Tariffs, Deficits, and Tech Stocks Slide – Oh My! Why Uncertainty Doesn’t Have to Derail Your Plan

U.S. markets have faced turbulence recently, with tariffs returning to the headlines, DOGE and federal deficits sparking renewed attention, and the tech-heavy U.S. stock market sliding sharply lower. While unsettling, these developments are part of the natural rhythm of investing. The good news? There’s a path forward that avoids panic and helps you stay focused on your long-term goals.

The Hidden Opportunity Most Investors Are Missing

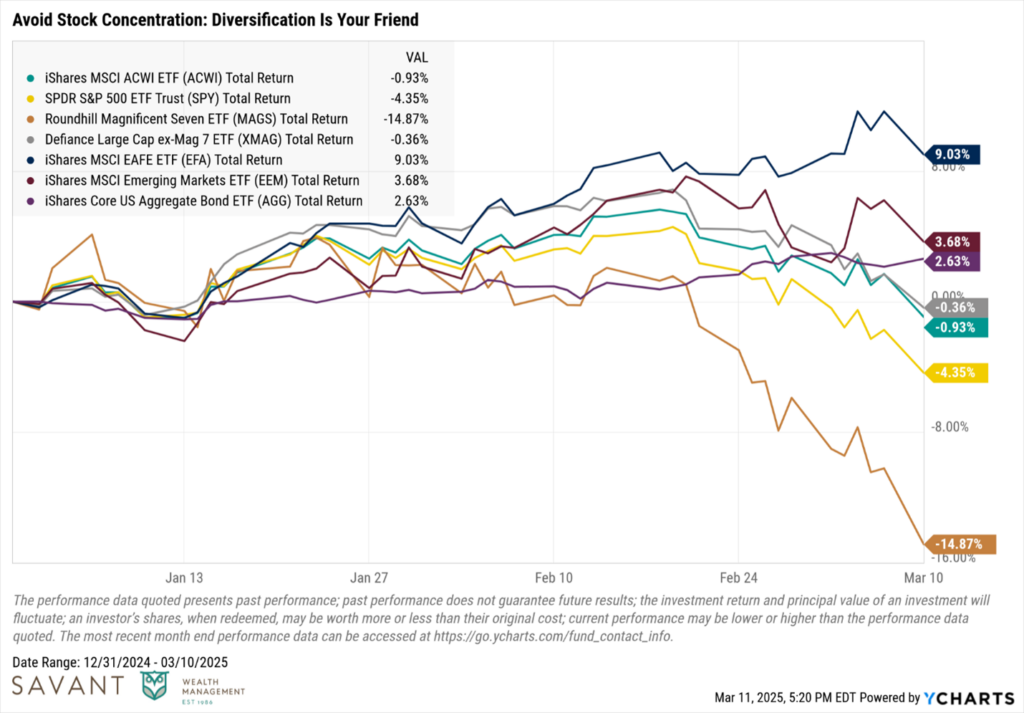

Much of the market’s recent turmoil stems from struggles in U.S. tech stocks. As of this writing (market close Mar. 11, 2025), the “Magnificent 7” (Apple, Microsoft, Nvidia, Amazon, Google, Meta, and Tesla) are down roughly 15% year-to-date and have fallen about 20% from their December peak. Meanwhile, the broader S&P 500 minus the “Magnificent 7” is down less than 1%.

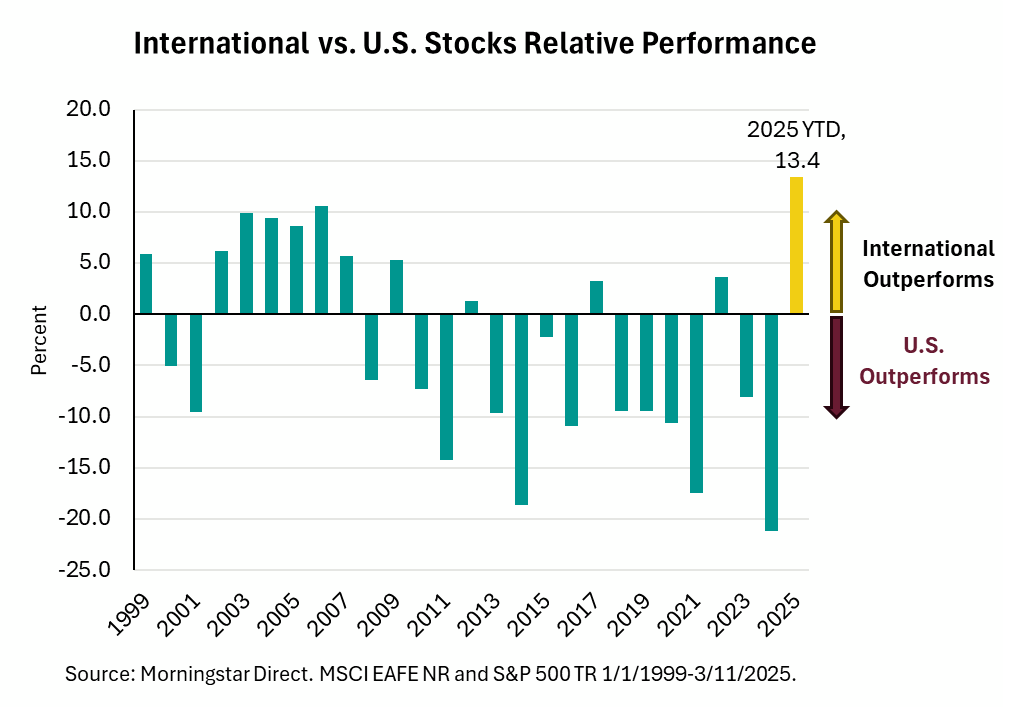

Yet, while U.S. tech stumbles, international markets are quietly outperforming. In fact, international developed markets are up +9.0% year-to-date, outperforming U.S. stocks by a significant margin. This is the largest gap in two decades, underscoring the value of diversification.

If your portfolio is still heavily tilted toward U.S. stocks, now is a good time to revisit your allocation. Diversifying globally not only reduces concentrated risk but can also position you to help capture growth wherever it occurs.

Turning Information into Wisdom

In today’s information age, data is abundant, but wisdom requires context. As Savant’s Chief Investment Officer Zach Ivey puts it:

This wisdom is especially important in volatile markets. The constant flow of headlines may tempt investors to make impulsive decisions, but we believe discipline and patience are what help lead to better outcomes over time.

Why Diversification is Critical Right Now

Investing in only U.S. stocks is like packing for a week-long trip with only shorts — it may work for sunny days, but can leave you vulnerable when the weather turns. International exposure provides balance, helping you prepare for changing conditions.

Markets are cyclical, and leadership between regions often rotates. Maintaining a diversified portfolio is designed to help increase your chances of capturing returns no matter which region is outperforming.

For deeper insights on international diversification, check out our recent article:

Why International Diversification is Essential for Building Timeless Portfolios

Tariffs and Deficits: What Should Investors Do?

New tariffs and rising deficits are fueling concerns about inflation and economic growth. While these headlines can be unsettling, they don’t change the principles of sound investing:

- Markets Are Resilient: While tariffs may create short-term volatility, markets have historically adapted to new policies over time. We invest in companies, not countries and politics, meaning strong, innovative businesses with global reach can thrive regardless of regional headlines. Jumping in and out of investments based on headlines is rarely a winning strategy.

- Focus on the Long-Term: Investors who stick to a disciplined plan are often rewarded, even during challenging economic periods.

- Diversify Across Regions and Sectors: By spreading risk across markets, you reduce the impact of isolated challenges like trade disputes or sector-specific downturns.

For additional insights on tariffs, read:

Tariffs Are Back in the Headlines: What Should Investors Do?

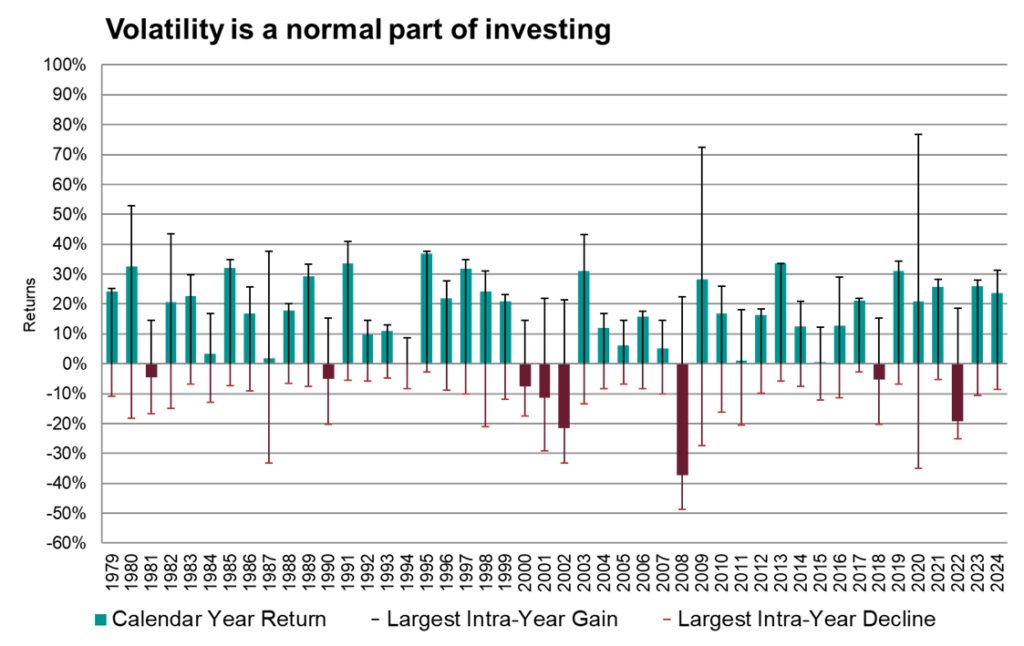

Volatility is the Price We Pay for Returns

Market volatility can feel like a storm, but it’s often the necessary path to long-term gains. Consider these facts:

- Markets typically experience a 14% intra-year decline every year.

- 2% daily market drops happen roughly eight times a year.

- Every five years or so, markets may decline 30% or more.

Despite these swings, markets tend to reward investors who stay the course over the long-term. Historically, the market has never been down three years after a recession.

Source: DFA. Data as of 12/31/2024. Data is calculated from rounded daily returns. U.S. Market is the Russell 3000 Index. Largest Intra-Year Gain refers to the largest market increase from trough to peak during the year. Largest Intra-Year Decline refers to the largest market decrease from peak to trough during the year. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Past performance is not a guarantee of future results. There is always the risk that an investor may lose money. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

For strategies to stay calm during volatile periods, check out:

Guide: The Level-Headed Investor’s Guidebook

Focus on What You Can Control

In moments of uncertainty, focusing on controllable actions is key:

- Stick to Your Plan: Emotion-driven decisions often lead to poor outcomes. Stay committed to your strategy.

- Tune Out the Noise: Headlines are designed to grab attention. Markets may shift, but your long-term goals should guide your decisions.

- Consider Opportunities: Market volatility can create opportunities to rebalance or strategically deploy cash into quality investments.

The Bottom Line: Stay Disciplined and Diversified

While headlines about tariffs, deficits, and tech stock struggles may seem overwhelming, they are part of the natural investing cycle. The key is to stay patient, diversified, and focused on your long-term plan.

If you’re unsure whether your portfolio is properly diversified or suspect it’s too heavily weighted in U.S. stocks, now is the time to reassess. A well-diversified portfolio may help provide a stronger foundation for navigating uncertainty and capturing future growth.

If you’d like to discuss your portfolio, we’re here to help.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only. Past performance is no guarantee of future results. Diversification does not guarantee a profit or protect against loss in declining markets. Investors should consider their individual risk tolerance, investment objectives, and market conditions when making portfolio decisions.