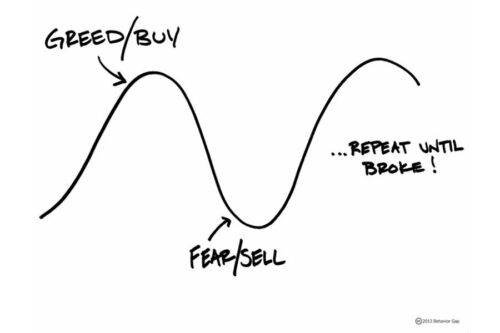

Just as many people were starting to think markets only move in one direction, the pendulum has swung the other way. Financial advisor Edward Cruickshank offers seven simple truths to help you live with volatility.

Stocks paused their rally last week amid a surge in COVID-19 cases, but diversifying alternatives such as trend following and reinsurance contributed positively. Learn more in our updated chart pack.

Provisions in the SECURE Act may affect your estate plan. Dominick Parillo takes a closer look at the specifics regarding inherited IRA accounts.

You may be surprised that many women don’t have adequate disability coverage. Janet Petran talks about why disability coverage is especially important for women.

Our updated chart pack takes a look at the ever-changing COVID case growth in the U.S., the reaction of capital markets, and how changing valuations (among stocks and bonds) may impact future returns.

Our Investment Research Team’s latest update to the Coronavirus Crisis Chart Pack: Risk assets sold off last week as news spread that the U.S. may be experiencing the dreaded second wave of COVID-19 cases. Our updated guide looks into the increase in cases along with how markets reacted. Download our 6-15-2020 Coronavirus Crisis Chart Pack

The Coronavirus is affecting many areas of our lives – even when it comes to preparing for, transitioning into, or living in retirement. What’s the new retirement reality post COVID? We answered your questions in an interactive Q&A webinar.

The New Retirement Reality Post COVID Live Webinar & Interactive Q&A Discussion will be held on Wednesday, June 24, 2020 at 1:00 PM CDT. Can not attend? Sign up anyway, and a link to the recorded presentation will be sent to all who register. The Coronavirus is affecting many areas of our lives – even when it comes to […]

Market timing blares its horn each spring as the common adage rings, “Sell in May and Go Away!” This calls for selling your portfolio in May only to reinvest the coming October, therefore reaping potential higher risk adjusted returns. Though certain factoids support the sentiment, is it truly in your best interest? Economists continue to […]

May saw positive returns in the market across the majority of asset classes. U.S. small (+6.5%) led the charge domestically while international small came in strong (+7.0%) as well. Global stocks dipped slightly but still came in positive at +4.6%. Bonds hovered close to zero, with intermediate‐term bonds holding the strongest return (+0.8%). With respect […]

Our Investment Research Team’s latest update to the Coronavirus Crisis Chart Pack: Returns to the U.S. Value and Size factors ripped higher as investors bet on a successful reopening and, currently, U.S. Large Cap stocks have posted positive year to date returns! Download our 6-9-2020 Coronavirus Crisis Chart Pack