Markets in Perspective: Investing at All-Time Highs

Key Points:

- Time provides perspective for long-term investors. History tells us new highs are normal, and stocks tend to move higher over the long term.

- Market returns during years when markets are making new highs tend to be strong.

- Long-term investors have an advantage, and historically, markets are more likely to be higher following investments at market highs than lower.

- New market highs are not exclusive to high-flying AI stocks. Many areas of the market are simultaneously achieving new highs in 2024.

- While many parts of the stock market are making new highs, there are areas off their high that present opportunities for long-term investors.

As the S&P 500 climbs to new record highs (through May 21, the S&P 500 has made 22 new all-time highs in 2024), investors often ask: “Should they wait for a pullback?” This question arises at all market points. In down markets, concern exists that selloffs will intensify. “Is the market going to go lower?” Interestingly, this “Is now a good time?” query comes up more in bear markets than bulls, a reflection of behavioral biases and investor psychology.

Considering the possibility of putting more money in at perceived tops stems from attempts to time the market. Trying to sidestep highs and wait for lower prices equates to trying to buy at the bottom — something extremely difficult, if not impossible.

Zooming Out

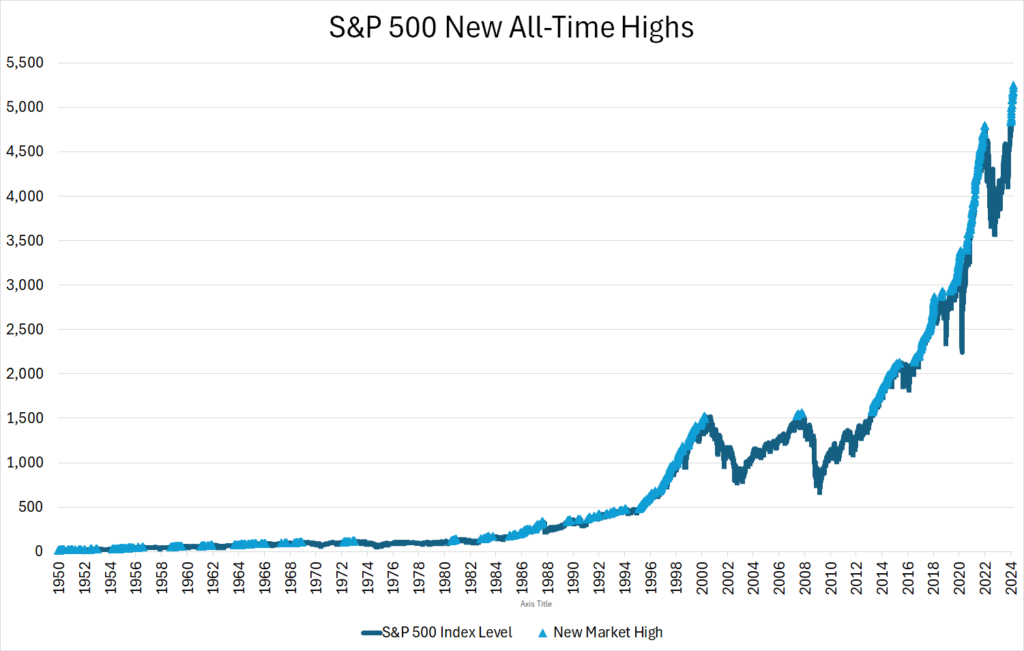

Markets set new highs frequently. Since 1950, the S&P 500 has charted 1,449 new records on its path higher. A historical chart of the S&P 500 shows new highs tend to occur consecutively and persist over long periods.

Long-term investors who make the decision to remain in cash and wait for a large correction before investing may wait a long time and regret missing out on returns.

Source: YCharts, Savant Wealth Management. S&P 500 Index daily values.

What’s Past is Prologue

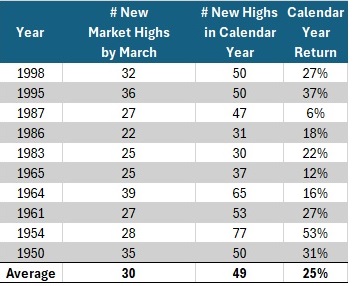

What does history tell us about years when the S&P 500 made more than 22 new highs by the end of May? This has occurred 10 times since 1950, and during those years the market continued reaching new highs on average 49 times and averaged 25% gains for the year.

Source: YCharts, NYU Stern – Historical Returns On Stocks, Bonds, and Bills: 1928 – 2023, Savant Wealth Management.

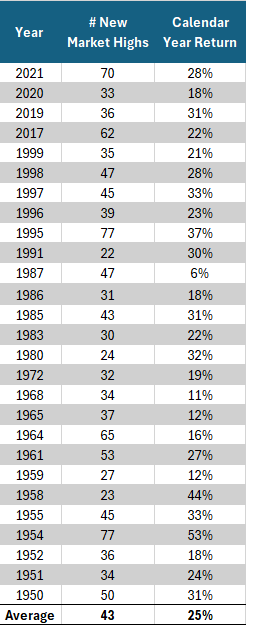

As shown in the table below, from 1950-2023, the S&P 500 saw 27 years with over 22 new highs, averaging 25% gains those years.

Some top yearly returns came in years with the most new highs such as 1995 with 77 new highs (37% gain) and 1954 with 77 new highs (53% return). More recently, in 2019 there were 36 new highs resulting in 31% return and 2021 with 70 new highs and a returned 28%. Of course, new highs don’t guarantee future gains, as 1987 with 47 new highs only returned 6%.

Source: YCharts, NYU Stern – Historical Returns on Stocks, Bonds, and Bills: 1928 – 2023, Savant Wealth Management

Putting the Odds in Your Favor

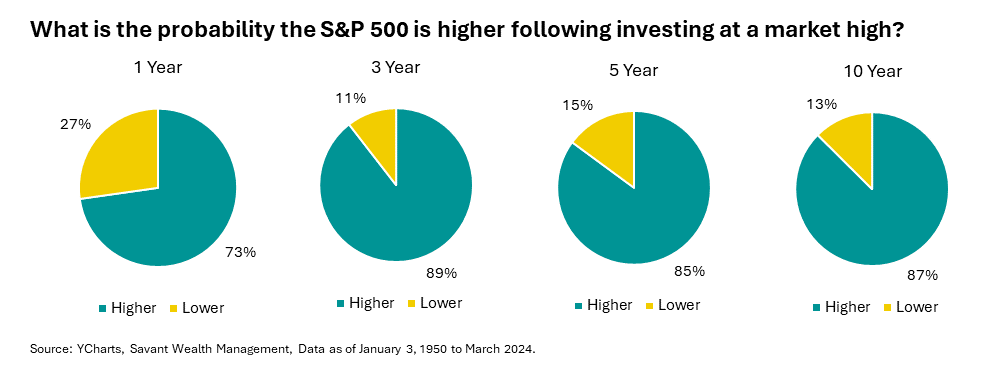

For those concerned about the likelihood of a pullback after a market high, it may be helpful to know how rare it is for markets to be lower after investing at new highs. The chart below shows how often the S&P 500 Index was higher or lower following a market high over various periods.

More Than Just Tech Stocks

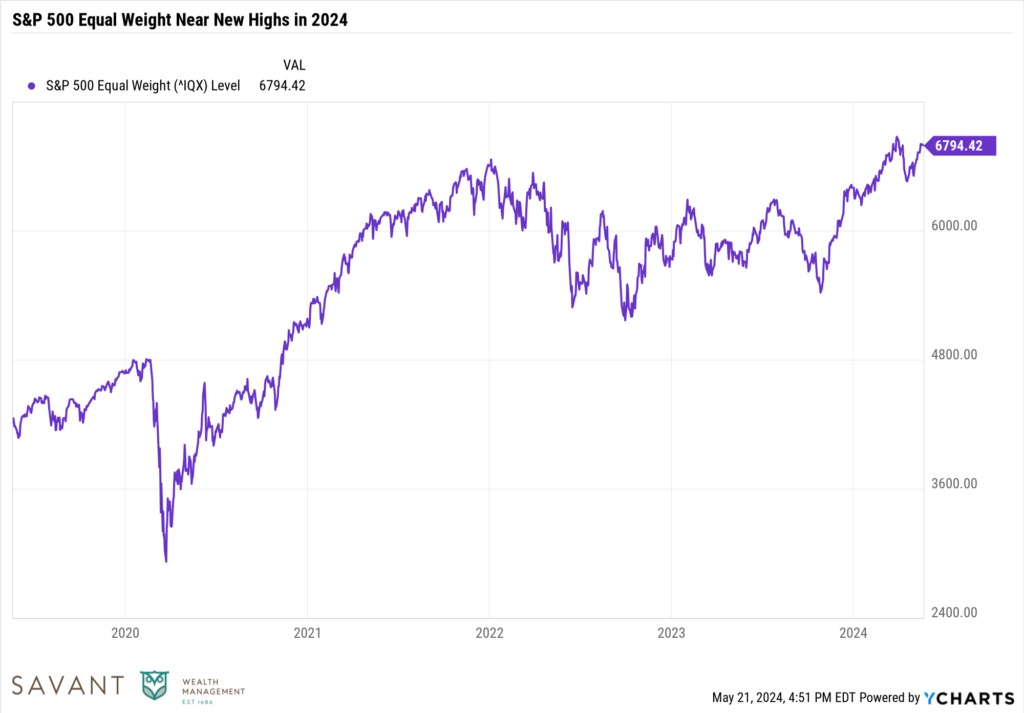

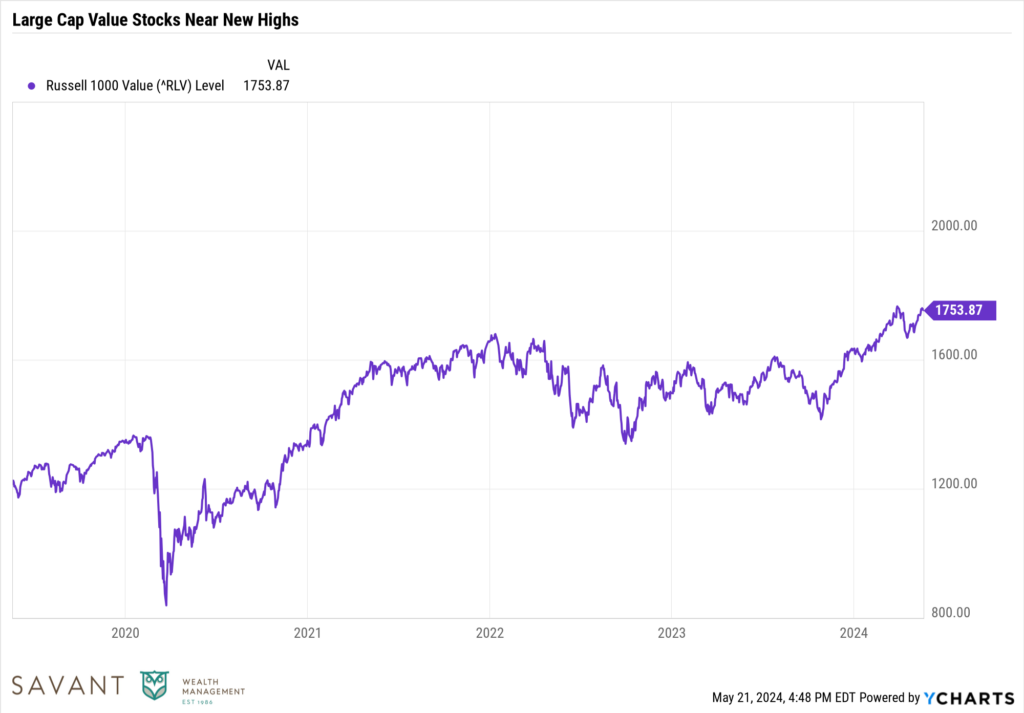

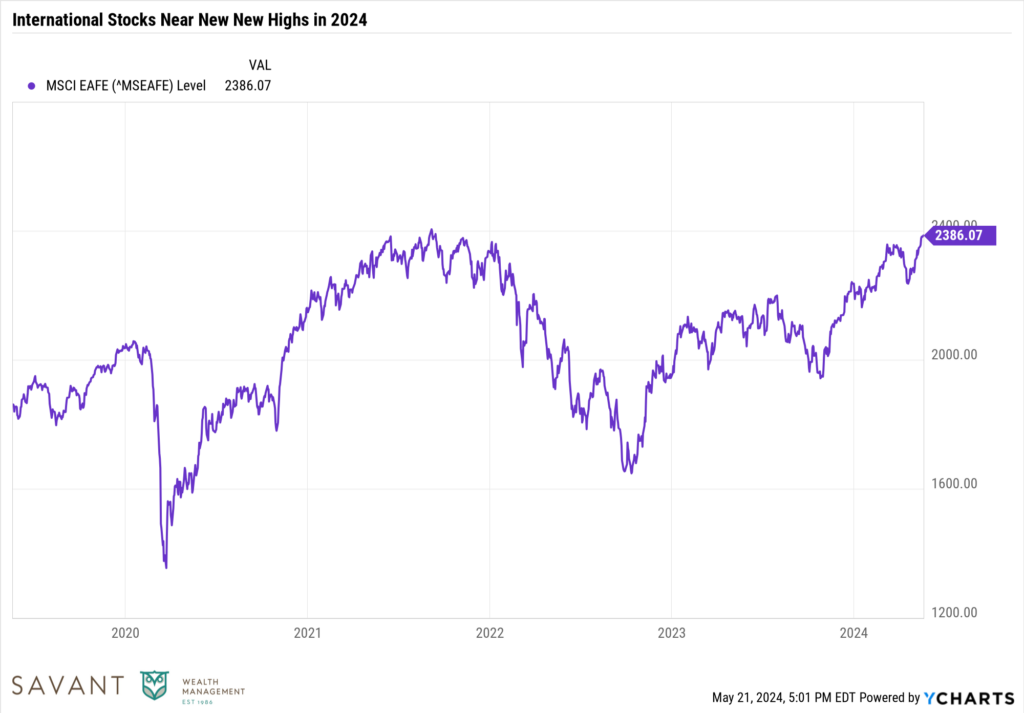

While large caps led in setting new highs, the perception that only AI tech stocks are making new highs in 2024 is a misconception. Despite what many believe, the rally in stocks this year has been broad-based, with the equal-weighted S&P 500, the Russell 1000 Value, and MSCI EAFE Index also near new highs.

Source: Y Charts. Data through May 21, 2019 – May 21, 2024.

Source: Y Charts. Data through May 21, 2019 – May 21, 2024.

Source: Y Charts. Data through May 21, 2019 – May 21, 2024.

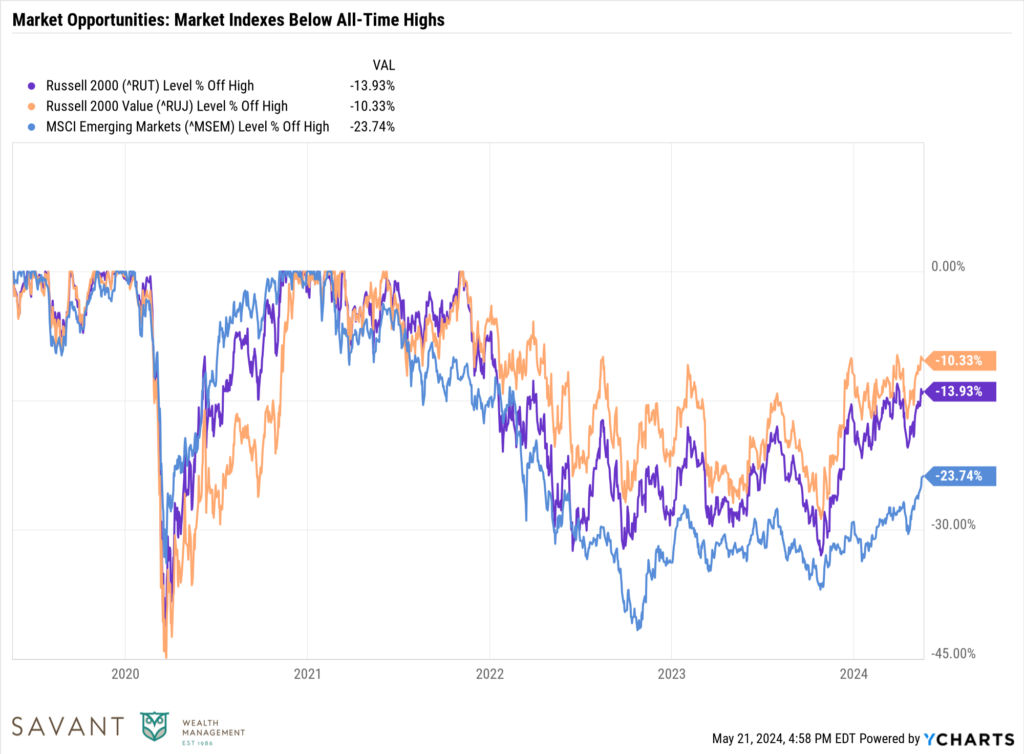

Market Opportunities

If investing at market highs still causes concern, small-caps, small-cap value, and emerging market equities remain off highs today, potentially offering attractive entry points.

Source: Y Charts. Date through May 20, 2019 – May 21, 2024

Final Thoughts

Rather than be deterred, investors should embrace new highs as signs of a healthy, upwardly mobile market. No one has a crystal ball, and trying to nail tops and bottoms rarely works. It could also dramatically change your retirement plan if you miss only a few good days. At Savant, we believe a better approach is to follow a disciplined strategy that removes psychological barriers, takes a long-term focus, and demonstrates diversification. If you are unsure about your investment strategy, consider consulting with one of our financial advisors, who can help provide guidance tailored to your financial situation and goals.

This is intended for informational purposes only and should not be construed as personalized investment advice.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.