Navigating Prosperity: Four Key Market Areas for Investors to Watch

Against a backdrop of the Fed having raised interest rates 11 times since March 2022 to a range of 5.25%-5.5%, and economic predictions that foresaw a downturn, the U.S. economy has defied expectations, sidestepping a recession in 2023 and showcasing resilience. Real GDP grew at an annual rate of 3.3% in the fourth quarter of 2023 and labor markets remain robust with unemployment at 3.7%. There’s now widespread anticipation of potential rate cuts later this year and markets are intensely focused on inflation’s progress downward. While inflation is trending downward, reaching the Fed’s 2% target could be uneven, and unexpected increases may disappoint those anticipating Federal Reserve rate cuts. Although inflation is a critical component of the Fed’s dual mandate, focusing on maximum employment and price stability, it’s not the only area of interest. There are four other key economic sectors on the Fed’s radar which offer insights into the overall health of the economy and could influence the timing of the Federal Reserve’s adjustments to its monetary policy.

Four Key Areas of the Market to Watch

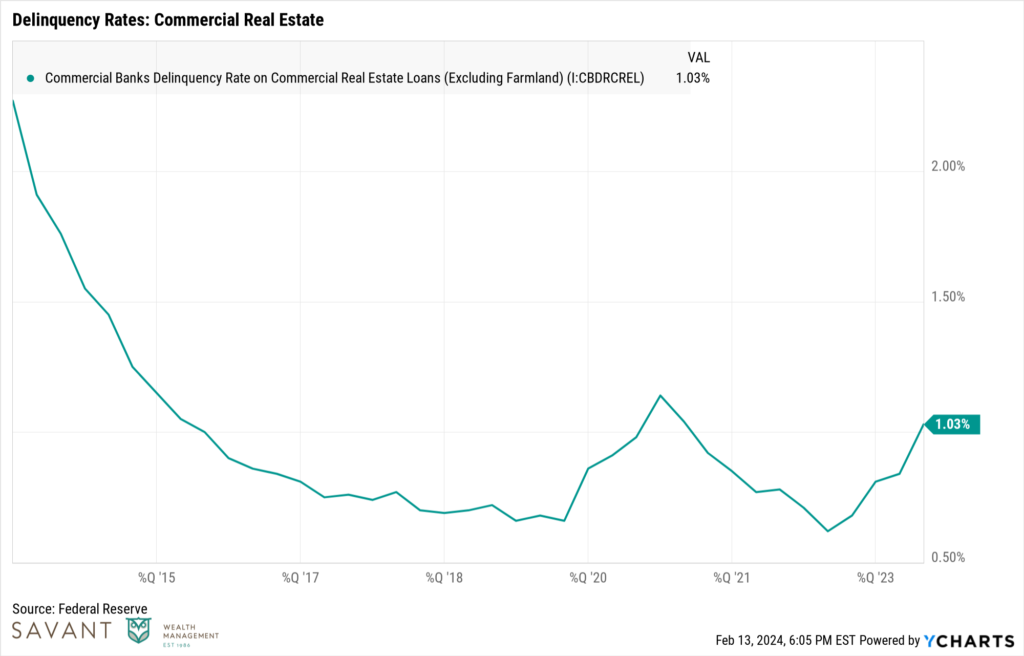

1 – Commercial Real Estate

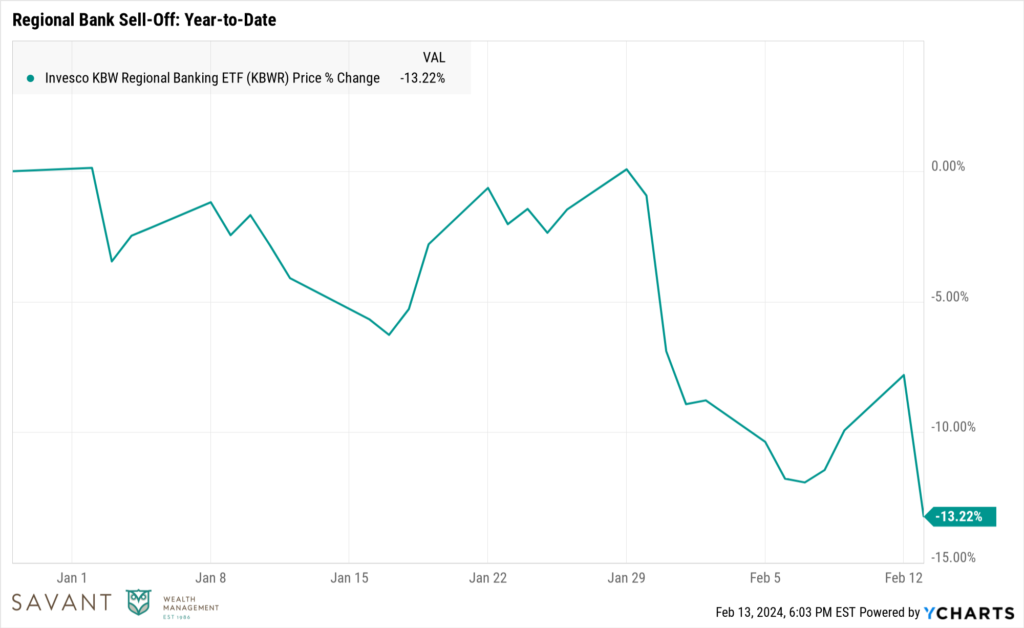

The commercial real estate sector, especially office buildings, is witnessing a troubling trend in rising delinquency rates. As of Q3 2023, commercial real estate delinquencies stood at 1.03%, marking a 67% increase from the previous year. This uptick in delinquencies is particularly concerning for lending institutions, notably regional banks, which have been the primary financiers of these properties. As a result, regional bank stocks have seen an 12% decline year to date, fueled by growing apprehensions about their exposure to the commercial real estate market becoming increasingly problematic.

Treasury Secretary Janet Yellen has acknowledged that losses in the commercial real estate sector are worrisome, but reassured that U.S. regulators are proactively working to ensure that the financial system’s loan-loss reserves and liquidity levels are sufficient to withstand potential setbacks. This situation underscores the interconnectedness of real estate market health, banking sector stability, and overall economic resilience, highlighting a critical area for investors to monitor given its potential implications for the broader economy.

Source: YCharts

Source: YCharts

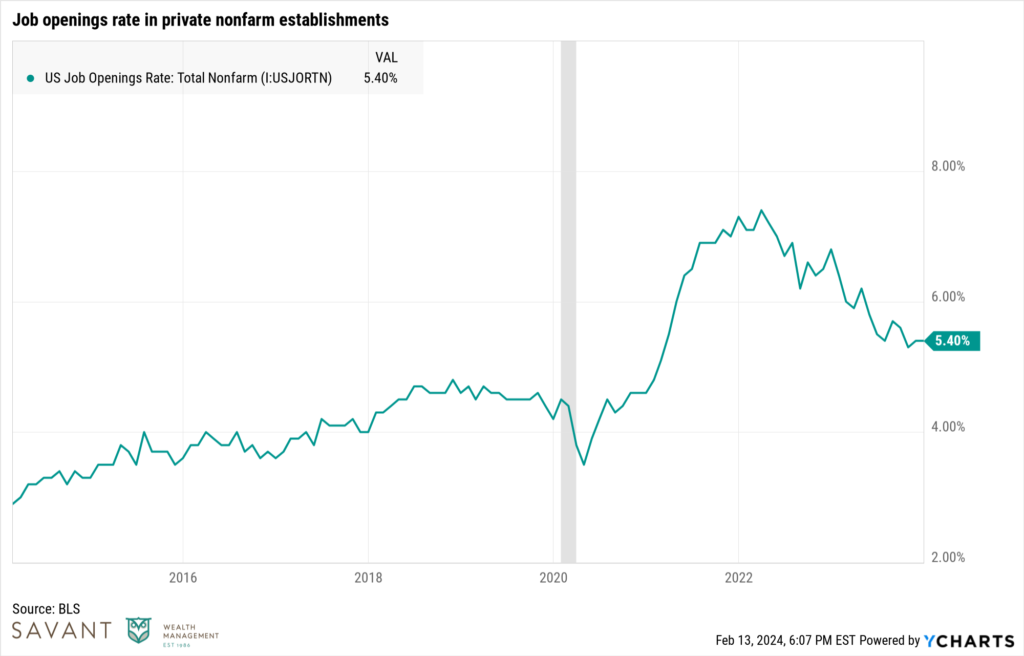

2 – Labor Demand

Despite the Federal Reserve’s aggressive interest rate hikes, the labor market demonstrates resilience, a vital sign of the U.S. economy’s strength. According to the Bureau of Labor Statistics (BLS) Job Openings and Labor Turnover Summary (JOLTS), on the last business day of December, there were 8 million job openings in private industry, showing stability from the 7.9 million figure in November. Over the month, the rate remained steady at 5.4%. Notably, this number of job openings is still significantly above the pre-pandemic rate of 4.7%, indicating robust labor demand. This sustained demand for labor is a positive sign but also an area to monitor closely, as any shift could signal changes in economic health.

Source: YCharts, BLS

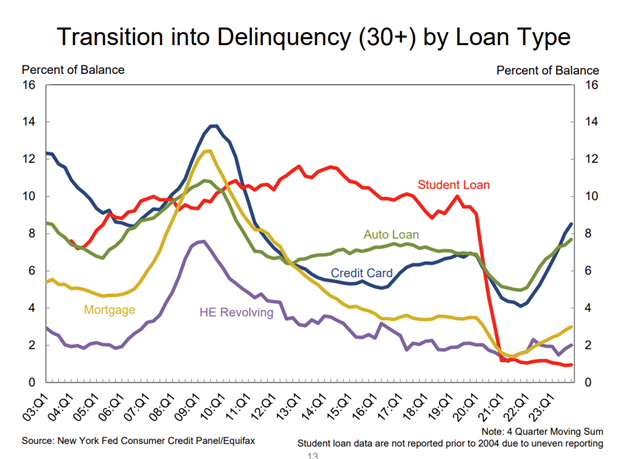

3 – Consumer Credit Delinquency

An emerging concern within the economy is the rise in credit card and auto loan delinquencies above pre-pandemic levels, pointing to increased financial stress, particularly among younger and lower-income households. Recent data reveals that delinquency rates have climbed for all types of debt, with the exception of student loans. On an annualized basis, around 8.5% of credit card balances and 7.7% of auto loans have transitioned into delinquency. Furthermore, serious credit card delinquencies have escalated across all age groups, with younger borrowers notably exceeding pre-pandemic levels.

This uptrend in delinquencies signals potential vulnerabilities within the economy, reflecting financial pressures that could dampen consumer spending and, in turn, economic growth. For investors and policymakers, these indicators warrant attention, as they could influence consumer confidence and spending behaviors, impacting overall market conditions.

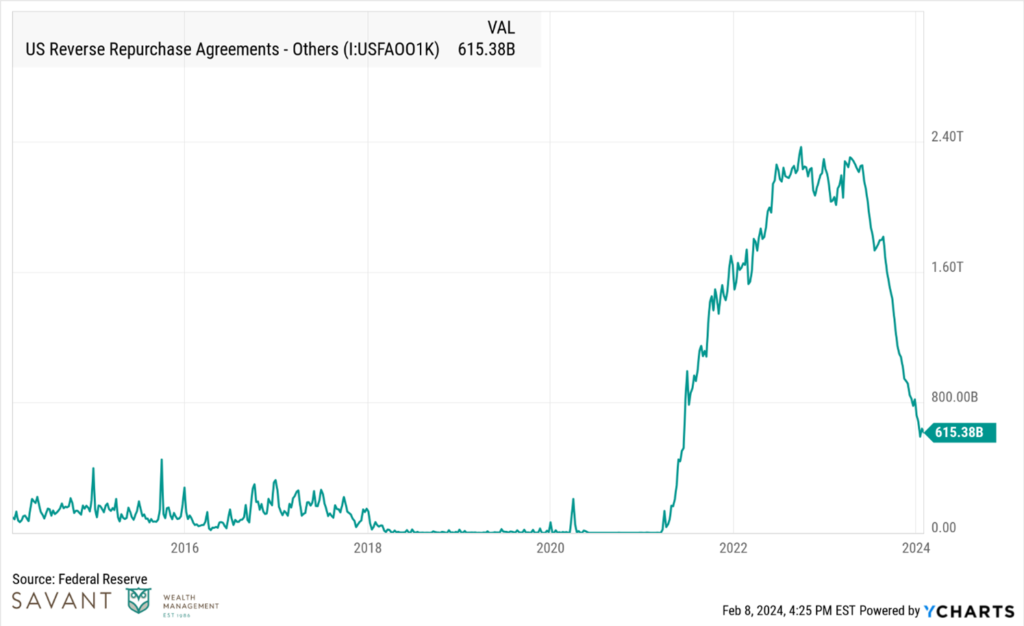

4 – Reverse Repo Operations

Reverse repo operations play a pivotal role in the Federal Reserve’s strategy to manage liquidity and maintain the federal funds rate within its target range. In these transactions, banks and other financial institutions “lend” their excess cash to the Federal Reserve in exchange for securities, such as government bonds, with an agreement to repurchase these securities at a higher price. The price differential functions similarly to interest, assisting the Fed in achieving its monetary policy objectives.

Following the pandemic, an influx of liquidity injected into the financial system left banks with substantial cash reserves. The rise in interest rates has made the reverse repo market an attractive option for banks to earn yields on this excess cash. However, a recent decline in the use of the reverse repo market signals a shift. It suggests that financial institutions are finding a need to use more of their cash reserves for purposes other than lending to the Federal Reserve, indicating tighter liquidity conditions.

This shift has broader implications for the financial system and the economy. Tighter liquidity conditions can affect lending practices, investment decisions, and overall economic growth. As such, the reverse repo market serves as a critical barometer for the financial health of institutions and the liquidity in the system, making it a crucial area for investors and policymakers to monitor.

Source: Federal Reserve

Conclusion: The Known Unknowns and Beyond

While the Federal Reserve is keeping a watchful eye on these four key areas to help better understand the current economic landscape and assess necessary policy actions, investors should note that market volatility is often driven not by “known unknowns,” but by unpredictable “unknown unknowns.” Markets are highly efficient, with known risks such as these already factored into current prices. The costs associated with attempting to time the market due to known and unknown uncertainties often exceed any potential gains. Therefore, Savant adheres to a disciplined, evidence-based investment strategy, maintaining capital in a broadly diversified global portfolio that is designed to help minimize unnecessary risk and strives for consistent investment outcomes.

You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant. Past performance is no guarantee of future results.