Tag: Income Tax Planning

Charitable Gifting [On-Demand Webinar]

In this recorded webinar, our financial advisors discuss several strategic ways to make a difference all year ‘round through charitable gifting. Learn how to create a gifting strategy that not only supports your favorite causes but also helps create tax efficiencies to save you money.

Year-End Tax Planning Updates and Strategies [On-Demand Webinar]

In this recorded webinar, hear from our team of tax and estate professionals as they recap the proposed and enacted legislative changes made in 2021, and provide you with some optimal year-end planning strategies to help better prepare you for the upcoming tax season.

Year-End Tax Planning Tips for Individuals and Small Businesses

With the holidays fast approaching, tax planning might not be high on your priority list. However, there are a few tax planning strategies that you can still execute before year-end.

Roth Conversions During the Current Low Tax Rate Environment

Roth conversions have increased in popularity over the past few years due to our current low tax rate environment. Because these rates are set to sunset and return to their pre-Tax Cuts and Jobs Act rates after 2025, it may be a good idea to investigate Roth conversions this year.

Tax Strategies for the Proposed Build Back Better Act [On-Demand Webinar]

Within the latest version of the Build Back Better Act, the budget reconciliation bill that contains pending tax reform, there are a few tax surprises worth noting. If you’re trying to prepare, you’ll want to watch this Savant webinar.

Closing the Back Door: What Could Happen to Roth Conversions Under the Build Back Better Act

As the end of the year draws near, lawmakers in Washington are considering plans to limit “backdoor” and “mega-backdoor” tax saving strategies for certain high-income taxpayers. In September, the House Ways and Means Committee approved changes as a way to fund the $3.5 trillion Build Back Better Act.

As Fall Temperatures Cool, Proposed Tax Legislation Gets Hotter

The House Ways and Means Chairman recently released the current House version of the Build Back Better Act that contains pending tax reforms. The new bill contains a few tax surprises worth noting for taxpayers who want to be prepared for the tax climate ahead.

The American Families Plan: Vaulting into the Middle Class

President Biden recently unveiled his newest proposal – The American Families Plan (AFP), an ambitious $1.8 trillion package aimed at vaulting education, childcare, and paid family leave. Michael Cyrs, senior director of wealth transfer, provides more details about the proposed plan.

Tax Strategies for the American Families Plan [On-Demand Webinar]

The proposed American Families Plan could change the tax relief we have recently grown accustomed to. The plan raises a number of issues and possible strategies for taxpayers to consider in 2021.

How Could the American Families Plan Impact the Taxation of Your Vacation Home?

If you have a second home or are thinking about purchasing one, you may want to think about how the proposed American Families Plan may affect how it is taxed. Financial advisor Jeff Lewis takes a closer look.

Key Income Tax Changes of The American Families Plan

President Biden recently presented his American Families Plan (AFP), a $1.8 trillion package aimed at reforming education, childcare, and paid family leave. This blog presents a high-level overview of some noteworthy proposed changes.

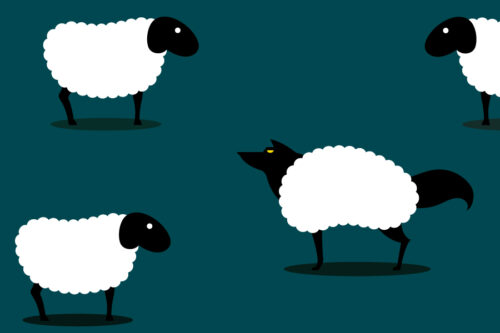

A Tax Wolf in Sheep’s Clothing: It’s All About the Basis!

The proposed American Families Plan could increase tax liabilities for many families by changing the way estates are taxed. Mike Cyrs, senior director of wealth transfer, takes a closer look at the plan and presents possible tax planning strategies.