The Long-Term Power of Starting Early in a 401(k)

When it comes to saving for retirement, one of the most valuable advantages available to 401(k) participants is the power of compounding. Compounding is growth of the additional balance that was generated by growth of the principal investment. Its long-term effect can be remarkably powerful.

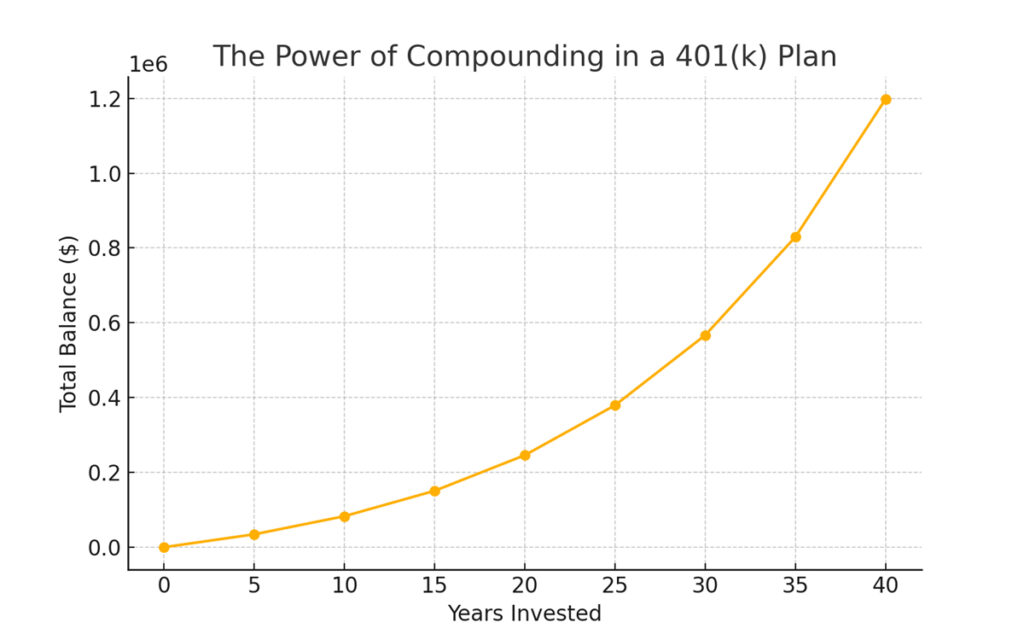

Let’s consider a hypothetical example. Suppose a 25-year-old begins contributing $6,000 annually to a 401(k) plan and continues to do so until age 65, earning an average annual return of 7%. Each year, their balance grows by 7%, and that additional amount, above and beyond their $6,000 contribution, will continue to grow at a 7% rate. As shown in the chart below, their savings can potentially grow substantially over 40 years, thanks to the compounding effect.

Total Balance in millions of dollars. This is intended for illustrative purposes only and is not representative of the performance of any specific investment or strategy. Actual investment results will vary.

Even modest contributions can grow into a significant nest egg when you start early. Delaying your savings can mean missing out on the growth potential of those early years. Compounding rewards both consistency and time. The longer your money stays invested, the greater its potential to grow.

Why Starting Early Matters

The key to maximizing compounding in a 401(k) plan is getting started as early as possible. By beginning to save in your twenties instead of waiting until your thirties or forties, you give your investments valuable extra years to grow. Thanks to the cumulative effect of compounding, even smaller annual contributions made early can outpace larger contributions made later in life.

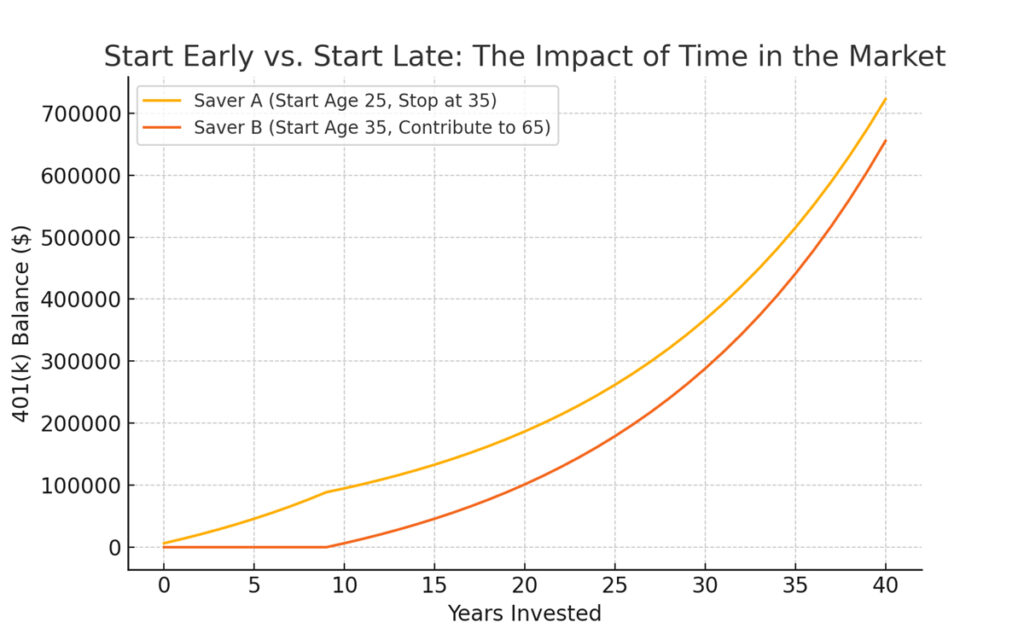

For example, consider two savers: one begins saving $6,000 per year at age 25 and stops at age 35. The other starts saving $6,000 annually at age 35 and continues until age 65. Remarkably, the first person may still end up with a larger 401(k) balance at retirement, simply because their investments had more time to grow and accumulate. In retirement planning, time is just as important as money in building long-term wealth.

The chart above illustrates this comparison: Saver A contributes for only 10 years, while Saver B saves for 30. Yet Saver A finishes with a larger retirement account balance, all thanks to an early start and the compounding effect over a longer period.

Stay the Course

Saving for retirement through a 401(k) plan is a long-term commitment. Markets will fluctuate, but staying invested and contributing consistently can lead to meaningful growth over time. It’s important for participants to stay focused on their long-term financial goals and avoid reacting emotionally to short-term market swings. As the old saying goes, time in the market beats timing the market.

Source:

Savings Fitness: A Guide to Your Money and Your Financial Future